State Farm Insurance Review

Free quotes, secure form, no

spam.

State Farm should be the first company you get a quote from if you want cheap car insurance. Not only does State Farm offer low rates to people with good driving records, according to our research, but it offers affordable rates to people with incidents like accidents and DUIs on their records, too. It also provides cheap auto insurance to teen and young drivers.

Two more reasons to consider State Farm auto insurance: it offers a wide range of coverage options and an even larger assortment of discounts.

Products Reviewed

Best if

- You want cheap car insurance from a large, well-known company.

- You’re a teen driver.

- You have incidents like accidents or DUIs on your driving record.

- You're looking for an insurer with a large network of agents.

- You want an insurance company with great customer service.

Worst if

- You prefer to get insurance from a small or local company.

- You want certain specialized types of coverage.

- You're looking for the cheapest home insurance rate.

- You’re looking for an insurer that offers many home insurance discounts.

Introduction

State Farm’s cheap car insurance premiums may be its defining characteristic, but that doesn’t mean low rates are all this company has to offer.

Along with affordable prices, State Farm offers an impressive array of coverage types and an even bigger range of car insurance discounts.

State Farm is the largest insurance company in the U.S., according to data from the National Association of Insurance Commissioners (NAIC). The company has written more than 66 billion in direct property and casualty premiums, giving it a market share of 9.12%.

If you also prefer to get home insurance from a well-known national company, consider State Farm. Not only does State Farm offer fair rates for home insurance, but with more than 19,000 agents and a slew of online tools, it also offers personalized customer service.

Auto Insurance

State Farm at a glance

Has the cheapest car insurance rates among the biggest providers in the U.S.

Offers many coverages and discount options that should meet the needs and budgets of a range of drivers.

Receives fewer customer complaints than its main competitors.

How much is State Farm car insurance?

Based on our data, State Farm car insurance costs an average of $65 per month — if you only want the minimum amount of coverage your state requires.

Full-coverage car insurance from State Farm costs an average of $128 per month, with a full-coverage policy including liability, comprehensive and collision coverages.

These rates are cheaper than State Farm’s primary competition, including GEICO and Progressive. They’re also cheaper than the national averages for minimum-coverage and full-coverage car insurance policies, which are $87 per month and $177 per month, respectively.

| Company | Minimum coverage | Full coverage |

|---|---|---|

| State Farm | $65 | $128 |

| Allstate | $110 | $222 |

| GEICO | $95 | $208 |

| Progressive | $89 | $169 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | ||

This isn’t to suggest State Farm’s auto insurance rates are the absolute cheapest in the U.S. A handful of smaller insurers offer lower average rates than State Farm, with Erie being one notable example. Erie offered our sample driver a minimum-coverage policy for $53 a month, on average, and a full-coverage policy for an average of $106 a month.

An important takeaway here is that it’s important to compare car insurance quotes from several companies before settling on a policy. What you pay for car insurance depends on a number of factors, such as where you live, your age, your vehicle and your driving record.

| Company | Clean record | After DUI | After accident | After speeding ticket |

|---|---|---|---|---|

| State Farm | $128 | $180 | $156 | $144 |

| Allstate | $222 | $412 | $331 | $260 |

| GEICO | $208 | $475 | $332 | $253 |

| Progressive | $169 | $223 | $260 | $218 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | ||||

Having one or more driving incidents on your record, like an accident or a DUI, can make your car insurance policy much more expensive than it would be if you had a clean record.

Even in this situation, though, State Farm is cheaper than companies like Allstate, GEICO and Progressive. The average monthly rate State Farm offered our sample driver with an accident on his record was $156 — less than half the average rates Allstate and GEICO offered.

Also, the average monthly rate State Farm offered our sample driver with a DUI was $180. This is $295 per month less than what GEICO offered the same driver.

| Age | Allstate | GEICO | Progressive | State Farm |

|---|---|---|---|---|

| 16 | $823 | $692 | $871 | $471 |

| 18 | $595 | $560 | $706 | $367 |

| 20 | $319 | $310 | $272 | $213 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | ||||

State Farm offers cheap car insurance to young drivers as well as drivers with incidents on their records, according to our data.

This is made especially clear when you look at the average rates State Farm and its top competitors offer to 16- and 18-year-old drivers. While the average rate State Farm offered our 16-year-old driver for a full-coverage policy was $471 per month, Progressive’s average offering was nearly twice that, at $871 per month.

Allstate, GEICO and Progressive are far more competitive when it comes to car insurance for 20-year-old drivers, but even then State Farm comes out on top, with an average rate of $213 per month.

Which types of car insurance coverage does State Farm offer?

State Farm is great for standard car insurance coverage types like liability, collision and comprehensive, as you might expect. It offers plenty of additional coverage options, too, like the following.

| Coverage | What it covers |

|---|---|

| Uninsured and underinsured motorist | Uninsured motorist covers damage or injuries caused by uninsured drivers. Underinsured motorist covers damage or injuries caused by drivers who don’t have enough insurance to cover the costs of an accident. |

| Medical payments | Some medical and funeral costs after an accident. |

| Emergency road service | “Common, reasonable expenses” needed to get your vehicle back on the road. |

| Rental car reimbursement | Rental car costs while your vehicle is being repaired after an incident. |

| Travel expenses | Meals, lodging and transportation costs if you're in an accident more than 50 miles from home. |

| Rideshare insurance | Insurance gaps that your rideshare company doesn’t cover. |

State Farm also offers antique and classic car insurance coverage. For classic car insurance, your vehicle must be 10 to 24 years old and have historic interest. To get antique car insurance from State Farm, your vehicle must be 25 or more years old.

State Farm auto insurance discounts

State Farm offers numerous car insurance discounts that may help you lower your premium even more.

| Discount | What it covers |

|---|---|

| Multiple auto discount | Have two or more vehicles listed on your State Farm policy and you might save as much as 20%. |

| Multiple line discount | Save as much as 17% when you have two or more insurance policies with State Farm. |

| Discount | What it covers |

|---|---|

| Anti-theft discount | You could earn this discount if your vehicle has an alarm or other similar device. |

| Passive restraint discount | Earn a discount up to 40% off medical payments coverage if your vehicle (1993 and older) has factory-installed air bags or another passive restraint system. |

| Vehicle safety discount | Save 40% on medical payments coverage if your vehicle was made no earlier than 1994. |

| Discount | What it covers |

|---|---|

| Accident-free discount | You may qualify for this discount if State Farm has insured your vehicle for at least three straight years without a chargeable accident. |

| Defensive driving course discount | Complete a driver safety course and you may receive a 10% to 15% discount. |

| Driver training discount | Have all drivers of your vehicle who are under 21 years old take an approved driver education course to take advantage of this discount. |

| Good driving discount | Have at least three years without moving violations or at-fault accidents and you might earn this discount. |

State Farm also has two programs that can help you save money on your car insurance coverage.

With State Farm’s Drive Safe & Save program, you save money right when you sign up. After that, you might save up to 30% more depending on how safely you drive.

State Farm’s Steer Clear program is for young drivers under the age of 25. To qualify for a Steer Clear discount, you need:

- A valid driver's license.

- No at-fault accidents or moving violations in the past three years

You must also complete all of the program requirements.

State Farm customer service ratings

State Farm has above-average customer service ratings from the Better Business Bureau (BBB), J.D. Power and the NAIC.

| Agency | Score |

|---|---|

|

BBB Rating |

A+ |

|

J.D. Power 2020 U.S. Auto Claims Satisfaction Study |

881 |

|

2020 NAIC Complaint Index |

0.79 |

The J.D. Power 2020 U.S. Auto Claims Satisfaction Study rating is based on a 1,000-point scale. The industry average is 872, with higher numbers being better than lower ones.

NAIC’s Complaint Index measures customer complaints based on the rate of formal complaints filed to state regulators. The national median Complaint Index is 1.0.

Home Insurance

Home insurance at a glance

State Farm is the largest writer of homeowners insurance in the U.S., according to data from S&P Global Market Intelligence

Bundling your auto and home policies with State Farm could save you up to $965 a year, which is based on a 2020 national survey by State Farm.

You can get a quote and file a claim on State Farm's website.

State Farm's customer satisfaction is above average among its competitors. J.D. Power gave State Farm 835 out of 1,000 in its 2021 U.S. Home Insurance Study, which is higher than the segment average of 825. State Farm also has fewer consumer complaints than what's expected of a company its size, according to the 2020 NAIC Complaint Index.

Home insurance coverages

State Farm offers all the coverages of a standard homeowners policy, such as dwelling coverage to protect the physical structure of your home, personal property to cover your belongings and personal liability.

If you need more coverage, State Farm's Personal Liability Umbrella Policy can provide additional liability coverage. Home insurance does not cover damage from earthquakes, but you may be able to add earthquake insurance by purchasing a separate policy through State Farm.

Home insurance discounts

State Farm doesn't offer as many discounts as its competitors. Still, you may be able to save money on your home insurance policy by taking advantage of the following discounts:

- Multiple line discount. If you purchase more than one insurance policy from State Farm, you could get a discount on your auto and home insurance premiums.

- Home security insurance discount. If you have a fire, smoke or burglar alarm, or any other home monitoring system, you may be eligible for a discount.

- Roofing discount. If you use impact-resistant roofing materials, you may qualify for a discount.

How much does State Farm home insurance cost?

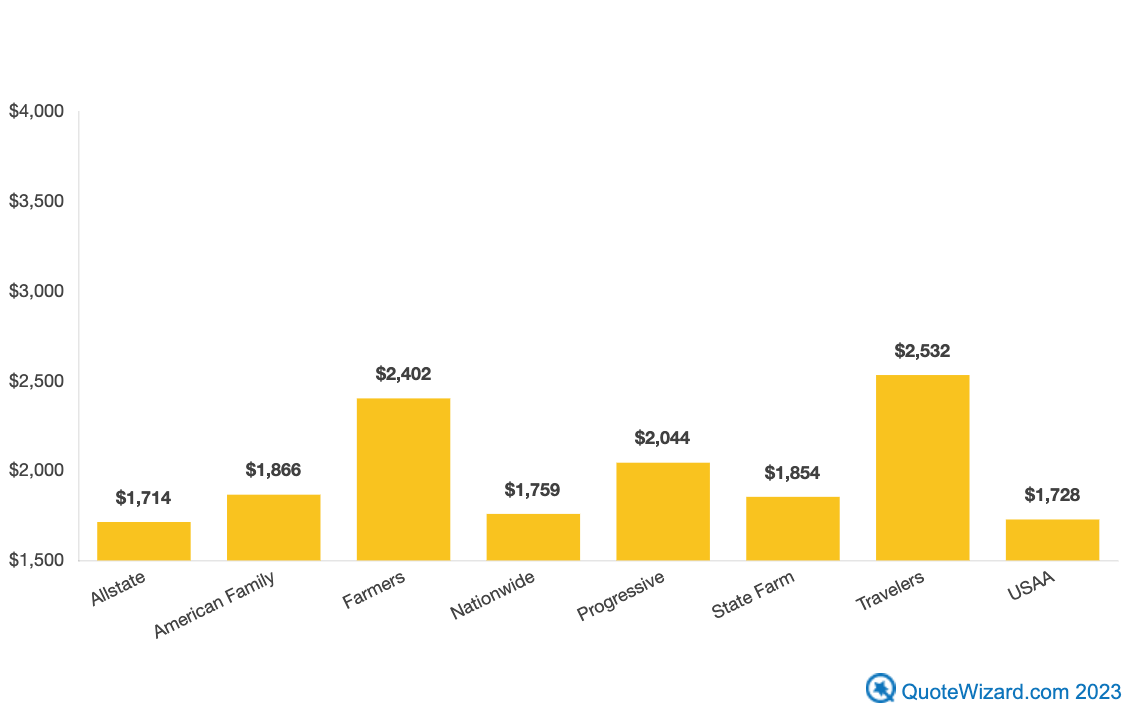

A State Farm home insurance policy costs an average $1,854 a year, which is slightly higher than the U.S. average of $1,735. State Farm falls in the middle of the pack compared to its competitors in the home insurance industry.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

Renters Insurance

Renters insurance is an affordable type of policy that protects your belongings and provides liability coverage.

Renters insurance coverages

A State Farm renters insurance policy covers losses from property damage caused by theft, vandalism, fire and several additional perils. If your home is uninhabitable due to a covered loss, State Farm can help with additional living expenses for a certain amount of time.

State Farm renters insurance may also protect you if someone injures themself in your home, or if you damage someone else's property.

Additional renters insurance coverages

A State Farm renters insurance policy allows you to add optional coverages, including:

- Inflation coverage. This protects your personal property by automatically increasing the amount of your coverage as inflation changes the cost of living.

- Personal liability. This helps pay for legal liability and legal defense costs due to bodily injury or property damage caused by an accident.

- Medical payments to others. This pays for medical expenses if someone is accidentally injured on your property due to a covered loss.

Renters insurance discounts

Although renters insurance is affordable, these discounts can help you save money on your policy.

- Multiline discount. If you purchase renters and auto policies from State Farm, you could be eligible for a discount.

- Home alert insurance discount. If you have a fire alarm, smoke detector, burglar alarm or any other home monitoring system, you may qualify for a discount.

What you need to know about State Farm renters insurance

- J.D. Power gave State Farm's renters insurance a score of 866 out of 1,000 for overall satisfaction in its 2021 study, while the segment average is 848 out of 1,000.

- State Farm's renters insurance policy has all the standard protection you would see in most competitors' policies.

We recommend purchasing a renters insurance policy through State Farm if you have an auto policy with the company to get a bundling discount.

Methodology

The sample quotes used for this review are based on a 30-year-old single male driver with a 2012 Honda Accord LX. Unless otherwise stated, this driver has a clean driving record with no prior insurance. He drives an average of 13,500 miles annually.

Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

For home insurance, we collected quotes for a standard HO-3 homeowners insurance policy. We used the following coverages:

- $275,000 dwelling coverage

- $27,500 other structures

- $137,500 personal property

- $55,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible