If you have an accident, speeding ticket or DUI on your driving record, American Family, State Farm and USAA provide the cheapest car insurance rates. The amount you'll pay will depend on various factors, such as the type of violation on your record and how many you have. While the increase isn't permanent, it is a dent in the pocketbook.

This article covers

Who are the cheapest car insurance companies for bad drivers?

USAA, State Farm and American Family have the most affordable car insurance rates for bad drivers. You should be aware that USAA only offers car insurance for military members and veterans, as well as their families. For civilian drivers, State Farm and American Family are your cheapest options.

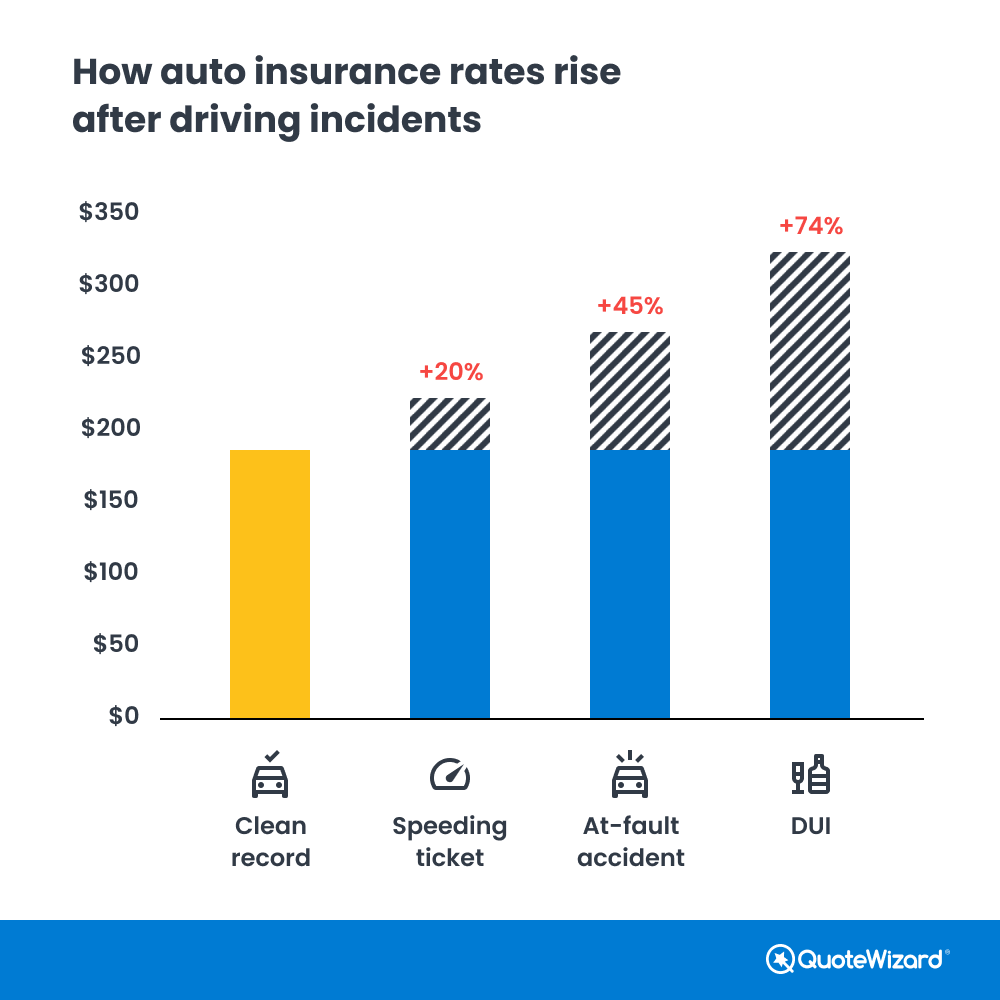

The following tables show the rates for the largest providers in the country after an at-fault accident, a speeding ticket or a DUI. For comparison, the average rate for car insurance for a driver with a clean record is $180 a month. To get your best rate after a driving violation, compare car insurance quotes from several companies.

Cheapest car insurance after an at-fault accident

Most drivers find their cheapest rate for car insurance after an accident they're responsible for with State Farm, which has an average post-accident rate of $275 a month. American Family has the next-lowest rate at $345 a month. The table below shows the cheapest rates after you have an accident, along with the percentage increase.

| Company | Annual rate | Monthly rate | Rate increase |

|---|---|---|---|

| USAA | $2,830 | $236 | 31% |

| State Farm | $3,304 | $275 | 53% |

| American Family | $4,142 | $345 | 92% |

| Progressive | $5,172 | $431 | 139% |

| Nationwide | $5,208 | $434 | 141% |

| GEICO | $5,254 | $438 | 143% |

| Farmers | $5,536 | $461 | 156% |

| Allstate | $5,622 | $469 | 161% |

| Travelers | $7,982 | $665 | 269% |

| Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |||

If you are in a car accident, the important thing to do first is stay calm and get to safety. Do not leave the scene of the accident, as this can be construed as a hit-and-run.

