Compare Home Insurance Quotes

Free quotes, secure form, no spam.

We know buying homeowners insurance

is a major decision.

Finding the right homeowners insurance company for you can be overwhelming. It's worth the effort, though, because you may get a lower price with one company than you do with others thanks to how they calculate quotes. We're here to provide you with the practical tools and insights you need to make an informed comparison between home insurance companies and quotes. QuoteWizard connects you with licensed agents from the top homeowners insurance companies in the U.S., making comparison shopping easy.

Compare Home insurance Tips

- The amount of insurance and the different types of coverages that you need play a big part in determining your rate.

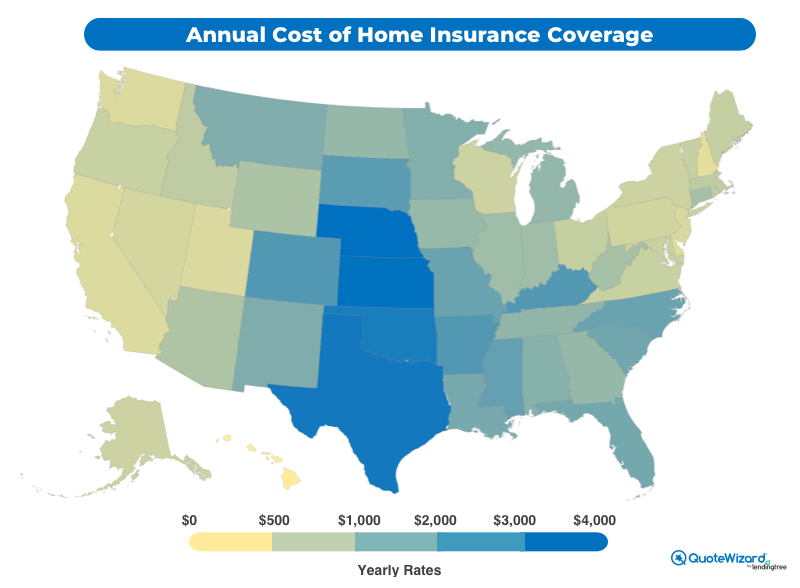

- The location of your home influences your home insurance rate. The average annual rate of home insurance in the U.S. is $1,903.

- Home insurance rates also differ by company. Erie Insurance has some of the cheapest quotes at $1,471 per year.

- Switching home insurance companies could save you up to 50% on premiums, depending on your history and needs.

We've got you covered — here's what else you should know

Compare home insurance premiums by state

What you can expect to pay in your state

Home insurance companies look at the risk profile of your state when calculating your premium. The table below can help you estimate how much your neighbors pay and whether you're overpaying with your current insurer. We also included the cheapest company in each state, according to QuoteWizard's study. Some of these companies offer average rates lower than $1,200 a year or $100 a month. That's why even if you are happy with your current home insurance company, shopping around can't hurt.

Average U.S. yearly

rate in 2023:

$1,903

| State | Cheapest plan | Average annual premium | Average monthly premium |

|---|---|---|---|

| Alabama | Allstate | $2,179 | $182 |

| Alaska | Country Financial | $1,195 | $100 |

| Arizona | Travelers | $1,608 | $134 |

| Arkansas | Shelter Mutual | $2,942 | $245 |

| California | Allstate | $972 | $81 |

| Colorado | Chubb | $2,934 | $245 |

| Connecticut | Allstate | $1,738 | $145 |

| Delaware | Nationwide | $921 | $77 |

| District of Columbia | Allstate | $1,299 | $108 |

| Florida | Chubb | $2,469 | $206 |

| Georgia | Progressive | $1,979 | $165 |

| Hawaii | DB Insurance Co. Ltd | $458 | $38 |

| Idaho | Mutual of Enumclaw | $1,395 | $116 |

| Illinois | USAA | $1,834 | $153 |

| Indiana | Erie Insurance | $1,820 | $152 |

| Iowa | Farmers | $1,949 | $162 |

| Kansas | Shelter Insurance | $4,076 | $340 |

| Kentucky | The Cincinnati Insurance Cos. | $2,936 | $245 |

| Louisiana | State Farm | $2,420 | $202 |

| Maine | Vermont Mutual Insurance | $1,274 | $106 |

| Maryland | Travelers | $1,226 | $102 |

| Massachusetts | Vermont Mutual Insurance | $1,404 | $117 |

| Michigan | Allstate | $2,017 | $168 |

| Minnesota | American Family | $2,235 | $186 |

| Mississippi | Southern Farm Bureau Casualty | $2,691 | $224 |

| Missouri | Allstate | $2,596 | $216 |

| Montana | Farmers Insurance | $2,265 | $189 |

| Nebraska | American Family | $4,125 | $344 |

| Nevada | State Farm | $1,124 | $94 |

| New Hampshire | Amica Mutual | $848 | $71 |

| New Jersey | Allstate | $1,022 | $85 |

| New Mexico | Allstate | $2,289 | $191 |

| New York | NYCM | $1,189 | $99 |

| North Carolina | State Farm | $2,597 | $216 |

| North Dakota | Farmers Union Insurance | $1,979 | $165 |

| Ohio | The Cincinnati Insurance Cos. | $1,285 | $107 |

| Oklahoma | American Farmers & Ranchers | $3,748 | $312 |

| Oregon | Mutual of Enumclaw | $1,239 | $103 |

| Pennsylvania | Penn National | $1,128 | $94 |

| Rhode Island | Heritage Insurance | $1,392 | $116 |

| South Carolina | Allstate | $2,502 | $209 |

| South Dakota | North Star Mutual Insurance | $2,829 | $236 |

| Tennessee | Erie Insurance | $2,047 | $171 |

| Texas | Chubb | $3,884 | $324 |

| Utah | Farm Bureau Financial Services | $995 | $83 |

| Vermont | Allstate | $1,263 | $105 |

| Virginia | VA Farm Bureau Federation | $1,242 | $104 |

| Washington | Nationwide | $969 | $81 |

| West Virginia | Erie Insurance | $1,717 | $143 |

| Wisconsin | Erie Insurance | $1,196 | $100 |

| Wyoming | Nationwide | $1,637 | $136 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |||

If your home insurance premium is higher than your state average, it may be time to consider switching companies.

Aside from floods and earthquakes, homeowners insurance covers most other natural disasters, meaning states at higher risk for natural disasters have higher rates. So, Texas' and Oklahoma's tornadoes contribute to their expensive premiums.

Compare rates from the top insurers in the U.S., all in one place

What is a home insurance quote?

A home insurance quote provides an estimate of how much you would pay for home insurance from a particular company. Insurance companies will look at many factors when giving a quote and weigh each factor differently. Getting multiple quotes from insurers allows you the chance to compare rates and coverages. You can customize a quote by choosing the coverages you need.

How to get a home insurance quote

You can get a home insurance quote using an online tool, an insurance agent from a provider or an independent insurance agent who can provide quotes from multiple companies. If you're using an online tool, you can typically request a quote 24/7. When getting a quote, home insurance companies may ask how old your house is, when you bought your home, features of your home, your claims and credit history, where your home is located and how much home insurance coverage you need. These questions can affect your home insurance rate. Other factors include:

- Your house's construction materials

- Square footage of your house

- Location of the closest fire station or water source

- Crime rate and natural disasters in your area

- Remodeling or renovations in your home

- Deductible amount

- Marital status

You will also need to know how much dwelling and personal property coverage you need. To determine how much dwelling coverage you need, you have to calculate your home's replacement cost. Your home's replacement cost is the amount of money needed to rebuild your home to its current specifications and standards if it is destroyed. Although home insurance companies can approximate the replacement cost for you, we recommend verifying their estimate.

Your personal property coverage limit is typically 50% of your dwelling coverage. However, you can lower or raise the amount of coverage based on the value of your belongings. We recommend creating an inventory to determine how much personal property coverage you need.

Types of home insurance quotes

There are several different types of home insurance policies. Policies for owner-occupied homes range from the most basic (HO-1), to standard (HO-2 and HO-3), to comprehensive (HO-5). HO-3 policies are the most common type of home insurance policy.

These policies will either be an open-peril or a named-peril policy type. Open-peril coverage works by covering everything that's not specifically excluded in the policy, while named-peril coverage protects against causes that are specifically named or listed in the policy.

| Policy options | What is covers |

|---|---|

| HO-1 | This coverage is the most basic policy. An HO-1 policy only covers damages that are caused by 10 perils stated in the policy. HO-1 policies also only cover the structure of your home and don't cover your personal belongings. |

| HO-2 | HO-2 policies cover the same perils as HO-1 policies as well as some additional perils. These include falling objects and damage due to the weight of snow or ice. HO-2 policies also cover personal property. |

| HO-3 | HO-3 policies cover all perils except ones that are clearly excluded in your policy for the structure of your home, which means they offer a wide range of coverage. Your personal belongings, however, are only covered for perils stated in the policy. HO-3 policies also include personal liability coverage. There are six coverages in a standard HO-3 homeowners insurance policy, and they each have their own coverage limit. |

| HO-4 | If you rent, you can purchase an HO-4, also known as a renters insurance policy. |

| HO-5 | HO-5 policies are the most comprehensive policies. A HO-5 policy, unlike other single-family home insurance policies, has an open-peril protection for your belongings. |

| HO-6 | HO-6 policies are intended for condo and co-op unit owners. |

| HO-7 | HO-7 policies are intended for mobile homes. |

| HO-8 | Homeowners who have an older custom home, or an older home that was built with building materials that are difficult to find, would most likely need to purchase an HO-8 policy. |

Home insurance coverages

A standard HO-3 home insurance policy has six coverages, which include coverage for your home and your belongings.

| Coverage | Typical coverage amount | What it covers |

|---|---|---|

Dwelling |

Cost to rebuild your home | Your home |

Other structures |

10% of dwelling | The other structures on your property, like a garage |

Personal property |

50% of dwelling | Your belongings |

Loss of use |

20% of dwelling | Extra living expenses if you temporarily cannot remain in your home |

Personal liability |

$100,000 | Legal and settlement costs if you are sued and found liable |

Medical payments to others |

$5,000 | Medical expenses if a guest is injured on your property |

Homeowners insurance often doesn't cover:

- Water damage from flooding

- Earth movement like earthquakes

- Power failure

- Wear and tear

- War

- Nuclear Hazard

- Intentional loss

How to compare home insurance quotes

When getting a home insurance quote, the price you receive is the result of multiple coverage limits and policy details. That means you should consider more than the final price on the quote. One company may have higher monthly premiums, but you may also get more coverage for the price. The details below can help you get a sense of what to expect when comparing homeowners insurance rates.

1. Consider coverage limits

When comparing multiple quotes, you should look at the coverage limits and additional coverages or endorsements being offered. For example, one company may quote you $150,000 for dwelling coverage, while another quotes you $180,000. When comparing the final quote price between these two companies, remember that one provides more dwelling coverage than the other and that home insurance rates can vary significantly by dwelling coverage. Below are average annual rates for dwelling coverage amounts ranging from $200,000 to $500,000:

| Dwelling coverage amount | Average annual premium |

|---|---|

| $200,000 | $1,904 |

| $275,000 | $2,355 |

| $350,000 | $2,836 |

| $425,000 | $3,344 |

| $500,000 | $3,881 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. States used for averages include Arizona, Georgia, Florida, Texas and Illinois. Your rates may vary. | |

You can also customize your policy by adding optional coverages. Insurers can offer different types of optional coverages. Optional coverages can include higher limits for jewelry and more, sump pump and water backup coverage, and identity fraud. We recommend looking at the different types of optional coverages companies offer and comparing them based on your needs.

