Compare Renters Insurance Quotes

Get the best deal by comparing rates.

Protect your stuff from the unexpected.

Renters insurance covers your possessions, assets and liability. Best of all, policies are affordable and simple. QuoteWizard will connect you with licensed agents from the best insurance companies so that you can get the best rate for the coverages you need.

We've got you covered — here's what else you should know

Renters insurance rates and quotes at a glance:

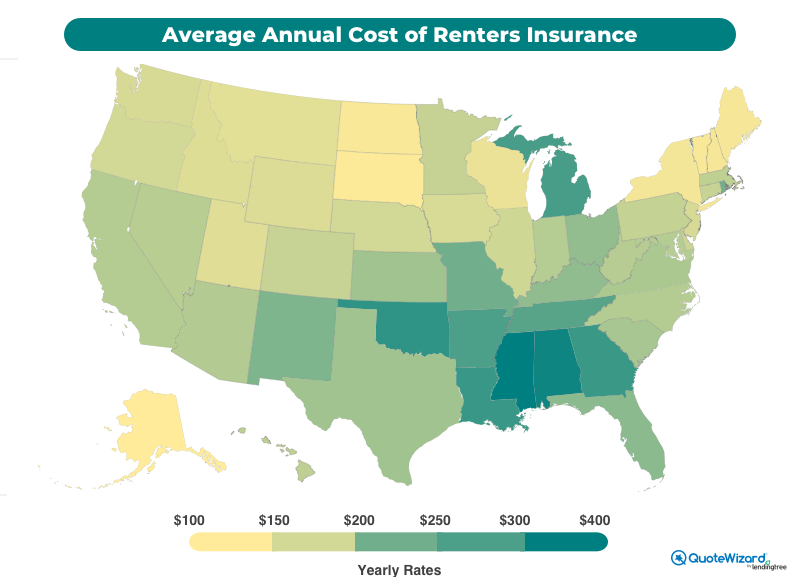

- The location of your rental influences your renters insurance rate. The average annual rate of renters insurance in the U.S. is $214.

- Renters insurance rates also differ by company. State Farm has some of the cheapest average quotes at $155 per year.

- Switching renters insurance companies could save you up to 56% on premiums, depending on your history and needs.

Compare renters insurance rates by company

We gathered online quotes from five different insurers. State Farm has the cheapest average renters insurance rate of the companies we surveyed. By comparing rates, you could save as much as 56%. Your rates will most likely differ from the quotes below depending on your location, coverage amount and other factors.

| Company | Average annual premium |

|---|---|

| Allstate | $233 |

| Amica | $206 |

| Farmers | $277 |

| State Farm | $155 |

| Travelers | $212 |

| Note: Average rates are based on online quotes from provider websites. Your rates may vary. | |

How renters insurance works

Your landlord's insurance policy doesn't cover any of your personal property. To protect your belongings and yourself if someone gets hurt in your rental unit, you must purchase a renters insurance policy. Renters insurance isn't required by law, but landlords may require that you have it as part of a lease agreement.

How to get a renters insurance quote

A quote is an estimate of how much you would pay for renters insurance from a specific company. You can get a renters insurance quote through local insurance agents from a specific provider or independent insurance agents who can give quotes from several companies, such as QuoteWizard. You can also get an online quote through a provider's website.

- Consider coverage limits. When getting a quote, you will be asked how much coverage you need. The amount of personal property coverage you need will impact your quote. We suggest making an inventory list to determine how much personal property coverage you will need.

- Gather information. You may also be asked for specific information in order to generate an accurate quote. This can include information about your rental and its location, your claims history, your legal name and birth year. You may be required to provide documents for certain discounts for which you qualify, too.

How to compare renters insurance companies

Comparing renters insurance quotes from different companies can help you get the best rates and coverage. You don't need to be a first-time renter to compare rates. We rated renters insurance companies based on their coverages, discounts, cost, online experience, financial strength and J.D. Power's overall customer satisfaction rating. Here's how some of the top companies compare.

| Company | J.D. Power overall customer satisfaction (out of 1,000)* | AM Best financial strength rating** | QuoteWizard rating (out of 5) |

|---|---|---|---|

| Allstate | 837 | A+ | 3.7 |

| Amica | - | A+ | 3.7 |

| Farmers | 831 | A | 2.1 |

| State Farm | 836 | A++ | 3.8 |

| Travelers | 801 | A++ | 2.9 |

| Sources: *J.D. Power ratings from 2022 U.S. Home Insurance Study. **Financial strength rating from AM Best. | |||

Allstate: Allstate has an average annual premium that's higher than the nationwide average rate at $233 a year. However, Allstate offers numerous discounts and many optional coverages. If you're retired or working part-time and are 55 years old or older, you can get up to 25% off your premium. Allstate offers identity theft restoration as an optional coverage, which can help cover legal fees and lost wages if someone steals your identity. You can also increase coverage or get broader protection for certain high value items with Allstate's scheduled personal property coverage.

Amica: Amica offers affordable renters insurance rates at an average premium of $206 a year. It also offers a variety of discounts. This includes a multi-policy discount, which can save you up to 15% if you bundle renters and car insurance with Amica. Like Allstate, Amica offers scheduled personal property as an optional coverage.

Farmers: Farmers has the highest average premium in our study at $277 a year. It also has a below-average customer satisfaction score of 831 out of 1,000 points on J.D. Power's 2022 U.S. Home Insurance Study. However, Farmers offers some unique discounts. If you're in a certain profession, such as teaching and engineering, you may be eligible for a discount depending on your state. If your household is smoke-free for at least two years, then you may be eligible for some incentives.

State Farm: State Farm has the cheapest average premium in our study at $155 a year. AM Best also gave State Farm a financial strength rating of A++, which is the highest rating a company can get. State Farm also has a great multi-policy discount. You can save up to $684 on your auto insurance if you bundle both renters and auto insurance with State Farm.

Travelers: Travelers renters insurance has an average premium of $212 a year, which is close to the national average rate. It also has a below-average customer satisfaction score of 801 on J.D. Power's 2022 U.S. Home Insurance Study. However, Travelers offers some unique coverages. With Travelers' personal property coverage, you can apply up to 10% of the coverage to cover improvements made by you or paid by you if damaged by a covered loss. Travelers also offers increased coverage or broader protection for certain high value items as an optional coverage. Like State Farm, AM Best gave Travelers a financial strength rating of A++.

How to compare renters insurance quotes

Renters insurance companies determine your quote using many factors. The price in the quote you receive is the result of multiple coverage limits and policy details. That means you should consider more than the final price on the quote. For instance, one company may have higher monthly premiums, but you may also get more coverage for the price.

One way to compare renters insurance quotes is to get several quotes from individual agents or companies in person, over the phone or online, and then compare them. This can take a lot of time, and it can also be confusing. We listed the coverages you would typically see in a renters insurance quote below.

| Coverage | What it covers |

|---|---|

|

Personal property |

Covers the cost to repair or replace your belongings up to a specific limit due to certain perils. |

|

Liability |

Covers the cost if a guest is injured in your rental, or if you accidentally damage someone else’s property. This includes legal expenses as well. |

|

Medical payments to others |

Covers medical costs if a guest is injured in your rental. |

|

Loss of use |

Covers extra living expenses if you have to relocate due to damages that are being repaired due to a covered event. |

Renters insurance policies are usually standardized, which means that coverages are similar between companies. However, premiums, coverage limits, discounts and customer service can vary between companies.

Another factor to consider when comparing quotes is whether your renters insurance will cover your belongings at actual cash value (ACV) or replacement cost. Replacement cost insurance policies reimburse you for your belongings based on how much money is needed to replace the item with a new one. Actual cash value insurance policies reimburse you based on the value of the item at the time of loss, factoring in depreciation. This means ACV policies can leave you with out-of-pocket costs.

Tips for comparing renters insurance quotes

- Consider deductible amounts. You'll want to compare deductible amounts when looking at quotes from multiple companies. Deductibles typically range from $250 to $2,500, but the most common deductibles are $500 and $1,000 for renters insurance.

- Consider discounts. Renters insurance companies also offer different types of discounts or savings. Some common discounts that insurers offer are a bundling discount and a claims free discount. We recommend comparing the different types of discounts that you qualify for in order to get a better idea of your renters insurance premium.

- Review add-ons available. Renters insurance companies can offer additional coverages for purchase. Renters insurance policies don't cover certain natural disasters such as flooding and earthquakes. However, they will sometimes offer flood and earthquake insurance that you can purchase separately. Insurance companies can also offer additional protection for valuable items such as artwork and jewelry. We recommend reviewing the different types of optional coverages companies offer and comparing them based on the coverages you need.

Compare rates from the top insurers in the U.S., all in one place

Compare renters insurance premiums by state

The average cost of renters insurance in the U.S. is $214 a year, according to our comprehensive study. Average renters insurance rates are different in each state. Your claims history, the amount of coverage you choose and your building's construction are all factors that may affect how much you pay for renters insurance. The table below can help you estimate how much your neighbors pay.

| State | Average annual premium | Average monthly premium |

|---|---|---|

| Alabama | $362 | $30 |

| Alaska | $138 | $12 |

| Arizona | $209 | $17 |

| Arkansas | $305 | $25 |

| California | $208 | $17 |

| Colorado | $190 | $16 |

| Connecticut | $190 | $16 |

| Delaware | $186 | $16 |

| District of Columbia | $183 | $15 |

| Florida | $247 | $21 |

| Georgia | $322 | $27 |

| Hawaii | $199 | $17 |

| Idaho | $169 | $14 |

| Illinois | $183 | $15 |

| Indiana | $207 | $17 |

| Iowa | $174 | $15 |

| Kansas | $226 | $19 |

| Kentucky | $242 | $20 |

| Louisiana | $324 | $27 |

| Maine | $146 | $12 |

| Maryland | $207 | $17 |

| Massachusetts | $197 | $16 |

| Michigan | $310 | $26 |

| Minnesota | $192 | $16 |

| Mississippi | $376 | $31 |

| Missouri | $271 | $23 |

| Montana | $165 | $14 |

| Nebraska | $180 | $15 |

| Nevada | $205 | $17 |

| New Hampshire | $146 | $12 |

| New Jersey | $175 | $15 |

| New Mexico | $258 | $22 |

| New York | $149 | $12 |

| North Carolina | $208 | $17 |

| North Dakota | $145 | $12 |

| Ohio | $239 | $20 |

| Oklahoma | $332 | $28 |

| Oregon | $180 | $15 |

| Pennsylvania | $193 | $16 |

| Rhode Island | $269 | $22 |

| South Carolina | $220 | $18 |

| South Dakota | $140 | $12 |

| Tennessee | $294 | $25 |

| Texas | $227 | $19 |

| Utah | $168 | $14 |

| Vermont | $145 | $12 |

| Virgina | $216 | $18 |

| Washington | $175 | $15 |

| West Virginia | $206 | $17 |

| Wisconsin | $157 | $13 |

| Wyoming | $171 | $14 |

| Note: Average rates are based on online quotes from provider websites. Your rates may vary. | ||

Areas with extreme weather and high crime rates typically have higher premiums. Mississippi and Alabama, which have the highest average rates in the U.S., are both affected by tornadoes.

See how much you can save when companies compete for your business.

Renters insurance situations

If you have a roommate or you're a college student, your renters insurance policy may differ from a typical policy.

If you live in a dorm or on-campus student housing, you might not need renters insurance. You may be covered by your parents' homeowners insurance policy. We recommend purchasing renters insurance if your parents’ policy doesn’t cover your personal belongings and rental.

If you have a roommate, then you may be able to purchase a renters insurance policy together, but we recommend that each person purchases their own policy due to complications that may arise with claims.

For unmarried couples, we also recommend purchasing separate renters insurance policies unless you and your significant other own several personal property together.

Frequently asked questions about renters insurance

Renters insurance protects your personal belongings and yourself if someone is injured in your rental or if you are sued for damages.

When you compare renters insurance quotes, look at prices, coverages, customer service ratings and more.

Renters insurance covers personal property, liability, medical payments to others and extra living expenses if you have to relocate due to damages from a covered event.

Understand Renters Insurance

-

Renters Insurance Basics

Learn about the fundamentals of a renters insurance policy, from coverage to cost.

-

What Renters Insurance Doesn't Cover

Don't assume everything is covered. A renters policy comes with many exclusions.

-

Replacement Cost vs Actual Cash Value

Learn how your insurance company calculates the value of your belongings.

Why QuoteWizard

- With our service, renters insurance agents compete for your business so you get the best deal.

- We are not affiliated with any renters insurance company.

- We’ve been doing this since 2006 and have connected over 50 million people to better rates.

- We are successful because we care about creating a great experience.

Methodology

We collected online quotes from thousands of addresses in the U.S. We used the following coverages:

- $30,000 of personal property coverage

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

- Loss of use: 30%

We used quotes from the following insurance companies: Allstate, Amica, Farmers, State Farm, Travelers and GEICO (used for Florida quotes only).

QuoteWizard rated insurance companies based on their cost, discounts, coverages, financial strength, J.D. Power score and online experience. We used a weighted rating for each of these categories and scored them out of five.