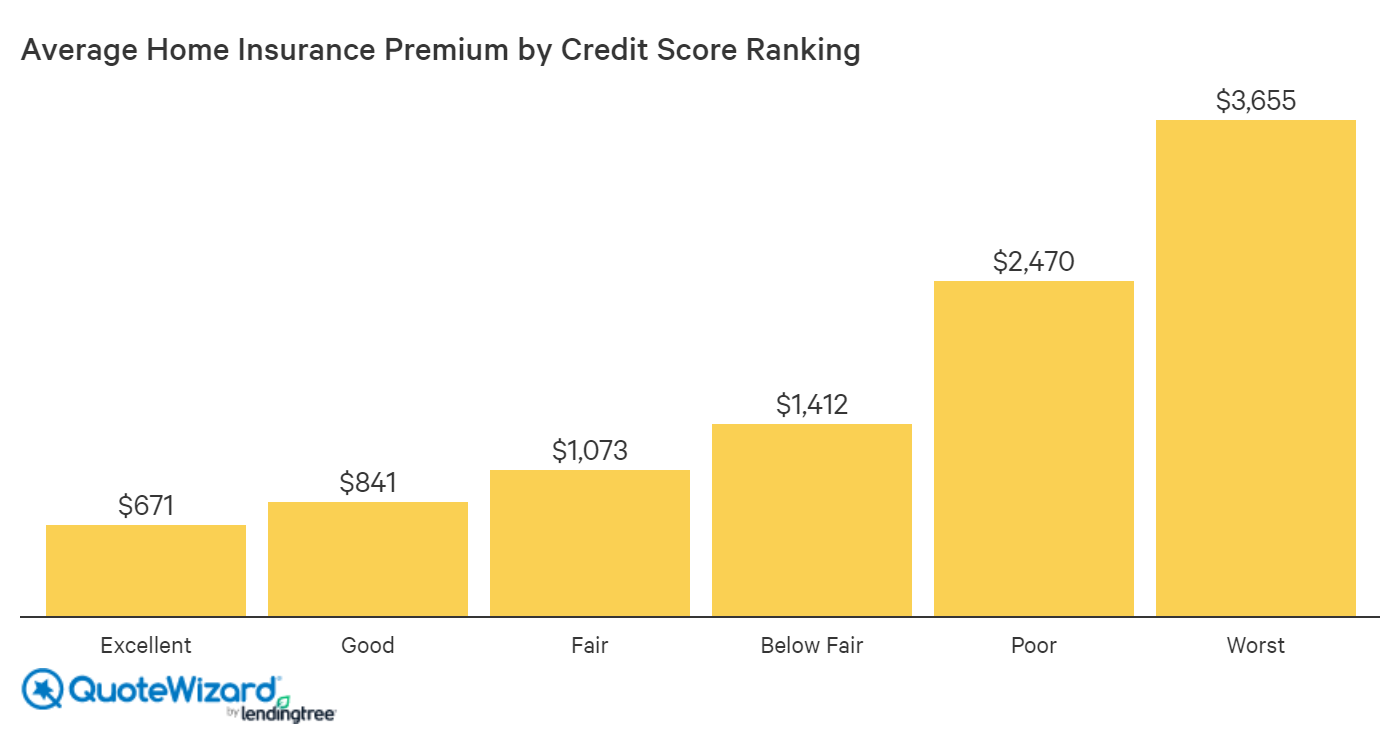

Your credit score is linked directly to your home insurance rate. QuoteWizard found that homeowners with the worst credit scores pay five times more for insurance than homeowners with excellent credit scores. Simply put, high credit scores usually mean cheaper home insurance rates for you. While there is strong debate over the fairness of the practice of credit-based insurance (CBI) scores being used to calculate homeowners insurance rates, many home insurers do it.

If you're aware of the personal credit factors that home insurance companies look at, as well as how to maintain a healthy credit score, you are more likely to get your best homeowners insurance rates.

In this article

How does my credit score affect my home insurance?

Most people think that their credit score gets looked at only when applying for a loan or a new credit card. However, the cost of your home insurance can be based on your credit rating as well.

FICO estimates that 85% of home insurance companies use customer CBI scores when calculating homeowners insurance quotes. Despite how common the practice is, most homeowners don't know their credit rating factors into their homeowners insurance ratings.

The simple truth is the lower your credit score, the higher your home insurance rate can go. Insurance Journal reported that homeowners with bad credit paid 91% more for home insurance than those with excellent scores. Even homeowners with average credit pay 29% higher home insurance rates than those with great credit.

