Reddit is an online source of advice that covers pretty much anything you can imagine — including car insurance. Although Reddit isn't a source of verified information, many turn to it for opinions on auto insurance. We combed through car insurance tips and advice from Reddit, including

- Whether car insurance is necessary

- How much coverage you need

- The cost of car insurance for young and new drivers

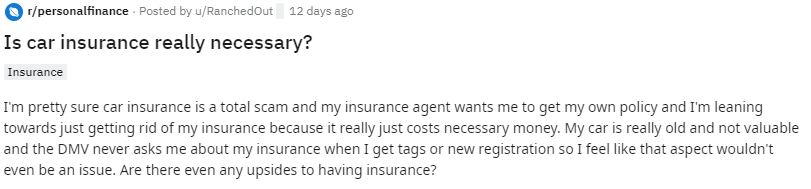

1. Do I actually need car insurance?

Reddit user RanchedOut posted about how skeptical they are about purchasing car insurance, especially because their car is old and not valuable. Many car owners feel similar to this at some point:

However, as user asdfghjkl24- points out, there are plenty of reasons why you should purchase car insurance:

This Redditor is right. In most states, car insurance isn't optional, it's actually required. Plus, your car insurance covers more than just damage done to your old vehicle. It also offers liability insurance for people you injure and property you damage in a car crash. As this user pointed out, if a car accident happens and you don't have enough car insurance, you could find yourself owing thousands of dollars.

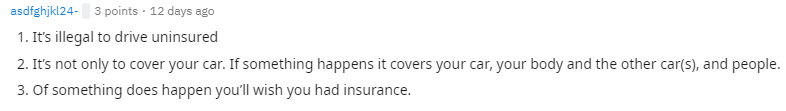

2. How much car insurance do I need?

So, now we know that drivers do need insurance, but how much car insurance do you need? Reddit user ryuukhang offers some advice on how to find the right coverage for you:

You'll need at least your state's minimum liability requirements, but outside of that, you need to have adequate coverage in case of an accident. As this Reddit user explains, you should get as much coverage as you can afford, and make sure you understand what's included in your policy and what isn't.

For example, you'll be out of luck if you only carry the minimum liability insurance but your car is damaged in a hit-and-run. If that happens and you don't have collision coverage, you may end up paying out of pocket for the damages.

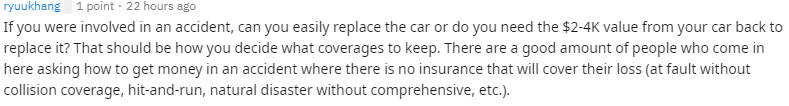

3. Should I get gap insurance?

Gap insurance is for drivers who are leasing or financing a vehicle. This type of coverage pays for the cost difference between how much you owe on a car versus how much your insurance pays for repairs. Redditors dutchesse and alphamini share why and how to get gap insurance:

As these posters mention, you may already have gap insurance through your lienholder or dealership. Make sure to check that you don't already have this coverage before purchasing a separate policy. It's often required by leasing companies, and even if it's not, it's definitely recommended.

4. What will first-time car insurance cost me?

If you're a young and new driver, car insurance is bound to be pricey. This is what Redditor TCFNationalBank has to say about teen car insurance:

They're right: Teens are more likely to get into accidents, which is why they're considered high-risk drivers. That's why teens and new drivers are more expensive to insure. Unfortunately for new drivers, that lack of experience isn't easily avoidable. Essentially, you just have to wait for your rates to lower over time as you age and clock in more hours on the road.

There's another good point in this post, which is that you can opt for pay-per-mile insurance if you aren't a regular commuter. Or, if you are away at college but still use your car and need insurance while you're home, you can look for student and low-mileage discounts through your provider.

5. How do I save money on car insurance?

There are several ways to save car insurance. Reddit users have compiled and posted some tips for saving money, including:

Adjust your deductibles

Redditor u/hakunamatea suggests reducing your deductible amount to save money on your premium:

This is an efficient way to reduce your monthly premium. However, it's important to note that you'll have to pay your deductible if you ever need to file a claim. That means your deductible shouldn't be so high that you can't afford to pay it to file a claim.

The redditor that posted this advice even admits that it wasn't the best option for their situation. Make sure to realistically evaluate what you can afford to pay at once if you're in an accident and whether that's worth saving monthly.

Switch to pay-per-mile insurance

As mentioned earlier, switching to pay-per-mile car insurance is a good option for drivers who aren't regulars on the road. This is what Redditor mesavemegame has to say about pay-per-mile insurance:

Metromile is a popular pay-per-mile insurance provider, but you can also find similar coverage through Milewise, SmartMiles and Esurance Pay Per Mile. Most companies only offer pay-per-mile insurance in some states, so check that it's available in your area.

Shop around, compare quotes and check for discounts

Reddit user luvjnx suggests comparing quotes from several insurance providers and checking for discounts once you choose one:

They also advise updating your information regularly, especially if you move or go through any other major changes. Updating your information is a straightforward way to immediately lower your rates.

6. The best car insurance companies according to Redditors

Many Reddit users recommend aiming for the big name companies like GEICO, Progressive, USAA and State Farm, to name a few. However, you can also find good car insurance through local agents, so the best option is to shop around and pull quotes from different companies. Reddit user DaveInPhilly offers good advice about using a well-known company:

Finding the best car insurance company depends on several personal factors like your age, location and credit score. That's why it's hard to find the best car insurance for your personal situation on a far-reaching platform like Reddit.

Summary

This is an overview of car insurance advice from Reddit:

- Car insurance is legally required in most states, which means you can't avoid purchasing it.

- Although you need to carry at least your state's minimum liability insurance requirements, you should consider purchasing additional coverage. Your assets could be at risk if you don't have enough coverage.

- For drivers who are leasing or financing their vehicle, it's smart to purchase gap insurance (and may even be required).

- Young and new drivers should expect high auto insurance premiums for their first years on the road.

- Drivers can save money on car insurance by adjusting their deductibles, switching to pay-per-mile insurance and comparing rates from several companies.

- The best car insurance is specific to your personal factors, so you need to shop around before landing on a company.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.