If you’re looking for cheap car insurance in Vermont, get quotes from GEICO, Union Mutual and USAA while shopping around for coverage. These companies offer the cheapest rates in the Green Mountain State, according to a QuoteWizard survey.

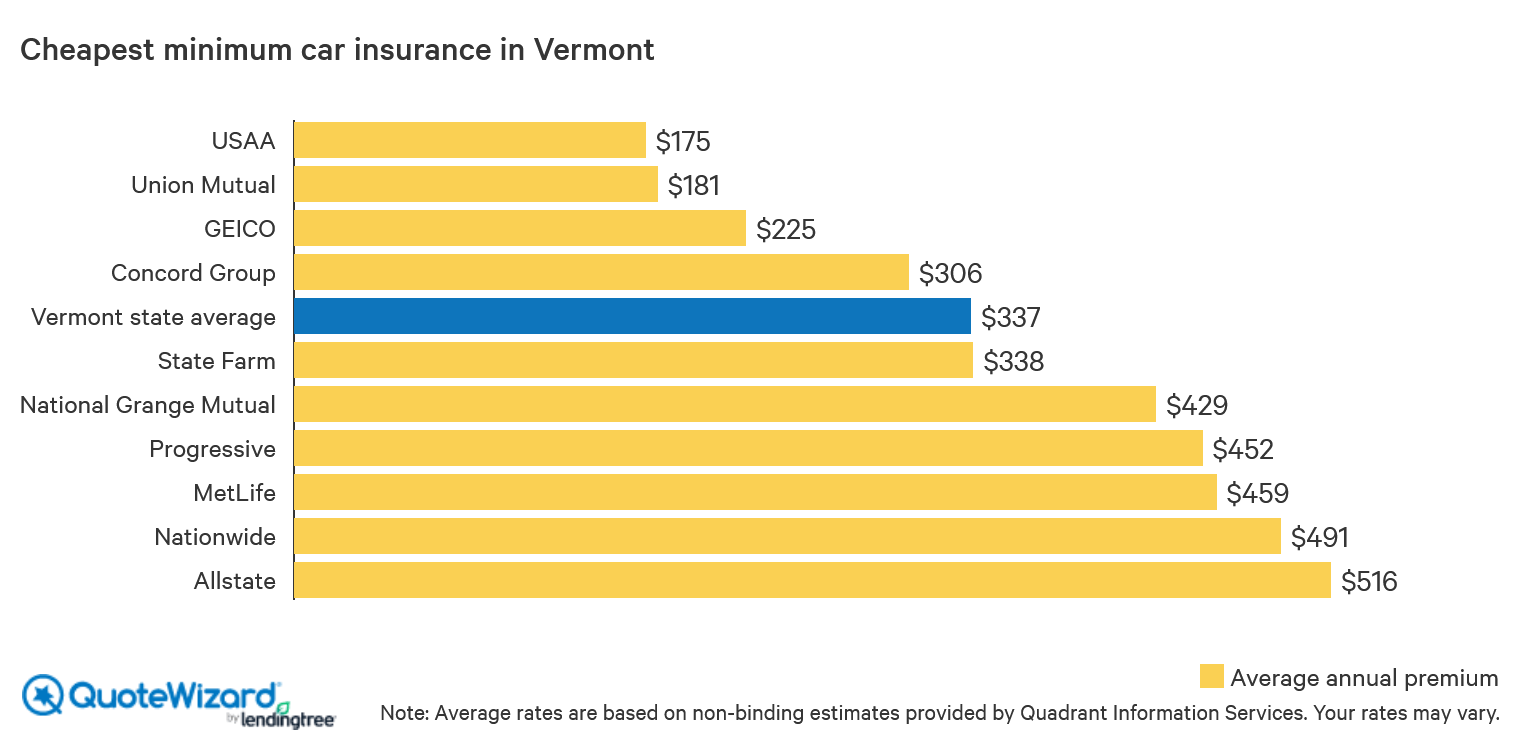

Drivers in Vermont pay an average of $175 per year when they buy the minimum amount of car insurance the state requires from USAA. They pay just a few dollars more, an average of $181 per year, when they buy a state-minimum policy from Union Mutual.