What home insurance companies consider average, good or bad credit rates will also vary. For example, here's how LexisNexis Property Insurance defines its credit rates:

- Good: 776 to 997

- Average: 626 to 775

- Below Average: 501 to 625

- Less Desirable: Under 500

So while 626 to 775 may seem "good," that range actually tends to fall into the average credit-based insurance score.

Finding out how insurance companies rank CBI scores can go a long way towards helping you find a good home insurance rate. If your credit score is average by one home insurer's standards and good by another's standards, going with the latter may save you money on home insurance premiums.

As an example, below is a graph showing the average home insurance premium by credit score rank. Even between excellent and good, you can see there's over a 20% difference in home insurance rates. When you look at the difference between excellent and worst credit scores, homeowners in the worst range are paying over five times more in home insurance premiums than those in the excellent range. When your credit score goes to below fair or lower, you start to see significant home insurance rate increases:

The credit score insurance controversy

Home insurers believe that CBI scores help to predict how likely a homeowner is to file a claim, or even how often they'll file claims. According to the iii, studies found a "highly statistically significant" correlation between insurance ratings and loss ratios. In other words, people who had low insurance scores also had a lot of insurance claim payouts. Even though the practice of using CBI scores to calculate home insurance rates is common, many see it as controversial and unfair. Some think it discriminates against people who have become unemployed or fallen ill through no fault of their own.

Other homeowners may have bad credit for reasons that don't have anything to do with their ability to pay bills on time. Some people open many credit card accounts to get perks like discounts, points or frequent flyer miles.

Many opponents of the practice also believe it targets minorities and low-income communities.

States where credit scores are improving

Credit scores are improving nationwide. Our team of analysts found that between 2020 and 2021, the average American credit score increased by half a percent, going from 712 to 716. Mississippi, Nevada and Maine saw the biggest improvements in their average scores. Credit scores in these three states went up by six points in one year. Mississippi, however, still has the lowest average credit score nationwide.

South Dakota, Oklahoma and Minnesota had the smallest changes in their average credit scores. The average score increased by just two points in South Dakota and Oklahoma. Minnesota’s average score increased by three points, but the state already had (and continues to have) the highest average credit score nationwide.

Credit scores increased significantly during the first year of the pandemic because many people were able to pay off debt. Our analysts found that credit card and student loan delinquency dropped by around 30% between 2020 and 2021.

