Key findings:

- Essential workers have an uninsured rate of 13% compared to 8% of nonessential workers.

- Nationally, 84% of employers offer health insurance coverage.

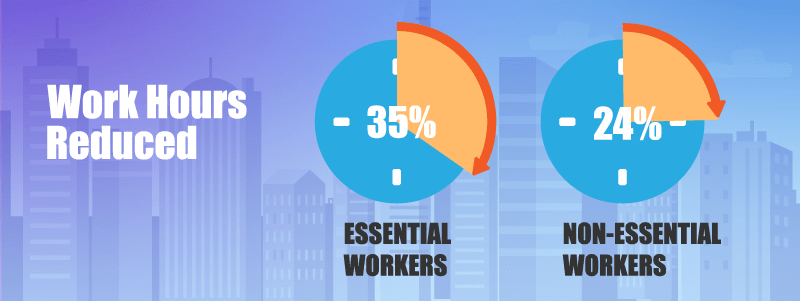

- Thirty-five percent of essential workers have had work hours reduced or limited from the pandemic compared to 24% of nonessential workers.

- Fifty percent of essential workers can’t afford a $500 unexpected medical bill, compared to 69% of nonessential workers.

- Restaurant, construction and home health industries have the highest rates of uninsured workers and low wage jobs.

Essential workforce facing increasingly risky work environments

The work environments during the pandemic have been extremely risky for the essential workforce. The essential workers putting themselves on the frontlines are considered heroes by many for keeping the country running in hard times. Unfortunately, it’s essential workers that are disproportionately underinsured and underpaid compared to nonessential workers. Essential workers have an uninsured rate of 13%, compared to 8% of nonessential workers. Lack of health insurance and low wages put essential workers at an increased financial risk and greater likelihood of contacting COVID-19. A significant issue with keeping the essential workforce safe is access to regular testing. Demand for increased testing in the workforce could amount to $25 billion a year for testing alone.

As many states' free testing sites begin to run out of money and the lack of capacity, there is a renewed fear of who bears the cost of COVID-19 testing. In the Families First Coronavirus Relief Act, there was an understanding that insurance companies would pay for testing. However, the Trump administration is advising that insurance companies aren’t responsible for covering testing. Without insurance coverage of testing, there’s a dispute between employers to pay for regular testing for employees. In the cases where insurance companies would cover testing, it’s estimated the costs of regularly testing a single essential worker would amount to $5,200. Individual costs like this covered by insurance would cause employer-sponsored health insurance premiums to rise 70%. In those cases, the employer would see their portion of the insurance premium skyrocket, leading to less coverage or no coverage for the current essential workforce.

For essential workers not covered by employer-sponsored health insurance, the reality of regular testing is a bleak one. Without insurance companies or employers covering regular testing, the regularity and costs could be too much for an individual to receive regular testing. A new relief bill is expected to pass congress in the coming weeks. Part of this could include testing provisions for essential workers, but early indications of infighting over the bill doesn’t appear to benefit essential workers. The Republican hardline stance on the bill is workplace liability protections. This grants employers immunity from being liable for an employee contracting COVID-19 on the job. With employers void of liability and financial responsibility for testing, essential workers will then face not only a high-risk work environment but also nearly no protections for their safety.

States around the country where essential workers could face the greatest risks are those with a high rate of essential workforce and states that lack employer-sponsored health insurance. We here at QuoteWizard analyzed health insurance data from State Health Access Data Assistance Center on the percentage of employers offering health insurance for workers in each state. We then paired that data with United Way’s rate of essential workers in each state. Our analysis aimed at finding which states have the highest rates of essential workers and how likely each state is to provide health insurance for workers. When looking at states with the highest rates of essential workers, there’s a mixed bag of how many employers offer health insurance to those essential workers. In states like Hawaii, Alabama and Illinois, we see a high rate of essential workers and a high rate of employers offering health insurance. These are states where essential workers face a lower-risk work environment that would have health insurance covering the risks of essential jobs. In states like Wyoming, Arkansas and Wisconsin, you have a high rate of essential workers but low levels of employer health insurance. Essential work environments in these states are likely to be riskier because of the low rates of employer health coverage.

States with the highest rate of essential workers

States are ranked 1 to 50 by the lowest rate of employer health insurance coverage. We then paired the rate of essential workers in each state.

| Rank | Location | % Employer Health Coverage | % Essential Workers |

|---|---|---|---|

| 1 | Montana | 70.6% | 46.4% |

| 2 | Wyoming | 71.6% | 53.5% |

| 3 | Alaska | 75.0% | 45.0% |

| 4 | Vermont | 76.8% | 45.3% |

| 5 | Idaho | 77.0% | 43.2% |

| 6 | New Mexico | 77.1% | 42.8% |

| 7 | Maine | 80.1% | 44.6% |

| 8 | Utah | 81.2% | 44.6% |

| 9 | Colorado | 81.7% | 42.6% |

| 10 | North Carolina | 82.2% | 46.0% |

| 11 | Oregon | 82.3% | 46.0% |

| 12 | Arkansas | 83.1% | 49.6% |

| 13 | Mississippi | 83.2% | 48.8% |

| 14 | Wisconsin | 83.5% | 50.1% |

| 15 | Florida | 83.6% | 40.0% |

| 16 | South Dakota | 83.7% | 50.4% |

| 17 | Nebraska | 83.7% | 49.4% |

| 18 | Washington | 83.7% | 42.4% |

| 19 | Michigan | 83.8% | 47.0% |

| 20 | Louisiana | 84.1% | 48.9% |

| 21 | West Virginia | 84.1% | 47.7% |

| 22 | Indiana | 84.3% | 51.8% |

| 23 | Oklahoma | 84.5% | 46.5% |

| 24 | California | 84.6% | 43.5% |

| 25 | Minnesota | 85.1% | 46.0% |

| 26 | Rhode Island | 85.1% | 41.1% |

| 27 | Georgia | 85.2% | 45.0% |

| 28 | Kentucky | 85.5% | 51.3% |

| 29 | Iowa | 85.6% | 46.6% |

| 30 | Ohio | 85.7% | 46.8% |

| 31 | South Carolina | 85.8% | 48.2% |

| 32 | Arizona | 85.8% | 39.3% |

| 33 | Tennessee | 85.9% | 49.0% |

| 34 | Nevada | 86.1% | 48.4% |

| 35 | Missouri | 86.1% | 46.8% |

| 36 | Texas | 86.1% | 44.0% |

| 37 | Kansas | 86.3% | 49.2% |

| 38 | New Hampshire | 86.4% | 40.5% |

| 39 | North Dakota | 86.5% | 57.2% |

| 40 | New York | 86.7% | 46.1% |

| 41 | Connecticut | 86.7% | 40.8% |

| 42 | Virginia | 86.8% | 43.3% |

| 43 | Maryland | 87.1% | 39.4% |

| 44 | Delaware | 87.3% | 46.6% |

| 45 | New Jersey | 87.6% | 44.1% |

| 46 | Alabama | 87.9% | 48.7% |

| 47 | Illinois | 88.0% | 48.0% |

| 48 | Pennsylvania | 88.3% | 46.3% |

| 49 | Massachusetts | 90.1% | 43.5% |

| 50 | Hawaii | 95.4% | 50.3% |

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.