American Family Insurance Review

American Family, or AmFam, offers decent rates to auto insurance customers with a customer service rating slightly above its competitors. While AmFam does not offer the absolute cheapest auto insurance rates, it has a wide selection of discounts and coverage options to lower your premium.

Products Reviewed

Best if

- You're looking for uncommon coverages, such as ridesharing or gap insurance.

- You're a teenager or a parent with a young adult driver.

- You're looking for an insurer with a convenient app and online claims process.

Worst if

- You live in the District of Columbia or one of the 31 states that American Family doesn’t cover.

- You're looking for the cheapest rates but don't qualify for any discounts.

Introduction

American Family offers auto, home and renters insurance at decent rates, unless you qualify for its range of discounts. Drivers able to stack multiple discounts can save a substantial amount on their premiums, making car insurance cheaper and more affordable.

You should check out AmFam if you're a teen or have a teen driver in your family, as the company offers an award-winning safe driving program to help young people improve their driving habits and accrue discounts.

According to the National Association of Insurance Commissioners (NAIC), American Family has written $11.5 billion in property and casualty premiums, making its market share 1.63%. This makes AmFam the 14th largest insurer in the nation.

American Family is based in Wisconsin and offers insurance coverage in the following 19 states: Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington and Wisconsin.

Auto Insurance

Auto insurance at a glance

Reinstatements up to 14 days (without a lapse)

Has one of the largest discount offerings of a mid-sized insurer

Planning to roll out pay-per-mile and pay-how-you drive policies in 2021

American Family offers mid-tier rates for drivers

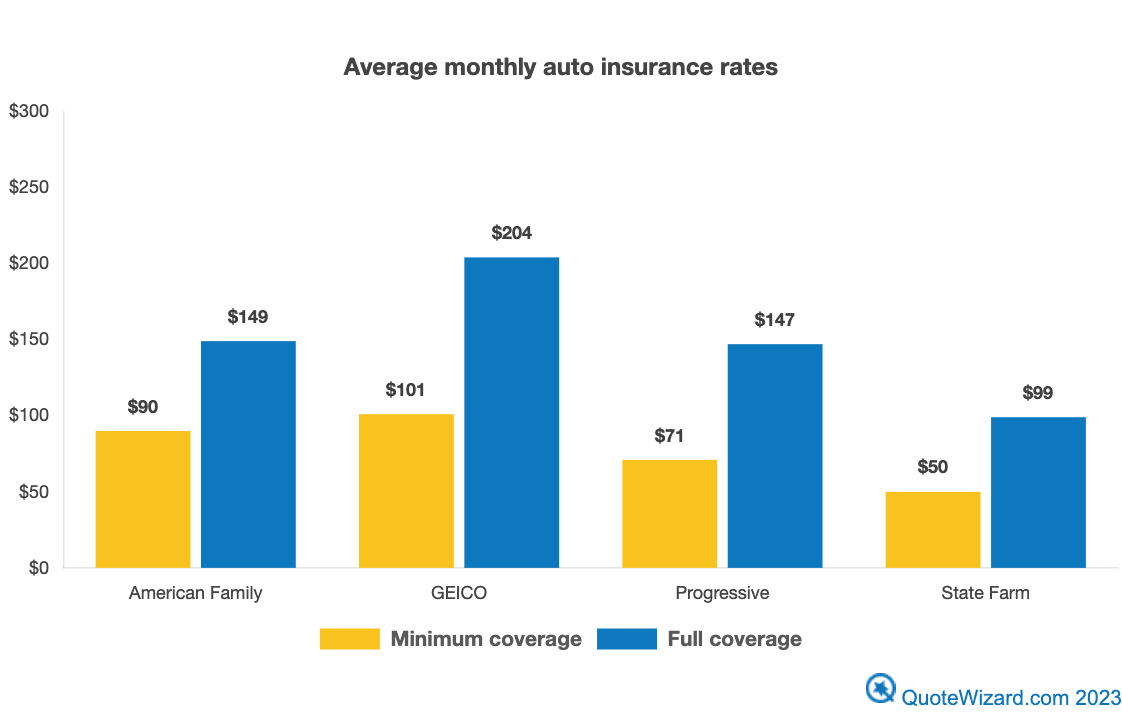

Compared to its major competitors, American Family offers rates that lean on the pricier side for the average driver. However, if you're a teen driver or have a history of driving incidents, like DUIs or accidents, American Family tends to have among the cheapest rates.

Rates may vary based on your driving history, location, vehicle and more, so make sure to shop around for quotes to get the cheapest auto insurance.

You can find unique coverage options through American Family that are not available at most competitors

You can purchase these standard additional coverages through American Family, including:

While American Family does not specify the costs of its add-on coverage, we found that having a minimum-coverage policy is $59 cheaper per month than having a full-coverage policy that includes collision and comprehensive protection.

Discounts on American Family car insurance

American Family is known for the plethora of diverse discounts available. In addition to having bundle and good student discounts, which most major insurers offer, American Family also has discounts for young volunteers and drivers with family members who are existing AmFam customers.

American Family auto insurance discounts include:

Young driver

- Good student: achieving a good academic track record either in university, technical school or high school.

- Away at school: for students under 25 years old who attend school more than 100 miles away from home and intend to keep their car at home.

- Volunteering: being under the age of 25 and completing at least 40 hours of volunteer work annually for a nonprofit organization.

- Generational: having a parent who is insured with American Family.

Safe driving

- Auto safety equipment: for cars possessing factory-installed airbags.

- Defensive driver: if you are age 55 or older and complete an approved defensive driving course in certain states.

