Comprehensive auto insurance covers your car if it is damaged by a falling tree. This is likely the insurance coverage you will be dealing with to get your car repaired. However, circumstances may change this. For example, if the tree is from a neighbor’s yard, it may be their responsibility to handle the damage to your car.

This article will cover:

Does my car insurance take care of damage from a fallen tree?

In the event that a tree or branch falls on your car and damages it, you’ll usually need comprehensive auto insurance to cover the repairs. It’s a common mistake to think that standard auto insurance covers damage like this, when in fact it only covers costs to others or their property in the event of a car accident. Comprehensive auto insurance covers damages to your car from non-collision accidents such as a falling tree. It also covers damage due to:

- Natural disasters such as earthquakes, floods and hurricanes.

- Fire.

- Theft of the entire car or parts of it.

Comprehensive insurance can be added to your standard auto insurance policy. If you do not have comprehensive coverage and a tree damages your car, you would have to pay out of pocket for the repairs.

What should I do if a tree damages my car?

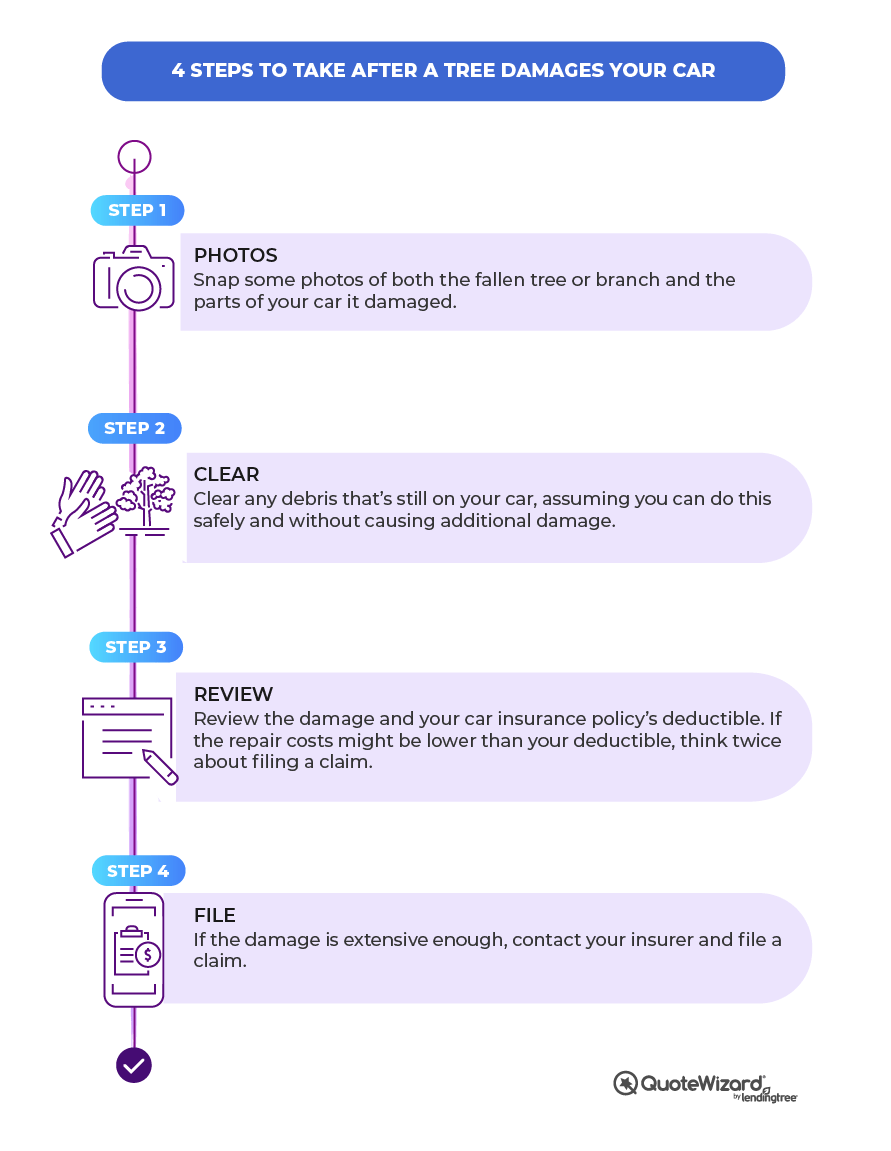

Take photos

If a branch or tree falls and damages your parked car, the first thing you need to do is take pictures of the damaged areas of the car. Photograph the fallen tree or branch, too.

Remove any debris, if possible

Your next step should be to remove any debris that’s on your car. Only do this if it’s safe to do so, though, and won’t cause further damage to the car.

Keep in mind that comprehensive auto insurance does not cover the removal of fallen trees or branches, just the damage they may do to your car. You’ll need to find another way to cover the cost of the debris removal. If the tree is on your property, your homeowners insurance should pay for the debris removal.

Assess the damage and your coverage

You’ll then want to assess the damage and look at your auto insurance policy limits. If the damage is slight, consider paying for repairs out of pocket.

Your auto insurance policy states the deductible you have to pay per claim. If the damages to your car are less than the deductible amount, you have no reason to make a claim because you won’t receive any money in return. Furthermore, making a car insurance claim usually raises your annual premium whether or not the claim is valid.

File your claim

After you’ve checked the damage and your coverage, contact your car insurance company and file your claim. Your insurer will make sure you have the proper forms to fill out and inform you of any other steps you may need to take. It may send an adjuster to inspect the damage as well. If the damage is covered by your policy, they will send a check to you, the repair shop or your lender, depending on the situation.

It’s important to know that if the cost to repair the car is more than the car is worth, your auto insurer will consider the car totaled. In this case, it will cut you a claim check for the actual cash value (ACV) of the car. ACV is the fair market value of your car, minus depreciation.

Buy comprehensive car insurance and be protected

Does comprehensive insurance always cover damage from a fallen tree?

While you’ll usually turn to comprehensive coverage if your car is damaged due to a falling tree, there are some situations when it may not be the best option. They include:

The tree is on your property

If a tree on your property crashed into your garage due to extreme weather and damaged your car, it’s possible that your homeowners insurance will cover it. In all other instances when a tree on your property hits your car, comprehensive insurance covers it.

The tree is on a neighbor’s property

If a tree on a neighbor’s property falls and damages your car, they may be responsible. You will still file a claim with your auto insurance company. However, if it can be proven that the tree fell due to your neighbor’s negligence, their homeowners insurance should cover your claim.

Proof of fault is the important factor here. If the tree came down due to a heavy windstorm, it’s not likely your neighbor is at fault. But if it can be established that the root system of the tree had decayed and your neighbor could have done something to prevent it, they may be found responsible for the damage to your car. This can be difficult to prove, but if you have any evidence, such as written communication warning the neighbor of the danger the tree presents, that can help your case considerably.

You hit a fallen tree

If you’re the one who hits a fallen tree, collision insurance would take care of the damage to your car. Collision insurance covers damages caused by you running into another vehicle or a static object, such as a fallen tree in this case. Like comprehensive insurance, collision coverage is supplemental insurance that you purchase as an add-on to your standard auto insurance.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.