| State | Credit score 2020 | Credit score 2021 | Change |

|---|---|---|---|

| Mississippi | 675 | 681 | 0.89% |

| Nevada | 695 | 701 | 0.86% |

| Maine | 721 | 727 | 0.83% |

| Louisiana | 684 | 689 | 0.73% |

| Alabama | 686 | 691 | 0.73% |

| New Mexico | 694 | 699 | 0.72% |

| Florida | 701 | 706 | 0.71% |

| Indiana | 707 | 712 | 0.71% |

| Michigan | 714 | 719 | 0.70% |

| California | 716 | 721 | 0.70% |

| Idaho | 720 | 725 | 0.69% |

| Connecticut | 723 | 728 | 0.69% |

| Hawaii | 727 | 732 | 0.69% |

| New Hampshire | 729 | 734 | 0.69% |

| Vermont | 731 | 736 | 0.68% |

| Texas | 688 | 692 | 0.58% |

| Georgia | 689 | 693 | 0.58% |

| South Carolina | 689 | 693 | 0.58% |

| Arkansas | 690 | 694 | 0.58% |

| West Virginia | 695 | 699 | 0.58% |

| Tennessee | 697 | 701 | 0.57% |

| Kentucky | 698 | 702 | 0.57% |

| North Carolina | 703 | 707 | 0.57% |

| Arizona | 706 | 710 | 0.57% |

| Missouri | 707 | 711 | 0.57% |

| Delaware | 710 | 714 | 0.56% |

| Ohio | 711 | 715 | 0.56% |

| Maryland | 712 | 716 | 0.56% |

| Kansas | 717 | 721 | 0.56% |

| Virginia | 717 | 721 | 0.56% |

| New York | 718 | 722 | 0.56% |

| Rhode Island | 719 | 723 | 0.56% |

| New Jersey | 721 | 725 | 0.55% |

| Utah | 723 | 727 | 0.55% |

| Montana | 726 | 730 | 0.55% |

| Oregon | 727 | 731 | 0.55% |

| Washington | 730 | 734 | 0.55% |

| Alaska | 714 | 717 | 0.42% |

| Illinois | 716 | 719 | 0.42% |

| Wyoming | 719 | 722 | 0.42% |

| Pennsylvania | 720 | 723 | 0.42% |

| Colorado | 725 | 728 | 0.41% |

| Iowa | 726 | 729 | 0.41% |

| Nebraska | 728 | 731 | 0.41% |

| Massachusetts | 729 | 732 | 0.41% |

| North Dakota | 730 | 733 | 0.41% |

| Wisconsin | 732 | 735 | 0.41% |

| Minnesota | 739 | 742 | 0.41% |

| Oklahoma | 690 | 692 | 0.29% |

| South Dakota | 731 | 733 | 0.27% |

| United States | 712 | 716 | 0.56% |

| Methodology: Credit score data sourced from Investopedia | |||

What determines your credit rating

While CBI scores are similar to your standard credit score, there are some slight differences. Credit-based insurance scores only use some of the factors that comprise standard credit scores.

Credit-based insurance scores are different from the FICO scores your mortgage lender or auto lender might pull. Credit-based insurance scores are designed to consider factors that can be found on your credit reports. They also consider factors from your previously filed insurance claims.

Home insurers look at different factors when calculating your CBI scores. The two main influences on your insurance credit score are:

- Hard inquiries: Hard inquiries occur when a possible lender, such as a credit card company or an auto loan financer, checks your credit score to measure your risk value. These can lower your credit rating. However, if you make all your searches for mortgage, student loan rates or anything else requiring a hard inquiry within a 45-day window, all the inquiries will count as only one.

- Payment history: Your ability to pay your bills consistently and on time is of great interest to home insurers. Being in good standing with all your accounts will reduce your risk level.

Other factors that can affect your CBI score are:

- Debt-to-available-credit ratio

- The length of your credit history

- Your credit limits

Your insurance score "differs from a traditional credit score because the company does not factor in your employment history, your earnings history, your gender or a good bit of other personal information." said David Bakke, contributor at Money Crashers. "It's a lot more limited compared to the criteria for establishing a credit score."

The three main credit bureaus, Equifax, Experian and Transunion, can weigh the influence of each factor differently as well. Experian may weigh your payment history at 20% of your score while Transunion may weigh it at 30%.

What to do if you have a low credit score

The best way to find out if your home insurance company uses your credit report to calculate a CBI score is to contact them and ask. This step may not even be needed. If your CBI score raises the cost of your home insurance coverage or causes you a loss of coverage, the Fair Credit Reporting Act Adverse Action Notification requires your home insurer to let you know.

How to improve your credit score

There are some simple steps you can take to improve your credit-based insurance score. They include:

Debt management

Getting your debt utilization under control. Debt utilization is simply how much of your credit limit you use. Credit Karma, a credit advice website, recommends keeping your debt usage to 30% of your limit or less.

Double check your credit reporting

Check to make sure your credit limit is reporting accurately. Some credit cards might not report a credit limit if a credit bureau runs a background check.

Usually, only credit reports with a known limit are used when the utilization rate is calculated. If a credit limit is left blank, your credit utilization rate may be negatively affected.

Look for inquiry errors

Look over your credit report to see if there are any unauthorized inquiries. If you find any, contact the company that made the inquiry and request that they contact the credit bureaus to remove the error.

Maintain a credit mix

To get a good credit mix, try to maintain four credit cards from major lenders. Also, try to include two retail credit cards as well as two loans and a mortgage. This appears to be the best ratio for attaining an 800+ credit score. Secure credit cards and credit builder loan programs are a good starting point.

Pay on time

Pay your credit card bills on time. If you see any items on your bills that do not seem accurate, request that your lender waive a one-time mistake. If you had a hardship such as unemployment or an illness that affected your CBI score, request that the account be re-aged.

Watch your credit score

Keep an eye on your credit score but be careful of how you go about it. There are a lot of sites that offer "free credit reports," but many of them are not free. Once a year, you can see your credit score from all three major credit bureaus at annualcreditreport.com at zero cost to you.

Do all states use credit scores for home insurance?

Not all states permit the use of credit reports to calculate home insurance rates. In California, Maryland and Hawaii, it is illegal for insurers to use your credit score to increase your home insurance rate.

Other states may allow the practice; however, these states won't allow insurers to use your CBI score as a reason to cancel or deny your home insurance coverage.

The Washington, D.C. Department of Insurance lets home insurance policyholders request that insurance companies calculate new home insurance rates every year based on their current credit score.

Methodology

Data for home insurance premium by credit score rankings was compiled by Quadrant Information Services from 12 top home insurers in Illinois for a home worth $181,900 built in 1965.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.