- Good driving: being free of accidents and violations.

- Low mileage: have you been driving less lately? You can qualify for savings if you anticipate driving less than 7,500 miles per year.

- KnowYourDrive: a pay-how-you-drive discount that can save you up to 20% for engaging in smart and safe driving decisions.

Additional discounts

- Insurance bundling: bundling auto, home, renters, car or motorcycle insurance can save you money on each. For instance, you can save up to 29% on your auto policy and 15% on renters if you bundle them together.

- Multi-vehicle: having more than one car or vehicle insured under American Family.

- Early bird: switch from having an active policy with another insurer to American Family at least seven days before your policy is slated to go into effect.

- Loyalty: if you've been a customer of AmFam for a long time, you could qualify for a discount depending on how long you've been insured under the company.

Along with the wide array of discounts American Family offers, it was also among the many insurers that offered partial refunds or discounts to drivers affected by the coronavirus pandemic. New and existing customers received discounts of 10% on their policies between July 1, 2020, and March 31, 2021, and 5% off between April 1, 2021, and May 31, 2021.

American Family has average customer service ratings

When compared to other major car insurers, American Family has a better-than-average Complaint Index, but an auto claims satisfaction rating slightly below the industry average.

The National Association of Insurance Commissioners (NAIC) measures customer complaints based on the rate of formal complaints filed to state regulators. The national median Complaint Index is 1.0. J.D. Power's 2020 Auto Claims Satisfaction Study is measured on a scale of 1,000, with an industry average of 872.

If you get comparable rates from multiple providers, it is important to consider their customer service reviews. When you need your car insurance the most, like at the time of an accident, you’ll want speedy claims and transparent practices.

Home Insurance

Home insurance at a glance

Offers customizable home insurance policy

Rewards you for having no claims by crediting your deductible $100 each year, up to your policy maximum.

Among the top 10 largest home insurance companies in the country.

American Family specializes in customizable home insurance policies. If you’re looking for the cheapest rates, then American Family isn’t the ideal insurer for you. However, if you’re looking for comprehensive coverage for your home from a large, national insurance company, then American Family is a good option.

American Family review

Although we found that American Family's customer service scores are relatively average, some customers had issues when filing a claim and getting money for damages. However, we found that customers were satisfied with the company’s rates and service.

American Family home insurance coverages

American Family includes all the standard coverages of a homeowners policy, such as property damage from perils like fire, lighting, windstorms, hail, smoke, vandalism and theft.

American Family also offers additional coverages and allows you to customize your policy.

Additional home insurance coverages

What you need to know about American Family’s coverages:

- American Family home insurance includes all of the standard coverages you would see in most home insurance policies.

- American Family gives you the option to purchase additional coverages.

How much does American Family home insurance cost?

American Family offers relatively affordable rates for home insurance. Since home insurance rates vary significantly from company to company, you should compare quotes you receive from American Family to other insurers. American Family has an average annual rate of $1,866, while has the 5th lowest rates in the table below.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

American Family home insurance discounts

You can save and get a lower premium on your home insurance by taking advantage of these discounts:

- Bundle discounts: When you bundle your home and auto insurance, you could save up to 29% on your auto coverage and up to 20% on your homeowners coverage. This is an exceptional discount for the industry.

- Age of home discount: If you have a newer home that is less than 15 years old, you might be eligible for a discount.

- Renovated home discount: If you have completely replaced the plumbing, electrical and heating systems in your home in the last 15 years, then you may be eligible for the renovated home discount.

- Loyalty discount: If you've been an American Family customer for a year or more, you may qualify for a lower home insurance premium.

- Generational discount: If one of your parents is an American Family customer and you’re between the ages of 18 and 30, you could save with the generational discount.

- Insurance payment discount: You can get a discount if you use auto pay, pay your premium in full and opt for paperless billing.

What you need to know about American Family’s discounts:

- With American Family, you can take advantage of a variety of discounts as soon as you become a customer.

- American Family’s auto insurance policy includes more discounts than its home insurance policy.

Renters Insurance

Renters insurance can be an important and inexpensive investment if you’re leasing a unit. It covers property and liability coverage that your landlord’s insurance doesn’t.

American Family includes all of the standard coverages of a renters policy. U.S. News ranks American Family the sixth-best renters insurance company of 2021.

American Family renters insurance coverages

Coverage includes:

- Your belongings if they’re damaged by a covered event.

- Medical bills and lawsuit-related expenses if someone is accidentally injured in your apartment.

- Hotel expenses if your rental is uninhabitable due to a covered event.

- Theft of your personal items while you're on the go.

American Family renters insurance discounts

- Bundle discount: You can save 29% on your auto coverage and 15% on your renters coverage if you buy both policies from American Family.

- Smart home discount: If you have a qualifying smart device, you may be eligible for a discount.

- You can also save on your renters insurance by taking advantage of the following discounts: insurance payment, loyalty and generational discounts.

What you need to know about American Family’s renters insurance:

- American Family’s renters insurance has all the standard coverages and offers a variety of discounts.

Methodology

Sample quotes are based on a 30-year-old single male driver with a 2012 Honda Accord LX. Unless otherwise stated, our driver has a clean driving record with no prior insurance. He drives for pleasure up to 13,500 miles annually.

To compare coverages from multiple insurers, we used the same driver profile across the 19 states where American Family is available. Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

For home insurance, we collected quotes for a standard HO-3 homeowners insurance policy. We used the following coverages:

- $275,000 dwelling coverage

- $27,500 other structures

- $137,500 personal property

- $55,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible