Elephant Insurance might be pricey for some groups, but it offers competitive rates for young drivers, according to our research. But Elephant car insurance struggles in customer service — some customers have found filing a claim or fixing billing errors to be challenging with this auto insurance company. The insurer does offer discounts which, when bundled, could total 40% off. Because auto insurance premiums vary widely based on many factors, it's important to shop around to see if Elephant Insurance is right for you.

Elephant Insurance is a relatively new provider in the auto insurance market, having only been established in 2009. Elephant writes auto insurance policies in six states: Illinois, Indiana, Maryland, Tennessee, Texas and Virginia. The company sells directly to drivers through its website to purchase a policy or file a claim.

Even though Elephant Insurance only writes auto policies, it offers a unique option to bundle policies. If you'd like to bundle your Elephant auto insurance with another policy, you can purchase homeowners and/or renters insurance from separate companies through Elephant Insurance's website. Elephant Insurance's parent company is Admiral Group, based in the United Kingdom.

In this article, we'll touch on:

- Elephant Insurance's customer service reputation

- Elephant Insurance car insurance rates for the average customer

- Standard auto insurance coverages offered through Elephant Insurance

Elephant auto insurance customer reviews

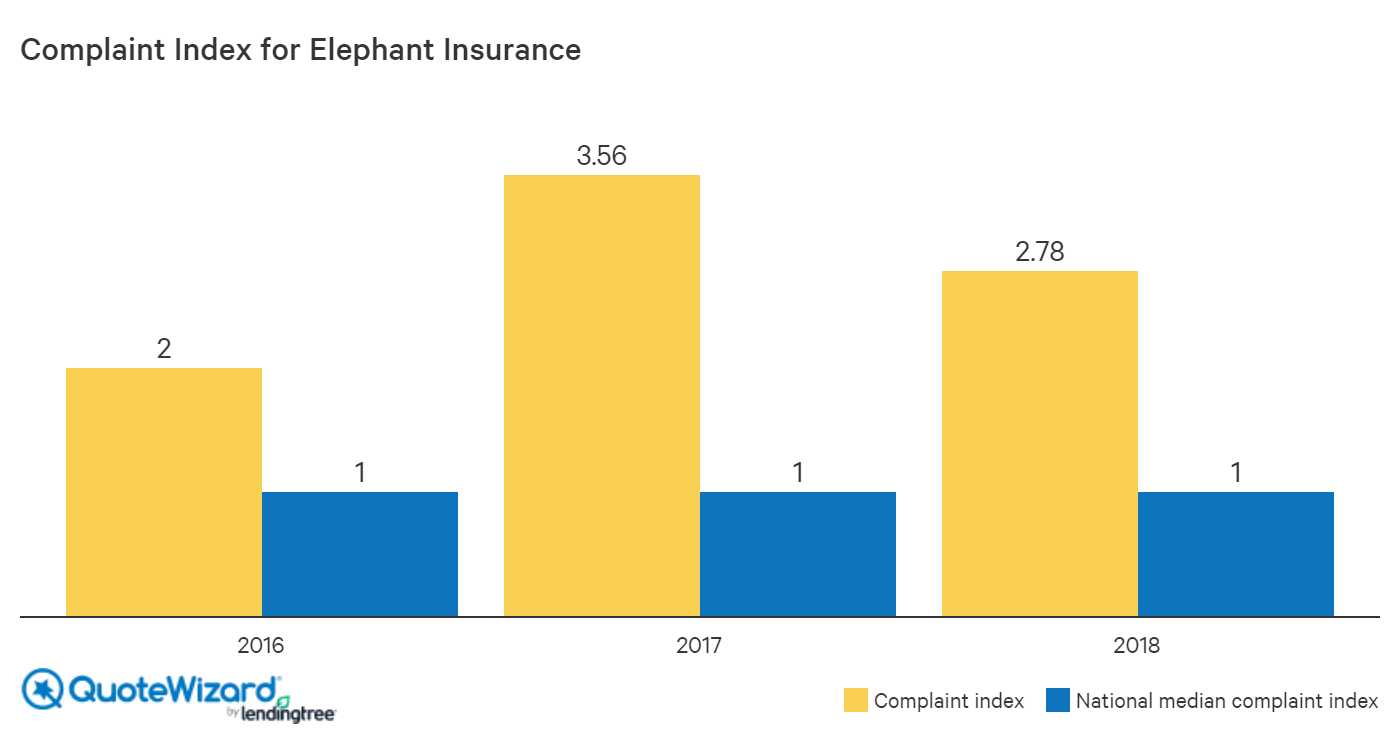

According to the NAIC, Elephant has significantly more complaints than the average car insurance company when adjusted for its size. So if you value good customer service and ease in filing claims, Elephant Insurance falls behind the competition. In the rare cases when you do need to make a claim, you might encounter some challenges similar to other customers. Depending on your quotes, Elephant Insurance still might be priced right to outweigh its customer service reputation.

In 2018, Elephant Insurance had a very high complaint index of 2.78, which means having almost three times as many complaints as would be expected for a comparable size insurance provider. Although the complaint ratio has decreased recently, it remains far above the national median.

Additionally, we analyzed complaints filed through the Better Business Bureau against Elephant Insurance over the past three years and found the following:

- Most customers had a problem with a product or service.

- There were consistent issues with billing and collections.

- Customers were charged an incorrect amount.

- Customers had trouble having a claim attended to.

- Customers did not receive prompt responses from representatives.

Filing an insurance claim through Elephant Insurance

Elephant Insurance offers a standard process to file a claim. You can do so online, which most companies (but not all) offer. Elephant Insurance also has an app similar to many major insurance companies. When you file a claim, you can leverage Elephant Insurance's network of recommended shops in case you need to repair your damaged vehicle. You're also free to shop around for an auto body shop and get reimbursed for your repair costs.

Claims telephone: 844-937-5353

Claims email: claims@elephant.com

Claims fax: 804-955-1722

Claims mailing address: PO Box 5205, Glen Allen, VA 23058

Elephant car insurance premiums vary for the average customer

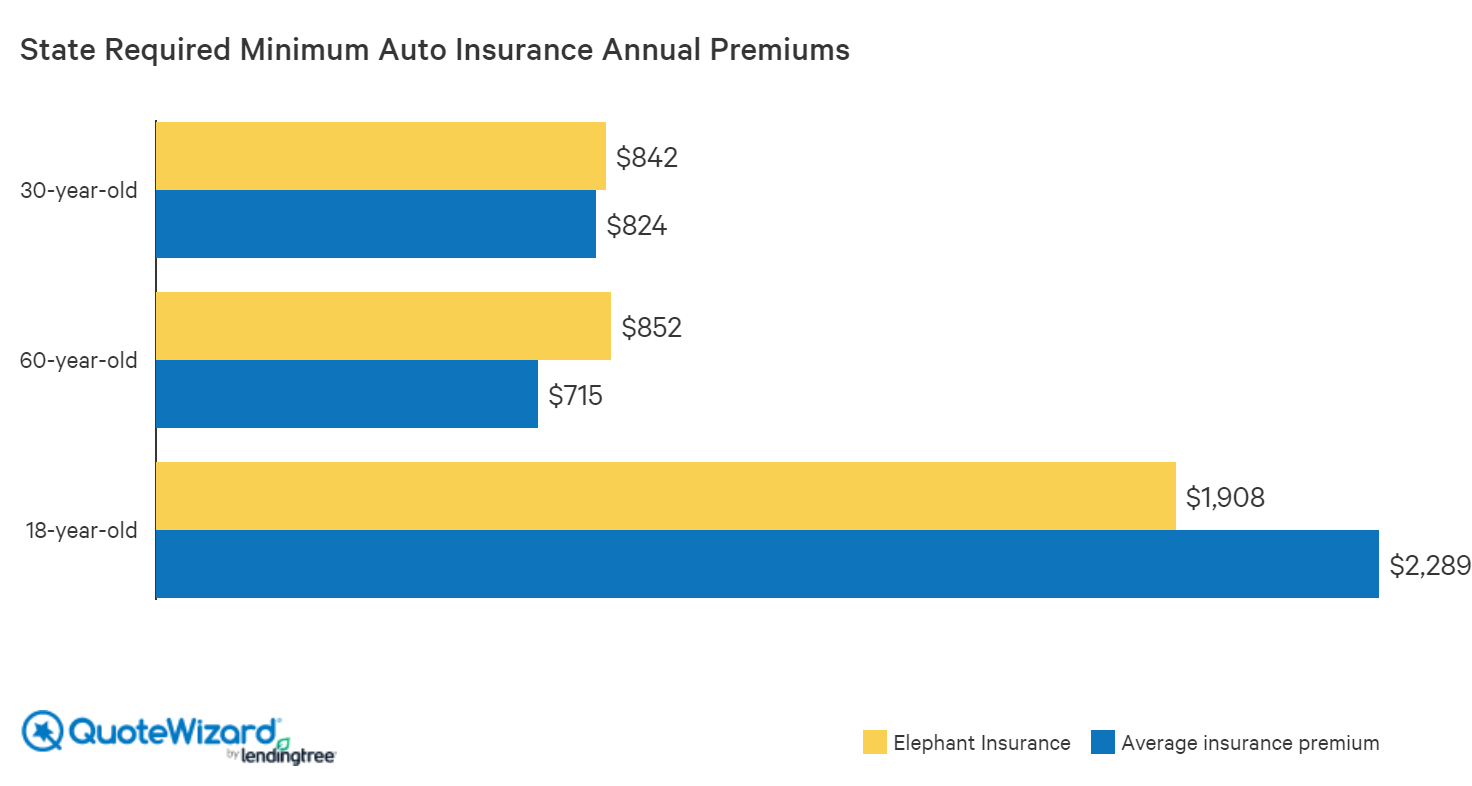

Based on our research, Elephant Insurance has above-average rates for mid-tenure drivers (in our case, 30 years old), and has cheaper rates for younger people and middle-aged people compared to the top 10 car insurance providers in our sample state, Illinois.

Elephant Insurance has pricier than average rates for our 30-year-old male driver compared to the top 10 largest auto insurance providers in Illinois. On the other hand, Elephant auto insurance is among the cheapest insurers for young drivers, offering 17% to 30% cheaper average car insurance premiums. It also offers lower than average premiums for 60-year-old female drivers. For young drivers who face some of the highest auto insurance premiums, Elephant Insurance might be a good option.

State required minimum auto insurance annual premiums

For Illinois state required minimum auto insurance, Elephant Insurance is expensive for our 30-year-old male, but relatively inexpensive for our young driver and 60-year-old married female.

These rates may vary per person, so you can potentially find a lower quote with Elephant Insurance through a combination of discounts for things such as bundling policies and an electronic signature. It's crucial to get quotes from as many companies as possible and weigh your options after.

Below, we break out average quotes for all the insurers in our analysis for an auto insurance policy with the minimum required limits.

30-year-old single male insurance premiums — minimum coverage

| Company | Annual premium |

|---|---|

| Farmers | $1,577 |

| Standard Fire | $1,130 |

| Allstate | $1,088 |

| Progressive | $928 |

| Elephant Insurance | $842 |

| Average | $824 |

| American Family | $633 |

| GEICO | $573 |

| State Farm | $544 |

| Country Preferred | $491 |

| USAA | $441 |

60-year-old married female insurance premiums — minimum coverage

| Company | Annual premium |

|---|---|

| Allstate | $1,043 |

| Standard Fire | $1,003 |

| Farmers | $937 |

| Elephant Insurance | $852 |

| Progressive | $849 |

| Average | $715 |

| GEICO | $620 |

| American Family | $591 |

| State Farm | $503 |

| Country Preferred | $386 |

| USAA | $369 |

18-year-old single male insurance premiums — minimum coverage

| Company | Annual premium |

|---|---|

| Farmers | $4,458 |

| Standard Fire | $3,280 |

| American Family | $2,582 |

| Progressive | $2,424 |

| Average | $2,290 |

| GEICO | $2,025 |

| Elephant Insurance | $1,908 |

| Allstate | $1,892 |

| State Farm | $1,706 |

| Country Preferred | $1,313 |

| USAA | $1,208 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.1 | |

Full-coverage auto insurance policy annual premiums

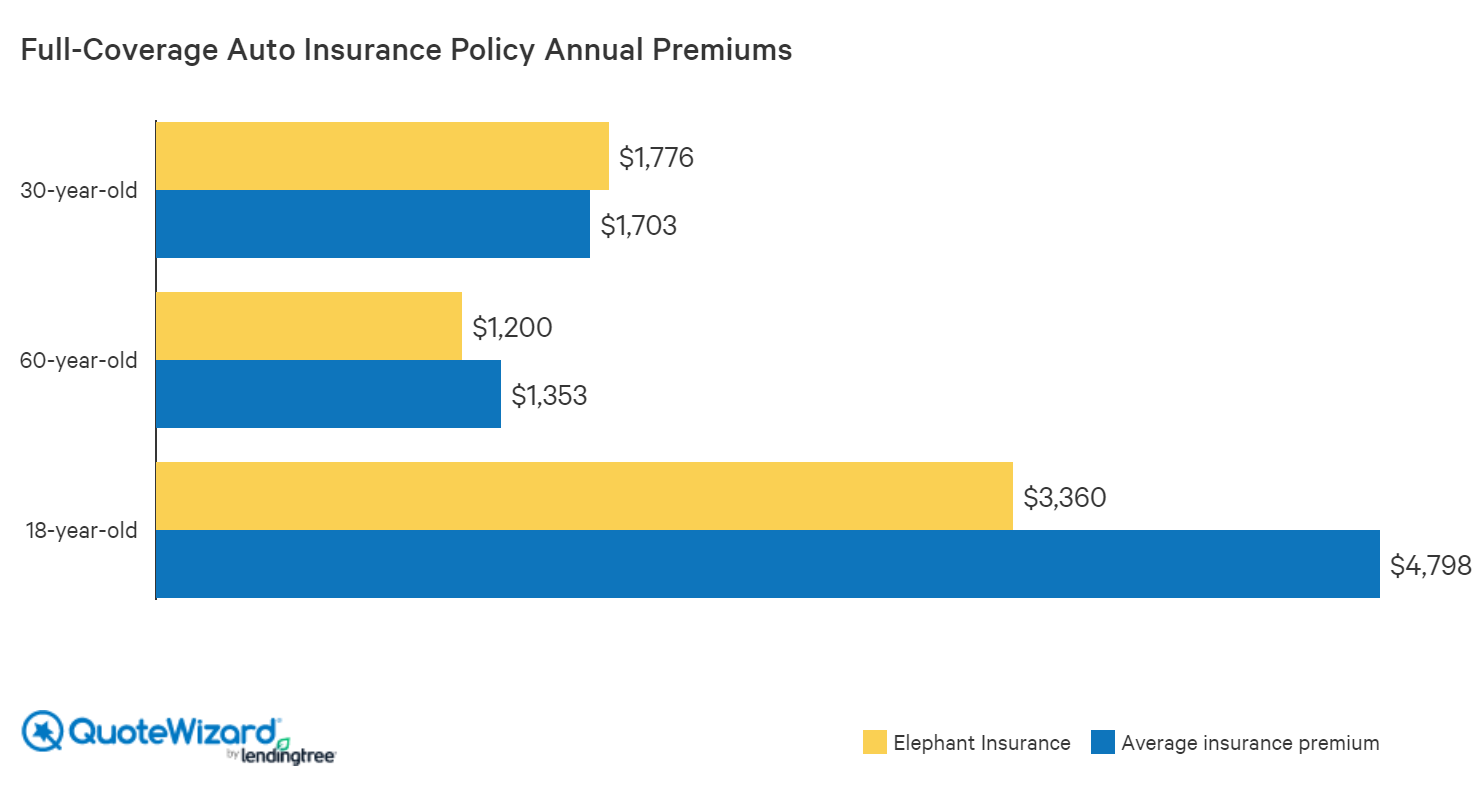

For a full-coverage auto insurance policy, Elephant again offers relatively cheap rates for young drivers and our 60-year-old female, while it is more expensive than average for a 30-year-old male.

For our 30-year-old male driver, Elephant Insurance is more expensive than the average car insurance rate for a full-coverage policy.

Elephant car insurance offers cheaper than average rates for a 60-year-old married female looking for a full-coverage auto insurance policy. There might be cheaper providers, but you need to shop around. Quotes may vary based on discounts you are eligible for, as well as other factors.

Elephant Insurance offers a highly competitive rate — 30% cheaper than the average quote — for our 18-year-old driver purchasing a full-coverage auto insurance policy.

Below, we break out average quotes for all the insurers in our analysis for an auto insurance policy with full coverage.

30-year-old single male insurance premiums — full coverage

| Company | Annual premium |

|---|---|

| Farmers | $2,955 |

| Allstate | $2,421 |

| Standard Fire | $2,043 |

| Elephant Insurance | $1,776 |

| Progressive | $1,709 |

| Average | $1,703 |

| GEICO | $1,382 |

| American Family | $1,310 |

| State Farm | $1,233 |

| Country Preferred | $1,195 |

| USAA | $1,006 |

60-year-old married female insurance premiums — full coverage

| Company | Annual premium |

|---|---|

| Allstate | $2,236 |

| Farmers | $1,675 |

| Standard Fire | $1,615 |

| GEICO | $1,407 |

| Progressive | $1,376 |

| Average | $1,353 |

| American Family | $1,214 |

| Elephant Insurance | $1,200 |

| State Farm | $1,109 |

| Country Preferred | $892 |

| USAA | $809 |

18-year-old single male insurance premiums — full coverage

| Company | Annual premium |

|---|---|

| Farmers | $7,933 |

| Standard Fire | $6,989 |

| Progressive | $5,738 |

| American Family | $5,181 |

| Average | $4,798 |

| GEICO | $4,698 |

| Allstate | $4,392 |

| State Farm | $3,944 |

| Elephant Insurance | $3,360 |

| Country Preferred | $2,970 |

| USAA | $2,777 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.1 | |

Elephant auto insurance includes all typical coverages

Elephant Insurance doesn't offer any unique coverages compared to its competitors. In other words, Elephant offers all of the standard car insurance coverages and additional coverages often found with top insurers. For our sample driver, we found the following costs for each form of coverage:

| Type of coverage | Coverage amount | Monthly price of individual coverage |

|---|---|---|

| Standard car insurance coverages | ||

| Liability coverage (bodily injury) | $25,000 per person; $50,000 per accident | $53.42 |

| Liability coverage (property damage) | $20,000 | $25.67 |

| Uninsured motorist coverage (bodily injury) | $25,000 per person; $50,000 per accident | $1.33 |

| Medical payments coverage | $10,000 | $7.17 |

| Comprehensive coverage | $500 deductible | $5.75 |

| Collision coverage | $500 deductible | $38.50 |

| Add-on car insurance coverages | ||

| Roadside assistance | $3.67 | |

| Rental reimbursement | $30/day ($900 per accident) | $3.83 |

| Custom equipment coverage | $10,000 | $7.17 |

| Diminishing deductible | $5 | |

| GAP coverage | $1.42 | |

| Total | $152.92 | |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.1 | ||

In this example, if you were to elect for every form of coverage in your Elephant car insurance policy, you would pay about $153. If you elected to only have the state required liability coverage and roadside assistance, you would pay roughly $83 a month.

Add-on car insurance coverages

You can purchase market standard add-on coverages to your auto insurance policy with Elephant Insurance. Accident forgiveness is offered after a few years and is not available for purchase. Some of Elephant Insurance's add-on coverages are relatively cheap, notably their gap coverage.

Gap coverage

Elephant Insurance offers relatively cheap gap insurance coverage for financed vehicles. When your car is worth less than the amount you owe the bank, you might want additional coverage in case of an accident. Based on our research, Elephant Insurance offers this coverage for as low as around $1 extra a month.

Elephant Insurance roadside assistance

As per market standards, drivers can purchase roadside assistance through Elephant Insurance for less than $4 a month in our example. Elephant partners with Urgent.ly, so you can know where your driver is in real time.

Elephant Insurance roadside assistance number: 877-321-9910

Elephant Insurance windscreen replacement

Similar to all other car insurance companies, Elephant Insurance covers windscreen replacements if you have an additional comprehensive or collision coverage. In our sample quote, adding these coverages with $500 deductibles, the amount you pay out of pocket would cost around $44 a month. The cost of replacing a windscreen is most likely less than or close to your deductible for these coverages, so you would probably elect to pay for windscreen replacement out of pocket.

Elephant Insurance accident forgiveness

After a few years, Elephant Insurance offers customers accident forgiveness. Accident forgiveness ensures rates will not increase due to an at-fault accident.

Rental reimbursement coverage

You can purchase additional rental reimbursement coverage through Elephant Insurance, which cost less than $4 a month in our sample quote. Rental reimbursement covers your rental car fees, up to your policy limits, when your car is being repaired or replaced. You can purchase:

- $30/day and $900 max coverage

- $40/day and $1,200 max coverage

- $50/day and $1,500 max coverage

Elephant Insurance auto insurance discounts can total 40%

Elephant Insurance offers standard car insurance discounts, which in combination can lead to a maximum of a 40% discount in total. These discounts include:

- Multi-car discount (up to 20%)

- Discount for bundling multiple forms of insurance

- Online quote discount (up to 12%)

- Good student discount (up to 12%)

- Full payment discount (13.5%)

- Electronic signature ($100)

- Responsible driver who is accident free for five years (up to 10%)

- Safety feature discount (~4%)

- Paperless discount (up to 3% per vehicle)

Elephant Insurance bundling policies discount

Although Elephant Insurance only writes auto insurance policies, its agents can sell other types of insurance policies from other insurance providers. This means that bundling discounts may be available when multiple insurance policies are purchased together.

Through Elephant car insurance partners, you can bundle these forms of insurance:

- Motorcycle insurance

- Homeowners insurance

- Renters insurance

- Umbrella insurance

- Condo insurance

- Life insurance

Methodology

1We researched sample quotes for three different driver profiles: a 30-year-old single male, a 60-year-old married female and an 18-year-old single male. All drivers have good driving records and drive a 2012 Honda Accord LX. Our sample profile driver has been licensed since the age of 16 and has never had a lapse in coverage.

The full comprehensive auto insurance policy sampled above entails the following coverages:

- $100K in bodily injury coverage per person

- $300K in bodily injury coverage per accident

- $100K in property damage

- Uninsured motorist coverage

- Comprehensive and collision coverages

- Roadside assistance

- Rental reimbursement

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.