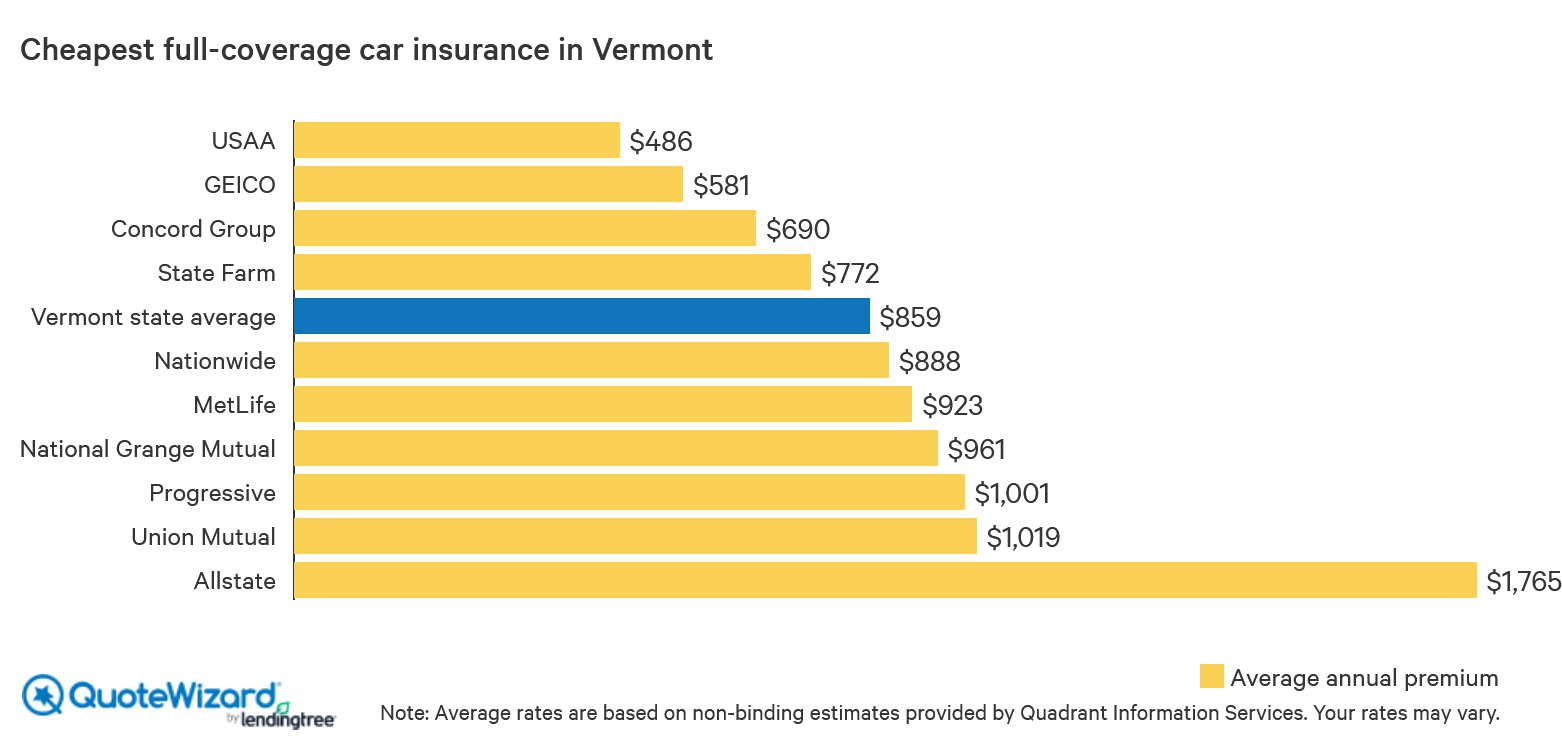

Vermont drivers pay an average of $486 per year when they buy full-coverage car insurance from USAA. And they pay an average of $581 per year when they buy such a policy from runner-up GEICO.

These rates are well below the state averages for minimum-coverage and full-coverage auto insurance policies. Our data shows that a typical driver in Vermont spends $337 per year on minimum coverage and $859 per year on full coverage.

Want to know more? Continue reading for information on:

- Where to find cheap auto insurance in Vermont

- Vermont’s best cheap car insurance companies

- Most popular auto insurance companies in Vermont

- Vermont car insurance laws and requirements

Where can I get cheap car insurance in Vermont?

USAA is the best company for cheap car insurance in Vermont whether you want a state-minimum or full-coverage policy. It offered our sample driver an average annual rate of $175 for a minimum-coverage policy. And it offered our driver an average annual rate of $486 for a policy that includes liability, collision and comprehensive coverage.

These average annual rates are based on quotes gathered throughout the state of Vermont for a standard driver.

USAA isn’t the only company that offers Vermont drivers cheap minimum-coverage car insurance. Which is good, as only active military members, veterans and their eligible family members can buy car insurance from USAA.

Union Mutual and GEICO also offer affordable state-minimum car insurance to drivers in Vermont. Union Mutual sent our sample driver an average annual rate of $181 for a minimum-coverage policy, while GEICO sent our driver an average annual rate of $225.

GEICO sent our sample Vermont driver a low average quote of $581 per year for full-coverage car insurance, too. Concord Group sent our driver an average quote of $690 per year. Concord Group’s quote is $204 per year more than the average quote USAA offered, but also $169 per year less than the state average for such a policy.