2. Consider deductible amounts

You'll also want to compare deductible amounts. A deductible is the amount you pay on a home insurance claim before your insurer covers the remainder, up to your policy limits. Increasing your deductible from $1,000 to $2,000 can decrease your annual premium by $204 on average. There are a few deductibles you might see on your policy. These include a policy deductible and special deductibles, like a wind, hail or hurricane deductible, depending on where you live. That means the amount you have to pay out of pocket may change depending on the peril that causes damage.

| Deductible | Average annual premium |

|---|---|

| $500 | $2,090 |

| $1,000 | $1,931 |

| $1,500 | $1,830 |

| $2,000 | $1,727 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

3. Consider how your insurer will reimburse you for claims

You'll want to compare how the policies pay out claims. Damages to the structure of your home and personal property can be reimbursed either based on their replacement cost (RC) or actual cash value (ACV).

RC: Replacement Cost

Replacement cost policies reimburse you based on the cost to completely replace a damaged item. For example, if a fire destroys your living room couch, an RC policy will reimburse you enough money to purchase a new couch.

ACV: Actual Cash Value

Actual cash value policies reimburse you based on the value of the item at the time of loss, factoring in depreciation. So, if that same couch is lost in a fire and you have an ACV policy, you may receive a substantially lower settlement that reflects the value of the used couch.

Different coverages in your policy may be RC or ACV. It's common for dwelling coverage to be RC and property coverage to be ACV. HO-3 policies typically pay out claims at actual cash value for your belongings, while HO-5 policies cover them at replacement cost.

4. Consider discounts

Insurance companies can offer different types of discounts or savings that may reduce your premium payment. A common discount that insurers offer is a bundling discount. If you have auto insurance, getting home insurance from the same insurance company can save you a great deal of money. Other common discounts include claims-free and safety device discounts. We recommend comparing discounts in order to get a better idea of what you will pay for home insurance.

5. Consider reviews and the financial strength of companies

When choosing a home insurance provider, it's important to consider customer service and the financial strength of the company in order to get quality service when filing a claim. You can see how QuoteWizard scored home insurance companies based on their coverages, discounts, third-party ratings and more below.

An example of comparing home insurance quotes

When comparing quotes from different insurance companies, you’ll have multiple components to compare. As an example, we made up two sample policies, which are described in part below.

| Policy A | Policy B | |

|---|---|---|

| Monthly premium | $ | $$ |

| Dwelling coverage | $150,000 | $200,000 |

| Personal liability coverage | $100,000 | $300,000 |

| Wind deductible | $1,000 | $250 |

| Property replacement policy | ACV | RC |

The two policies have different monthly premiums - Policy A is cheaper than Policy B. But how does the coverage compare?

Policy B provides more liability protection than Policy A. That means if you reach your liability limit of $100,000 with Policy A, you could be responsible for any additional out-of-pocket costs. Similarly, Policy B's dwelling coverage limit is higher, meaning your home's structure is protected for a larger amount.

There's also the wind deductible to consider: you could be out $1,000 for Policy A, but only $250 for Policy B after a loss due to wind. This difference could easily negate any policy savings you got by going with Policy A.

Lastly, consider the property replacement type. For Policy A, you'll receive actual cash value after a loss, meaning you'll have to pay some amount out of pocket to completely replace the item. The replacement cost with Policy B, on the other hand, means your insurance company will reimburse you the full cost to replace your belongings after a loss.

The final cost of your homeowners insurance policy doesn't matter if you aren't receiving the coverage you need. Even if one company has lower monthly premiums, what if it doesn't fully cover you after a loss? That's why we recommend comparing price and the quote coverage limits.

