Marriage and divorce rates are declining nationwide, indicating that while fewer people are getting married, those who do so are staying together. Our team of analysts found that the marriage rate has declined by 8% since 2011. The divorce rate, meanwhile, has dropped by 17% over the same period.

Key findings:

- West Virginia, Arkansas and Maine have the highest percentages of divorces.

- Utah, Idaho and Wyoming have the highest percentages of marriages.

- More than 33% of people — or one in three — have never married.

- Men who earn over $100,000 a year are the most likely to be married.

- Women who earn $75,000 to $100,000 a year have the highest divorce rate.

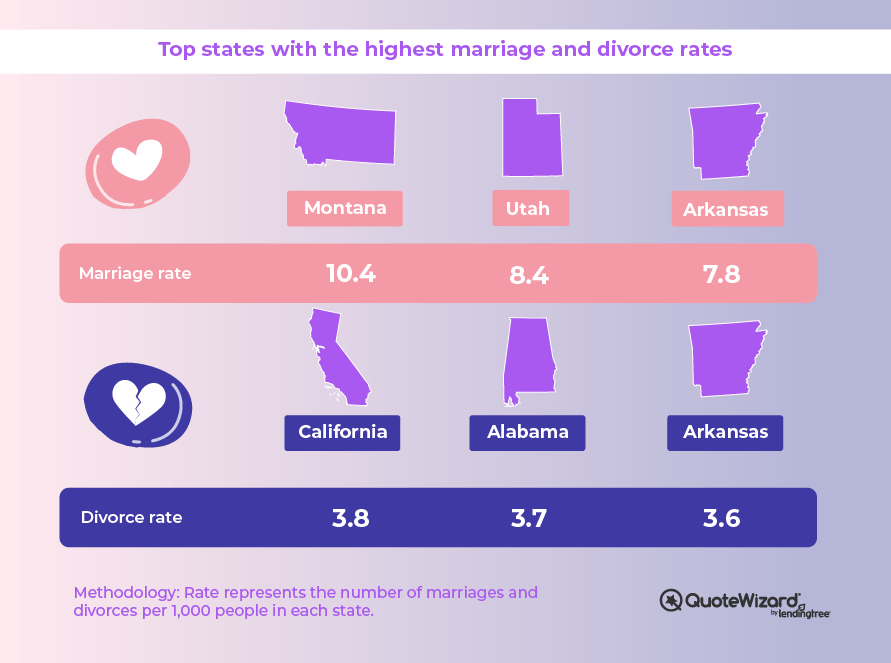

States with the highest numbers of marriages and divorces

The number of people who are married or divorced varies from state to state by as much as 10 percentage points.

- New York, California and Massachusetts have the highest percentages of people who have never married.

- Utah, Idaho and Wyoming have the highest percentages of people who are married.

- Arkansas, West Virginia and Maine have the highest percentages of people who are divorced.

Nationwide, 49% of people are married, 11% of people are divorced and 33% of people have never married. Not included in the table below are the number of people who are widowed in each state.

| State | % married | % divorced | % never married |

|---|---|---|---|

| Alabama | 47% | 12% | 32% |

| Alaska | 49% | 11% | 34% |

| Arizona | 49% | 12% | 33% |

| Arkansas | 49% | 13% | 29% |

| California | 46% | 9% | 38% |

| Colorado | 50% | 11% | 33% |

| Connecticut | 47% | 10% | 36% |

| Delaware | 48% | 10% | 34% |

| Florida | 47% | 13% | 32% |

| Georgia | 47% | 11% | 35% |

| Hawaii | 50% | 9% | 34% |

| Idaho | 55% | 12% | 27% |

| Illinois | 47% | 10% | 36% |

| Indiana | 49% | 13% | 31% |

| Iowa | 51% | 11% | 32% |

| Kansas | 51% | 11% | 31% |

| Kentucky | 49% | 13% | 30% |

| Louisiana | 44% | 12% | 36% |

| Maine | 52% | 13% | 29% |

| Maryland | 48% | 10% | 36% |

| Massachusetts | 47% | 9% | 38% |

| Michigan | 48% | 12% | 34% |

| Minnesota | 51% | 10% | 33% |

| Mississippi | 45% | 12% | 35% |

| Missouri | 49% | 12% | 31% |

| Montana | 51% | 12% | 31% |

| Nebraska | 52% | 10% | 31% |

| Nevada | 45% | 13% | 35% |

| New Hampshire | 51% | 12% | 31% |

| New Jersey | 50% | 9% | 34% |

| New Mexico | 45% | 13% | 35% |

| New York | 44% | 9% | 39% |

| North Carolina | 49% | 11% | 33% |

| North Dakota | 50% | 10% | 34% |

| Ohio | 47% | 12% | 33% |

| Oklahoma | 49% | 13% | 30% |

| Oregon | 49% | 13% | 33% |

| Pennsylvania | 48% | 10% | 34% |

| Rhode Island | 45% | 11% | 37% |

| South Carolina | 48% | 11% | 33% |

| South Dakota | 51% | 10% | 32% |

| Tennessee | 49% | 12% | 31% |

| Texas | 50% | 10% | 33% |

| Utah | 55% | 9% | 32% |

| Vermont | 49% | 11% | 33% |

| Virginia | 50% | 10% | 33% |

| Washington | 51% | 11% | 32% |

| West Virginia | 49% | 13% | 29% |

| Wisconsin | 50% | 11% | 33% |

| Wyoming | 54% | 12% | 28% |

The number of people getting married and divorced is changing particularly quickly in certain states. The marriage rate has dropped by 20% in three states over the last decade. The divorce rate, however, has seen an even bigger decline. For instance, divorces have dropped by 32% in Massachusetts since 2011.

Only six states have seen an increase in their marriage and divorce rates. Divorces have increased in Utah and Iowa by as much as 8%. Marriages have increased by as much as 7% in Mississippi, Colorado, Utah and Montana. Utah is the only state that has seen an increase in both marriages and divorces.

| State | Marriage rate | Divorce rate | % change in marriage rate since 2011 | % change in divorce rate since 2011 |

|---|---|---|---|---|

| Alabama | 7 | 4 | -12% | -4% |

| Alaska | 6 | 3 | -12% | -18% |

| Arizona | 5 | 3 | -4% | -20% |

| Arkansas | 8 | 4 | -13% | -23% |

| California | 3 | NA | -10% | NA |

| Colorado | 7 | 3 | 6% | -20% |

| Connecticut | 4 | 2 | -2% | -7% |

| Delaware | 4 | 2 | -12% | -17% |

| Florida | 6 | 3 | -3% | -15% |

| Georgia | 5 | 2 | -3% | NA |

| Hawaii | 7 | NA | -20% | NA |

| Idaho | 7 | 3 | -8% | -15% |

| Illinois | 4 | 2 | -9% | -27% |

| Indiana | 6 | NA | -5% | NA |

| Iowa | 5 | 2 | -17% | 8% |

| Kansas | 5 | 2 | -9% | -29% |

| Kentucky | 5 | 3 | -10% | -13% |

| Louisiana | 3 | 1 | -21% | -23% |

| Maine | 6 | 2 | -7% | -20% |

| Maryland | 4 | 2 | -8% | -10% |

| Massachusetts | 4 | 1 | -3% | -32% |

| Michigan | 4 | 2 | -7% | -19% |

| Minnesota | 4 | NA | -9% | NA |

| Mississippi | 6 | 3 | 1% | -20% |

| Missouri | 6 | 3 | -4% | -14% |

| Montana | 10 | 2 | 7% | -20% |

| Nebraska | 5 | 3 | -10% | -12% |

| Nevada | 21 | 3 | -22% | -22% |

| New Hampshire | 6 | 2 | -4% | -16% |

| New Jersey | 4 | 2 | 0% | -13% |

| New Mexico | 3 | NA | -23% | NA |

| New York | 5 | 2 | -3% | -8% |

| North Carolina | 6 | 3 | -5% | -12% |

| North Dakota | 5 | 2 | -12% | -12% |

| Ohio | 5 | 3 | -5% | -14% |

| Oklahoma | 6 | 4 | -9% | -16% |

| Oregon | 5 | 3 | -6% | -11% |

| Pennsylvania | 5 | 2 | -3% | -7% |

| Rhode Island | 5 | 2 | -3% | -14% |

| South Carolina | 6 | 2 | -13% | -20% |

| South Dakota | 6 | 3 | -10% | -10% |

| Tennessee | 7 | 3 | -8% | -13% |

| Texas | 5 | 2 | -14% | -24% |

| Utah | 8 | 3 | 7% | 5% |

| Vermont | 6 | 2 | -11% | -19% |

| Virginia | 5 | 3 | -7% | -16% |

| Washington | 5 | 3 | -12% | -16% |

| West Virginia | 6 | 3 | -11% | -24% |

| Wisconsin | 5 | 2 | -4% | -15% |

| Wyoming | 7 | 4 | -7% | -12% |

| United States | 5 | 3 | -8% | -17% |

| Note: The marriage and divorce rate is defined as the number of people who are married or divorced per 1,000 people in each state. | ||||

Marriage and income

The reasons why marriage and divorce rates are changing are complex. In general, people are getting married later in life. There is also less of a societal emphasis on marriage and a greater financial cost when getting divorced.

One factor that seems to be fairly consistent is the effect of income on marriage. We found that the more money someone earns, the more likely they are to be married. However, our analysts also found that while women are more likely to be married than men at lower income levels, men are more likely than women to be married at higher income levels.

Overall, men who earn more than $100,000 a year are the most likely to be married. Meanwhile, women who earn between $75,000 and $100,000 a year are the most likely to be divorced.

| Demographic | % never married | % married | % divorced |

|---|---|---|---|

| Men: $5,000 or less | 66% | 24% | 5% |

| Men: $5,000-$15,000 | 59% | 29% | 7% |

| Men: $15,000-$25,000 | 53% | 35% | 8% |

| Men: $25,000-$40,000 | 44% | 42% | 8% |

| Men: $40,000-$75,000 | 30% | 56% | 9% |

| Men: $75,000-$100,000 | 21% | 67% | 9% |

| Men: $100,000 or more | 13% | 78% | 6% |

| Women: $5,000 or less | 52% | 32% | 8% |

| Women: $5,000-$15,000 | 47% | 36% | 9% |

| Women: $15,000-$25,000 | 38% | 43% | 12% |

| Women: $25,000-$40,000 | 34% | 46% | 13% |

| Women: $40,000-$75,000 | 26% | 55% | 13% |

| Women: $75,000-$100,000 | 23% | 57% | 14% |

| Women: $100,000 or more | 17% | 66% | 12% |

Health insurance considerations when getting married or divorced

When you get married, you and your spouse have the choice to pick a health insurance plan that is available to each of you. For instance, if you both have employer-sponsored health insurance plans, you can choose to select a single plan with the best benefits. The same would apply to a public or private health insurance plan. It typically makes the most sense to each join the same plan, as opposed to having separate plans.

After a divorce, one spouse will likely want to stop being a dependent on the shared health insurance plan. In that case, there are a few options for the spouse who leaves the shared plan.

- Enroll in your workplace plan. A life event like divorce qualifies you to sign up outside of regular enrollment periods.

- Continue coverage with your spouse's insurance company with COBRA. A COBRA plan allows you to keep the same health care coverage in the event that you are no longer with your partner.

- Get a plan through healthcare.gov.

- Seek a private insurance plan.

- Check to see if you qualify for Medicaid or Medicare.

Methodology

Analysts at QuoteWizard reviewed U.S. Census data on marriage and divorce in the United States. We compared marriage and divorce rates from 2011 to 2020. The percentage of people who are married, divorced or have never been married was derived from 2020 data. Most figures presented in this article are rounded to the nearest whole number.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.