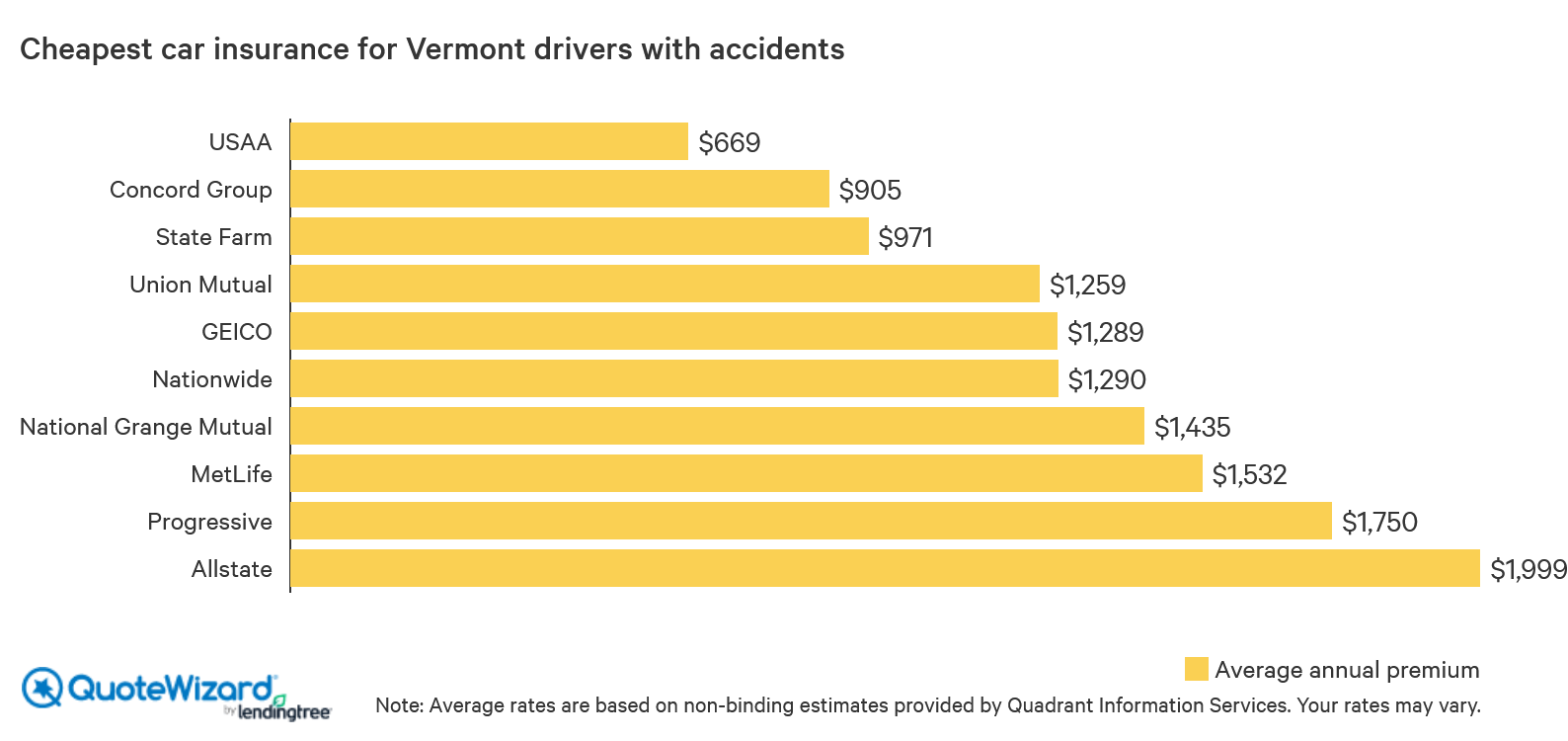

Drivers with even one at-fault accident on their records often pay more for auto insurance than drivers with clean records.

USAA comes out on top in this area as well. It offered our sample driver with an accident an average rate of $669 a year for a full-coverage policy. That’s by far the cheapest of the 10 companies we surveyed.

If you have an accident on your record and you’re not eligible for USAA membership, at least compare quotes from Concord Group and State Farm. Concord Group sent our driver an average annual rate quote of $905, while State Farm’s average quote was $971 per year.

Although drivers with an accident on their records usually pay higher rates for auto insurance, that’s not always the case. This is because insurers consider several factors when determining rates. Your driving record is one of these factors, as are your age, your gender and your vehicle’s make and model.

What are the best cheap car insurance companies in Vermont?

USAA is the best car insurance company for drivers in Vermont who want cheap full-coverage or minimum-coverage auto insurance, according to our research. It sent our sample driver an average premium of $175 per year for a minimum-coverage policy and an average premium of $486 per year for a full-coverage policy.

Not everyone can get auto insurance from USAA, though. If you’re among the people who can’t, check out Union Mutual or GEICO. Based on our data, besides USAA, Union Mutual offers the cheapest minimum-coverage policies in Vermont, and GEICO offers the cheapest full-coverage policies in the state.

Also, after USAA, Concord Group offers the cheapest full-coverage auto insurance for Vermont drivers with an accident on their record.

What are the best car insurance companies in Vermont for state-minimum coverage?

Union Mutual sent our sample driver an average premium of $181 per year for the minimum amount of car insurance Vermont requires. This average premium is only $6 per year more than what USAA offered for the same amount of coverage. Also, it is $156 per year cheaper than the state average for a state-minimum policy. That’s a difference of $13 per month.

GEICO and Concord Group offer cheap state-minimum auto insurance to Vermont drivers, too. GEICO sent our driver an average annual premium of $225, while Concord Group sent an average annual premium of $306.

What are the best car insurance companies in Vermont for a full-coverage policy?

GEICO sent our sample Vermont driver an average premium of $581 per year for full-coverage car insurance. This average premium is $95 per year more than what USAA offered for the same amount of coverage. It’s also $278 per year, or just over $23 per month, cheaper than the state average for a full-coverage policy.

Concord Group and State Farm offer cheap full-coverage auto insurance to drivers in Vermont as well. Concord Group sent our driver an average annual premium of $690 for this type of policy, while State Farm sent an average annual premium of $772.

What are the best car insurance companies in Vermont for drivers with accidents?

USAA sent our sample driver with one accident on his record an average premium of $669 per year for full-coverage car insurance.

Concord Group and State Farm came in second and third in this area, respectively. Concord Group offered our driver an average premium of $905 per year for a full-coverage policy. State Farm offered an average premium of $971 per year.

What are the most popular car insurance companies in Vermont?

Progressive is Vermont’s most popular car insurance company, according to S&P Global. It writes just over 16% of the state’s policies in this area.

GEICO is a close second, writing slightly under 16% of Vermont’s auto insurance policies.

| Insurance company | Vermont market share | |||

|---|---|---|---|---|

| Progressive | 16.2% | |||

| GEICO | 15.8% | |||

| Liberty Mutual | 8% | |||

| State Farm | 7.3% | |||

| Allstate | 6.7% | |||

| USAA | 5.7% | |||

| Concord Group | 5.5% | |||

| Vermont Mutual | 4.4% | |||

| Patrons Co-operative Fire Insurance Company | 3.8% | |||

| Travelers | 3.5% | |||

| Travelers | 3.5% | |||

| Source: S&P Global | ||||

Concord Group, which we found offers the cheapest full-coverage car insurance for Vermont drivers with an accident after USAA, holds 5.5% of the state’s market share.

Union Mutual, our pick for cheapest state-minimum coverage in Vermont if you aren’t eligible for coverage from USAA, writes 1.7% of auto insurance policies there.

What are Vermont’s car insurance requirements?

To legally drive in Vermont, you must have a car insurance policy with at least:

- $25,000 of bodily injury liability coverage for the injury or death of one person.

- $50,000 of bodily injury liability coverage for the injury or death of two or more people.

- $10,000 of property damage liability coverage.

Vermont law also requires all car insurance policies that offer liability coverage to include a minimum of:

- $50,000 of uninsured and underinsured motorist bodily injury coverage for the injury or death of one person.

- $100,000 of uninsured and underinsured motorist bodily injury coverage for the injury or death of two or more people.

- $10,000 of uninsured and underinsured motorist property damage coverage per claim.

Vermont drivers who don’t want to maintain a car insurance policy can file evidence of self-insurance in the amount of $115,000 with the state’s Commissioner of Motor Vehicles.

Methodology

Best car insurance companies for a full-coverage policy: We compiled this data using the driver profile of a single, 35-year-old male in Vermont who has an excellent credit score and a clean driving record. He owns a 2012 Honda Accord, drives it an average of 15,000 miles a year and has a full-coverage auto insurance policy that includes liability, collision and comprehensive coverages.

Best car insurance companies for a minimum-coverage policy: This data uses the driver profile of a single, 35-year-old male in Vermont who has an excellent credit score and a clean driving record. He owns a 2012 Honda Accord, drives it an average of 15,000 miles a year and has an auto insurance policy with the minimum amount of coverage the state requires.

Best car insurance companies for drivers with an accident: This data uses the driver profile of a single, 35-year-old male in Vermont who has an excellent credit score and one accident on his driving record. He owns a 2012 Honda Accord, drives it an average of 15,000 miles a year and has a full-coverage auto insurance policy.

Sources:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.