Questions to ask about your quote

Asking the right questions can help you better understand your quote options and make an informed decision about which home insurance policy to get. But it's not always clear what questions to ask, so here are a few questions to ask yourself and the insurance companies when you're comparing quotes.

Questions to ask about a quote

- Are my belongings covered by RC or ACV?

- Are there special deductibles (for example: wind, hail, hurricane)?

- Am I eligible for any more discounts?

- Are there specific coverage exclusions?

Questions to ask yourself

- Do I have sufficient personal property protection to cover all my belongings?

- Do I own anything that will exceed my policy limits, like jewelry?

- Do I have enough personal liability protection to protect my assets?

- Do I value an online experience or having a dedicated agent?

A few more tips for comparing home insurance quotes

Here are a few more things to consider as you shop for home insurance and compare quotes:

- We recommend buying enough coverage so you'll be able to fully rebuild your home and replace your belongings in the event of a catastrophe.

- Take the time to make an inventory of your possessions. We recommend writing down purchase dates, prices, as well as each item's model name and model number. We also recommend keeping receipts and photos of your items.

- We recommend reviewing your policy every year in order to get the best rates. You may have made changes to your home, or insurance companies may have changed their policies, either of which could impact your home insurance rate.

- If you have a few insurance companies in mind when shopping, you can talk to their insurance agents to get more information on the policies and to get the best premium you can.

- Before submitting a quote, we recommend double-checking all the information you noted about you and your home for accuracy.

How to compare homeowners insurance companies

Whether you want to switch companies to save money, purchase homeowners insurance for your first house or are just window shopping, comparing companies is a great way to get your best rates and coverage. We know that companies can begin looking the same the more quotes you get. The table below summarizes some high-level differences.

| Company | AM Best financial strength rating* | 2022 J.D. Power overall satisfaction (out of 1,000)** | 2022 NAIC Complaint Index (lower is better)*** |

|---|---|---|---|

| USAA | A++ | 884 | 0.36 |

| Amica | A+ | 849 | 0.13 |

| American Family | A | 842 | 0.13 |

| Country Financial | A+ | 830 | 0.06 |

| State Farm | A++ | 829 | 0.35 |

| Erie | A+ | 827 | 0.14 |

| Auto-Owners | A++ | 825 | 0.13 |

| Nationwide | A+ | 816 | 0.75 |

| Allstate | A+ | 815 | 0.33 |

| Chubb | A++ | 809 | 0.13 |

| Liberty Mutual | A | 805 | 0.25 |

| ASI Progressive | A+ | 801 | 0.92 |

| Travelers | A++ | 794 | 0.17 |

| Farmers | A | 792 | 0.38 |

| Note: *Financial strength rating from AM Best. **J.D. Power ratings from 2022 U.S. Home Insurance Study. ***Complaint Index from NAIC. | |||

*The AM Best financial strength rating shows if a company is in good financial health.

**J.D. Power's Home Insurance Study examines home insurance companies' interactions, policy offerings, premiums, billing process, policy information and claims.

***The NAIC complaint index measures the complaints policyholders file against an insurer, with the average complaint index being 1.0.

Providers Include

Comparing home insurance companies by premiums

Although your home insurance rates depend on many factors, you can get affordable coverage for your home by comparing rates from different insurance companies. Home insurance companies may look at different factors or weigh a certain factor differently from other companies when determining rates. We reviewed thousands of rates from several home insurance companies and compiled average rates for some of the largest home insurance companies. The difference between the cheapest company's average annual rate in our study and the most expensive company's average annual rate is $995.