Get cheap car insurance with a bad driving record

Cheap auto insurance after a speeding ticket

If you're looking for the cheapest car insurance after you get a speeding ticket, State Farm has the cheapest rate for most drivers at $247 a month. This is a 37% increase over the average national rate of $180. American Family comes next at $267 a month.

| Company | Annual rate | Monthly rate | Rate increase |

|---|---|---|---|

| USAA | $2,407 | $201 | 12% |

| State Farm | $2,967 | $247 | 37% |

| American Family | $3,204 | $267 | 48% |

| GEICO | $4,224 | $352 | 96% |

| Allstate | $4,568 | $381 | 112% |

| Progressive | $4,579 | $382 | 112% |

| Nationwide | $5,070 | $423 | 135% |

| Farmers | $5,201 | $433 | 141% |

| Travelers | $7,743 | $645 | 258% |

| Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |||

Cheapest car insurance after a DUI

Most drivers get the cheapest rates for car insurance after a DUI with State Farm, which offers an average rate of $313 a month. American Family has the next-cheapest rate after a DUI at $338 a month.

| Company | Annual rate | Monthly rate | Rate increase |

|---|---|---|---|

| USAA | $3,595 | $300 | 67% |

| State Farm | $3,754 | $313 | 74% |

| American Family | $4,055 | $338 | 88% |

| Progressive | $4,488 | $374 | 108% |

| Farmers | $5,657 | $471 | 162% |

| Allstate | $5,734 | $478 | 166% |

| Nationwide | $6,781 | $565 | 214% |

| GEICO | $6,948 | $579 | 222% |

| Travelers | $9,171 | $764 | 324% |

| Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |||

After a DUI, on top of fines and possible jail time, chances are your drivers license gets suspended. To get it reinstated, you may have to file an SR-22, depending on the state you're registered to drive in. You are required to carry an SR-22 for up to three consecutive years.

How does a bad driving record raise my car insurance?

An infraction can drive up your car insurance rates considerably, depending on the type of offense and the state you live in. A ticket, accident or DUI can stay on your record for many years, depending on the offense. A speeding ticket may only affect your rates for three years, but a DUI can stay on your insurance record for up to 10 years. The table below shows what car insurance rates look like in each state after an accident, speeding ticket or a DUI.

| State | After accident | After speeding ticket | After DUI |

|---|---|---|---|

| Alabama | $407 | $353 | $476 |

| Alaska | $245 | $212 | $259 |

| Arizona | $560 | $490 | $538 |

| Arkansas | $307 | $261 | $345 |

| California | $366 | $322 | $562 |

| Colorado | $431 | $372 | $441 |

| Connecticut | $605 | $522 | $832 |

| Delaware | $483 | $417 | $530 |

| Florida | $761 | $645 | $719 |

| Georgia | $354 | $295 | $478 |

| Hawaii | $173 | $152 | $409 |

| Idaho | $218 | $193 | $283 |

| Illinois | $456 | $384 | $466 |

| Indiana | $293 | $230 | $339 |

| Iowa | $279 | $224 | $342 |

| Kansas | $292 | $252 | $306 |

| Kentucky | $604 | $547 | $694 |

| Louisiana | $674 | $530 | $668 |

| Maine | $227 | $176 | $242 |

| Maryland | $433 | $366 | $378 |

| Massachusetts | $408 | $369 | $437 |

| Michigan | $631 | $583 | $1,280 |

| Minnesota | $438 | $361 | $534 |

| Mississippi | $400 | $332 | $458 |

| Missouri | $381 | $317 | $402 |

| Montana | $263 | $238 | $307 |

| Nebraska | $313 | $274 | $326 |

| Nevada | $566 | $476 | $601 |

| New Hampshire | $366 | $308 | $373 |

| New Jersey | $556 | $461 | $634 |

| New Mexico | $264 | $199 | $247 |

| New York | $541 | $567 | $703 |

| North Carolina | $142 | $137 | $353 |

| North Dakota | $302 | $260 | $399 |

| Ohio | $278 | $236 | $281 |

| Oklahoma | $399 | $330 | $406 |

| Oregon | $435 | $363 | $445 |

| Pennsylvania | $457 | $366 | $465 |

| Rhode Island | $515 | $584 | $962 |

| South Carolina | $481 | $412 | $549 |

| South Dakota | $296 | $247 | $370 |

| Tennessee | $269 | $244 | $324 |

| Texas | $484 | $359 | $551 |

| Utah | $436 | $350 | $512 |

| Vermont | $236 | $202 | $262 |

| Virginia | $285 | $245 | $321 |

| Washington | $339 | $282 | $347 |

| Washington, D.C. | $389 | $330 | $405 |

| West Virginia | $265 | $231 | $348 |

| Wisconsin | $290 | $233 | $315 |

| Wyoming | $268 | $262 | $346 |

| Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |||

Compare auto insurance quotes to get your best rate

How bad drivers can lower their car insurance rates

If you are looking to get the best coverage at the cheapest cost after an infraction, one of the best things you can do is compare car insurance quotes from multiple providers. Looking at the coverage you need from many different insurers will give you the best overview of who has the best and cheapest quote for your needs.

Bundling your car insurance with a renters, home or life insurance policy is another practical route toward lowering your car insurance. When you bundle your car insurance with another policy, you can say money off of both policies.

Also, check with your provider to see what other discounts are available. Some suggestions to look into are:

- Low mileage

- Good student

- Defensive driving

High-risk car insurance for bad drivers

If you have multiple violations on your insurance record, it may do more than hike up your rates. Many infractions can rate you as a high-risk driver in the eyes of car insurance companies. If this occurs, at best you will pay much higher rates and at worst it will leave you with no auto coverage.

Fortunately, there are providers that specialize in covering high-risk drivers. These include:

- Acceptance

- Bristol West

- Dairyland

- GAINSCO

- The General

- Kemper

Methodology

We used Quadrant Information Services to generate thousands of car insurance quotes from the following providers:

- Allstate

- American Family

- Farmers

- GEICO

- Progressive

- State Farm

- Travelers

- USAA

Our sample driver is a 35-year-old male who drives a 2012 Honda Accord LX 13,500 miles per year.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.