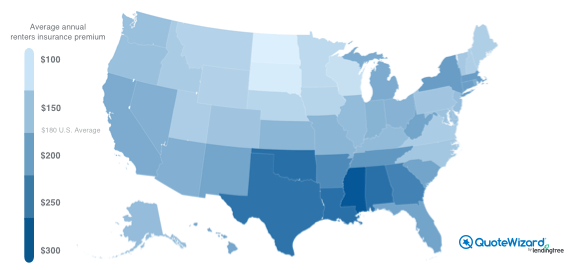

Renters insurance is relatively affordable, costing an average of about $18 a month, or $214 a year.

Renters Insurance Fundamentals

Learn the fundamentals of renters insurance including deductibles, coverage limits, riders, storage units, flood insurance, additional living expenses, and more.

Renters insurance provides financial protection from the most common and costly risks you may face as a tenant. Here's how it works.

If you're renting a storage unit, there are several ways to protect your belongings if they are stolen or damaged.

Your renters insurance policy does not cover damage caused by flooding. We can help you get the flood coverage you need.

Renters insurance provides valuable coverage for your belongings, as well as protection from liability claims and other common risks.

Assisted living expense coverage helps pay your increased costs if you need to relocate after your rental home is damaged or destroyed.

If you're a senior and renting a living space, renters insurance is invaluable. We'll discuss how it works for you.

The liability coverage in renters insurance normally covers pets, but some companies have restrictions on certain types of pets.

Canceling renters insurance is easy, but doing it wrong can be costly. Here's what you need to know to get it right.

If you're a college student living in a dorm or apartment, renters insurance can help cover you against unforeseen accidents.

The liability coverage in renters insurance pays for injuries or damage you cause. Increasing your coverage is cheap.

Renters insurance usually covers your belongings in the event of a ceiling leak. However, it won't cover all water damage.

How the type of renters insurance coverage you choose affects your rates and the amount you may receive in a claim.

Your renters insurance deductible can impact your wallet in important ways. Discover how it works and why it matters.

Renters insurance covers items stolen from your car after a break-in but not the car itself. Here's what you need to know.