Compare home insurance rates by credit score

Although some states ban or limit insurance companies from using credit scores to determine rates, your credit score can greatly affect your home insurance premium in others. On average, homeowners with a poor credit score pay about twice as much for home insurance than homeowners with good credit.

| Company | Average annual rate: good credit | Average annual rate: poor credit |

|---|---|---|

| Allstate | $1,504 | $2,983 |

| Farm Bureau | $1,344 | $2,476 |

| Farmers | $1,277 | $4,401 |

| Nationwide | $2,088 | $3,243 |

| State Farm | $1,348 | $3,265 |

| USAA | $1,374 | $2,300 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. States used for averages include Arizona, Georgia, Texas, Utah and Illinois. Your rates may vary. | ||

California, Maryland, Hawaii, Massachusetts and Michigan ban or limit using credit scores for home insurance rates.

See how much you can save when companies compete for your business.

Home insurance company reviews

Allstate: Allstate is one of the best-known insurance companies. It's also one of the largest, with thousands of agents. Allstate offers affordable rates, numerous discounts and many optional coverages. With Allstate, you can save up to 25% if you bundle your auto and home insurance policies. You can also save up to 20% if you switch to Allstate and don’t have a recent home insurance claim. On the flip side, it has a below-average customer satisfaction score of 815 (out of 1,000) on J.D. Power's 2022 U.S. Home Insurance Study.

Great for discounts and affordable rates

QuoteWizard rating: 3.9 out of 5

American Family: American Family provides great customer service and receives few complaints. American Family has an above-average customer service score of 842 on J.D. Power's 2022 U.S. Home Insurance Study. It also offers a variety of optional coverages, such as sump pump and water backup coverage. However, American Family's home insurance rates are higher than average at $2,466 a year, according to our research.

Great for customer service and optional coverages

QuoteWizard rating: 3.5 out of 5

Chubb: Chubb offers affordable rates and unique coverages if you upgrade to the company’s Masterpiece policy. The Masterpiece policy includes added protection if your home repairs exceed your policy’s limit, as well as a cash settlement if your home is a total loss and you decide not to rebuild it. On the flip side, Chubb has a below-average customer satisfaction score of 809 (out of 1,000) on J.D. Power's 2022 U.S. Home Insurance Study, but has fewer complaints than expected for a company of its size. AM Best also gave Chubb a financial strength rating of A++, which is the highest rating companies can get.

Great for affordable rates and extra protection

QuoteWizard rating: 4.3 out of 5

Erie: Erie Insurance offers the cheapest average home insurance rate in our study at $1,471 a year. It also has an above-average customer service score of 827 on J.D. Power's 2022 U.S. Home Insurance Study. Unfortunately, Erie Insurance doesn’t offer online home insurance quotes and potential customers need to connect with an agent by email or phone. Also, compared to some of its competitors, Erie doesn’t offer many discounts.

Great for cheap rates and customer service

QuoteWizard rating: 4.0 out of 5

Farmers: Farmers home insurance has a higher average premium compared to competitors. It also has a below-average customer satisfaction score of 792 out of 1,000 points on J.D. Power's 2022 U.S. Home Insurance Study. However, Farmers home insurance offers many as well as unique discounts to reduce your annual rate. Farmers provides an affinity discount for homeowners who are members, employees or retirees of certain businesses, occupational groups or professional organizations. It also offers a green discount if you have certain certifications.

Great for unique discounts

QuoteWizard rating: 2.7 out of 5

Nationwide: Nationwide's home insurance rates are average compared to its competitors. It also has an average customer service score of 816 on J.D. Power's 2022 U.S. Home Insurance Study. Still, it offers several discounts to help lower the cost of a policy. These discounts include a claims free discount, a gated community discount, a new home discount and a multi-policy discount. Nationwide also offers coverages that aren’t typically available with many insurance companies. Nationwide’s standard home insurance policy includes credit card coverage for unauthorized transactions. It offers a better roof replacement as an optional coverage, too. This coverage will replace your roof with stronger and safer roofing materials after a covered loss.

Great for credit card coverage

QuoteWizard rating: 3.5 out of 5

State Farm: State Farm is one of the biggest home insurance companies around, and its many customers give it high marks for service. AM Best gave State Farm a financial strength rating of A++, which is the highest rating a company can get. State Farm’s average rate is close to the national average, though. We recommend State Farm if you can take advantage of its bundling discount. With it, you could save up to $1,073 on your auto and home insurance policies.

Great for a reliable option

QuoteWizard rating: 3.4 out of 5

Travelers: Travelers home insurance has an average annual premium above the national average and a below-average customer satisfaction score of 794 on J.D. Power's 2022 U.S. Home Insurance Study. However, Travelers offers many optional coverages for home insurance, such as Special Personal Property Coverage, which provides more protection for your possessions in the event of a covered loss. AM Best also gave Travelers a financial strength rating of A++. We recommend Travelers if you're looking for a wide range of additional coverage options.

Great for a variety of optional coverages

QuoteWizard rating: 3.3 out of 5

USAA: USAA has affordable rates and top-notch customer service, but only military members, veterans and their families can buy coverage. USAA has the highest customer satisfaction score of 884 on J.D. Power’s 2022 U.S. Home Insurance Study. AM Best also gave USAA a financial strength rating of A++. After a covered loss, USAA’s replacement cost coverage will pay out on your personal property at whatever the current price is for the covered item. If you’re a military member, USAA provides additional benefits. This includes coverage for your uniform with no deductible and coverage for military equipment. USAA is a great option for home insurance if you qualify.

Great for customer service and military personnel

QuoteWizard rating: 4.0 out of 5

Don't forget:

Supplemental home insurance policies

A standard home insurance policy does not cover flood or earthquake damage, but you can purchase separate policies that cover these perils.

Flood insurance

Flood damage can be purchased separately through the National Flood Insurance Program. You can also purchase private flood insurance, which can offer higher limits. In the event of a flood, flood insurance covers your house and belongings. If you live in a high-risk flood zone, your mortgage lender may require you to have flood insurance.

Learn More

Earthquake insurance

If your home is damaged by an earthquake, you need a separate policy to cover your home and belongings. You are not required by law to have earthquake insurance. Whether or not you need an earthquake insurance policy depends on if your area is prone to earthquakes.

Learn More

Frequently asked questions

Home insurance is not required by law. If you have a mortgage, however, lenders can require insurance as a condition of your loan.

Comparing home insurance quotes is about more than price because coverage can vary between companies. Our guide can walk you through the process of getting multiple quotes so you can find the best rates and coverage for you.

Home insurance covers your home and belongings. It also provides valuable liability coverage, among other protections.

Our national study found that the average cost of homeowners insurance is $1,903 a year. Check out our state averages to see where your state ranks.

Erie Insurance and Chubb have the cheapest average home insurance rates in the U.S. Erie Insurance offers the cheapest average home insurance at $1,471, while Chubb has the second-cheapest average rate at $1,615.

Why QuoteWizard

- With our service, home insurance agents compete for your business so you get the best deal.

- We are not affiliated with any home insurance company.

- We’ve been doing this since 2006 and have connected over 50 million people to better rates.

- We are successful because we care about creating a great experience.

Featured in

Methodology

Our in-house homeowners insurance experts use data sources including the U.S. Census Bureau, FEMA, the U.S. Department of Veterans Affairs and various state insurance regulation offices.

This guide on comparing homeowners insurance quotes is the product of decades of combined experience in the insurance industry and represents what QuoteWizard deems to be the most effective way to purchase the best home insurance for you and get your best rates.

QuoteWizard rated insurance companies based on their cost, discounts, coverages, financial strength, J.D. Power score, NAIC Complaint Index, and website experience. We used a weighted rating for each of these categories and scored them out of five.

Average rates were compiled from rates in all 50 states. The following coverages were used:

- $275,000 dwelling coverage

- $27,500 other structures

- $137,500 personal property

- $55,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible