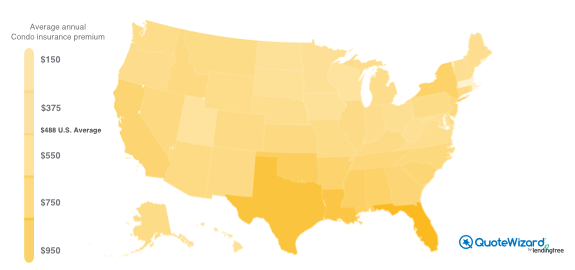

Based on our research, condo insurance costs $511 a year on average, but rates vary depending on your location and coverage amount.

Homeowners Insurance Fundamentals

Learn the fundamentals of homeowners insurance including deductibles, coverage limits, riders, flood insurance, and more.

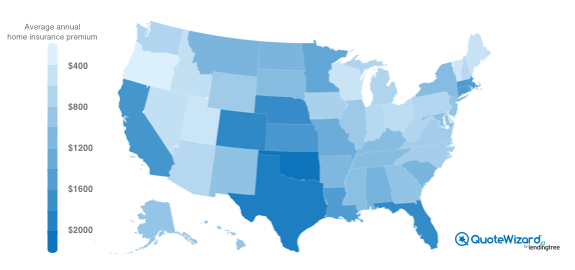

The average cost of home insurance is $1,903 per year, according to our study of all 50 states.

Flood insurance in New Jersey costs an average of $78 a month. We can help you understand what it costs and covers.

Proper hurricane insurance coverage requires a few different policies. Learn how to protect your house from a hurricane.

Home insurance only covers AC units for damage from a covered peril. This rules out most mechanical breakdowns and maintenance issues.

Actual cash value and replacement cost home insurance policies pay out very differently. That difference can save you money.

A hailstorm can cause significant damage to your roof. Find out how home insurance covers your home for hail damage.

Homeowners insurance typically covers most types of wind damage, but there are exclusions.

Hazard insurance, also called dwelling coverage, covers the structure of your home. We'll explain how it works.

Texas has a high risk for windstorms. The Texas Windstorm Insurance Association provides coverage if you can't get it elsewhere.

Homeowners insurance protects you, your home and your family. Coverage can help you recover if the things important to you are damaged.

Home insurance usually covers wildfire damage, but there are exceptions and limits. This article can help clear the air.

An accurate estimate of your home's replacement cost is key to getting the right amount of homeowners insurance.

All dogs can bite, regardless of breed and temperament. Here's what dog owners should know about the coverage home insurance provides.

Flood insurance is required on some homes and optional for others. Here is key info to help you decide if you need it.

If you have a second house as a vacation or rental home, insuring it can work differently from your primary residence.

There’s no law that says you need home insurance, but your mortgage provider will probably require you to get coverage.

If you have the misfortune of having your identity stolen, identity theft insurance can assist you in paying to fix it.

Mobile home insurance protects your investment, but it can be tough to get coverage for older homes. Find out how you can insure your mobile home.

Tsunamis aren’t common, but when they do happen, they usually cause a lot of damage. Here’s how you can protect yourself, your home, and your car.

If you own a condo unit in Chicago, you'll want to get insurance for it. We'll explain how it works and how to get it.

If you have to relocate while your home is repaired, loss of use helps with the costs. We'll explain how it works.

Home insurance typically only covers mold, mildew and other rot on a rare, limited basis. Prevention is your best bet.

Personal property insurance covers your belongings from theft, fire and many other threats. Learn what's covered here.

Having an itemized list of your home's contents ready ahead of time can get you paid sooner for an insurance claim.

Renovating or remodeling your home affects your home insurance rates. Read on to learn how a fix-up changes your premium.

Everything you need to know to get the right amounts of coverage for your home without overpaying for insurance.

Canceling your homeowners insurance is not difficult, but doing it wrong can be costly. Here's how to avoid mistakes.

Updating your insurance coverage is an important step in getting your home ready for a sharing service like Airbnb.

Part of your monthly mortgage payment may go toward your homeowners insurance. Read on to find out how it works.

When you own a condo unit, you usually need HO-6 insurance. Here are key details about how these policies work.

Home insurance covers tree damage and removal under certain conditions. We can help you learn the specifics.

Moving to a new home is a hassle as it is. We can help you learn about what to do with your old home insurance policy.

If you live in an earthquake zone, home insurance won't cover the damage. We'll explain how earthquake insurance helps.

Homeowners insurance doesn’t cover landslides, but another type of insurance may protect your home from landslides.

Your home insurance declaration page is a valuable tool that has many uses. Learn here how to navigate it to your benefit.

Your deductible affects how much your home insurance costs. Here’s what you need to know to pick the right deductible.

Homeowners insurance covers the replacement of personal items stolen from your car. We'll explain how it works.

Insurance riders can help protect your most valuable items. Here’s when to add one to your home insurance policy.

Your house’s foundation is covered by home insurance, but there are exclusions. Find out what types of foundation damage home insurance covers.

Home insurance covers a lot of plumbing damage, but only if it’s sudden and accidental — and it is not without limits.

If your insurance company goes bankrupt, you will still be covered while you find a new insurer. We can explain further.

Homeowners insurance typically doesn't cover the wear and tear of your appliances. Find out how home appliance insurance can cover them.

Homeowners insurance is not tax deductible if you only use your house as a residence. But if you have a home office or business, you can get tax breaks.

Having a home business brings insurance needs that home insurance may not cover. Learn here about your options.

In the event of a flood, home insurance won’t cover your damages. Learn here how flood insurance picks up the slack.

Standard home insurance covers fire damage, but less so if you’re in a high fire risk area. This may limit your coverage.

Building or renovating a home? This guide covers the types of insurance you or your contractor need for your protection.

Personal liability insurance is part of homeowners insurance and can cover property damage and bodily injury if you are found responsible.

Termites can cause costly damage to your home. Learn here when your home insurance covers it and how to prevent it.