Recent trends in health care costs, health care coverage, medical debt and household income have contributed to growing disparities between different income groups in the United States. Our team of health industry analysts found that nationwide, people are spending an average of 12% of their income on medical costs and have just over $770 worth of medical debt in collections.

Key findings:

- Nearly 80 million Americans have significant medical debt.

- The median medical debt in collections ranges from around $450 in Hawaii to over $1,500 in Wyoming.

- Nationwide, people are spending an average of 11.7% of their income on medical costs and have just over $770 worth of medical debt in collections.

- In 42 states, residents contribute more than 10% of their incomes towards out-of-pocket health costs.

In 2005, 34% of people said they were struggling to pay off their medical bills. Now, 41% of people say they are struggling with medical debt. Exact amounts vary by state, but we found the median medical debt in collections ranges from around $450 in Hawaii to over $1,500 in Wyoming.

The number of people without health insurance has gone down since the beginning of the COVID-19 pandemic, however, we did not find a direct correlation between the number of people in each state without health insurance and that state’s median medical debt.

| State | % of people with medical debt in collections | % of people without insurance | Median medical debt in collections |

|---|---|---|---|

| West Virginia | 27.0% | 9.6% | $669 |

| South Carolina | 24.9% | 15.8% | $957 |

| Louisiana | 23.1% | 11.9% | $853 |

| Texas | 22.7% | 24.0% | $1,068 |

| Oklahoma | 22.7% | 20.5% | $1,176 |

| North Carolina | 20.8% | 15.7% | $708 |

| Tennessee | 20.5% | 14.7% | $996 |

| Arkansas | 20.0% | 12.0% | $662 |

| Alabama | 19.3% | 15.5% | $1,000 |

| Missouri | 19.3% | 13.4% | $877 |

| Mississippi | 19.2% | 18.6% | $866 |

| Indiana | 19.2% | 11.0% | $813 |

| Nevada | 18.7% | 15.1% | $909 |

| Kentucky | 18.6% | 7.9% | $501 |

| Georgia | 18.6% | 18.9% | $952 |

| Wyoming | 18.3% | 14.8% | $1,563 |

| Delaware | 18.1% | 8.1% | $799 |

| Kansas | 18.1% | 12.6% | $824 |

| New Mexico | 18.0% | 14.0% | $741 |

| Maine | 18.0% | 11.5% | $919 |

| Florida | 18.0% | 19.1% | $1,065 |

| Ohio | 16.9% | 8.8% | $678 |

| Virgina | 16.5% | 12.3% | $790 |

| Arizona | 16.1% | 14.6% | $942 |

| Alaska | 14.6% | 16.4% | $1,313 |

| Illinois | 14.5% | 9.9% | $644 |

| Michigan | 14.5% | 7.6% | $492 |

| Utah | 13.7% | 12.2% | $1,012 |

| New Jersey | 13.1% | 10.5% | $531 |

| Montana | 13.0% | 11.6% | $815 |

| Colorado | 12.7% | 10.2% | $748 |

| Idaho | 12.6% | 16.5% | $1,013 |

| Maryland | 12.2% | 8.4% | $530 |

| Pennsylvania | 11.5% | 7.5% | $583 |

| Connecticut | 11.2% | 7.6% | $560 |

| Wisconsin | 11.0% | 7.6% | $904 |

| Iowa | 10.6% | 6.9% | $605 |

| California | 8.8% | 10.3% | $750 |

| New Hampshire | 8.0% | 8.4% | $537 |

| Nebraska | 7.7% | 11.8% | $745 |

| Hawaii | 6.9% | 5.9% | $455 |

| New York | 6.5% | 7.7% | $484 |

| Oregon | 6.2% | 10.2% | $625 |

| North Dakota | 6.1% | 9.4% | $562 |

| Rhode Island | 6.1% | 5.7% | $584 |

| Vermont | 5.4% | 5.8% | $581 |

| Washington | 5.4% | 9.4% | $604 |

| Massachusetts | 4.9% | 3.9% | $402 |

| South Dakota | 4.2% | 14.2% | $726 |

| Minnesota | 2.4% | 5.9% | $425 |

The statistics in the chart above are staggering. But they don’t tell the whole story. These numbers represent only the percentage of people in each state whose medical bills have moved into the collections phase. The real amount people owe is likely far higher. And while exact figures are hard to come by, according to a recent survey, 15% of people said their medical bills were $10,000 or more.

Middle-class income and health care costs

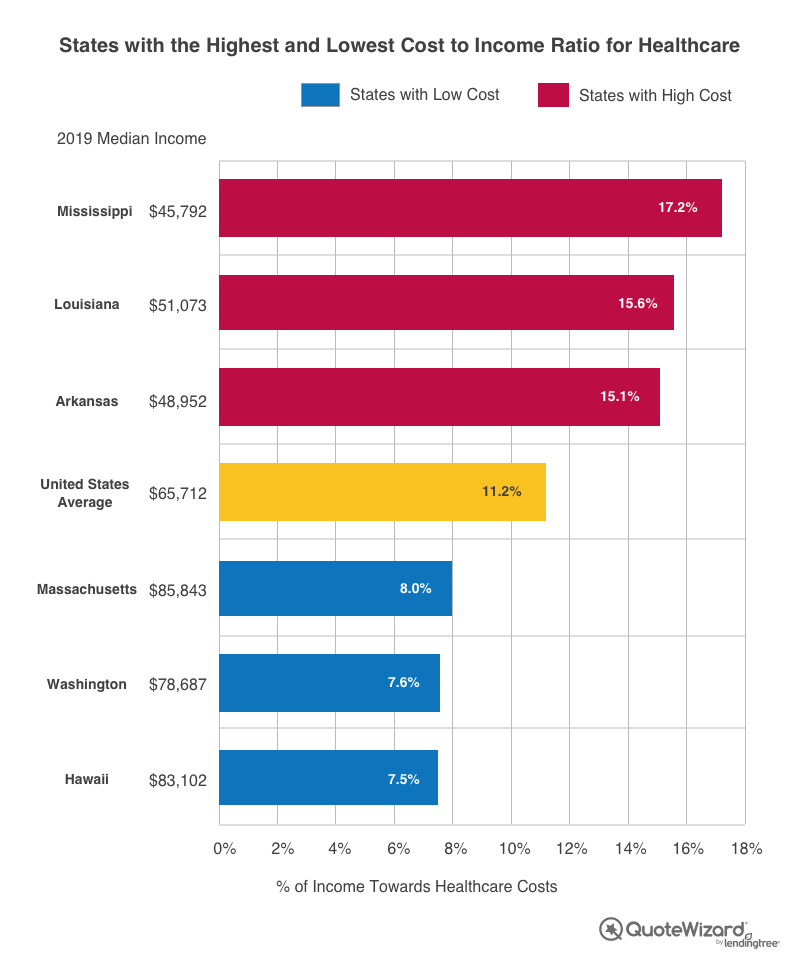

One reason for the rising amount of medical debt is simple: Income is not keeping up with rising health care costs. States that had the largest median wage increases over the last decade paid the least in combined deductibles and premiums in 2018. Washington State experienced the second-largest median wage increase (35.5%) from 2008 to 2019, while its residents pay nearly the lowest out-of-pocket costs for health care (7.6% of annual wages). Colorado, Utah, California and Massachusetts were also in the top ten for highest wage increases and ranked in the bottom ten for out-of-pocket premium and deductible costs.

On the contrary, Mississippi, Louisiana and Arkansas residents experienced the lowest median wage increases in the country while paying the most in out-of-pocket health costs — between 15% and 17% of their income. Residents in these states pay the most of their income towards combined annual premiums and deductibles. Rising deductibles in low-income states leave many underinsured, causing them to skip their care because of higher costs. A person is underinsured when the average deductible is more than 5% of their annual income, according to The Commonwealth Fund.

The top 10 states whose residents pay the largest portions of their income towards out-of-pocket health insurance costs increased their median wages by an average of $10,615 from 2008 to 2019. The 10 states whose residents pay the least amount of their wages towards health care costs increased their median incomes by an average of $17,028. Additionally, as of 2019, the states with the highest out-of-pocket health care costs had a median income of $54,679, while the 10 states whose residents paid the least out of pocket earned a median income of $80,104.

Nationally, a middle-income person pays an average of $4,396 towards yearly health premiums and $2,992 on deductibles, adding to a combined average total out-of-pocket cost of $7,388 per year.

Forty-two states’ residents contributed more than 10% of their incomes towards out-of-pocket health costs in 2018, compared to only seven states in 2008. Health care costs are increasing at a faster rate than wages. As of 2018, 11.2% of middle-class wages go to out-of-pocket health coverage costs, and the trend could likely continue if wages remain stagnant and health care costs increase. As wages increase, so do employer premiums and deductible contributions, thus putting less burden on employees.

| Rank | State | 2019 average household income | Out-of-pocket premiums and deductible cost | Total % of income towards healthcare costs per year |

|---|---|---|---|---|

| 1 | Mississippi | $45,792 | $7,864 | 17.2% |

| 2 | Louisiana | $51,073 | $7,951 | 15.6% |

| 3 | Arkansas | $48,952 | $7,402 | 15.1% |

| 4 | South Dakota | $59,533 | $8,621 | 14.5% |

| 5 | Kentucky | $52,295 | $7,470 | 14.3% |

| 6 | Tennessee | $56,071 | $7,966 | 14.2% |

| 7 | North Carolina | $57,341 | $8,091 | 14.1% |

| 8 | Arizona | $62,055 | $8,364 | 13.5% |

| 9 | Oklahoma | $54,449 | $7,312 | 13.4% |

| 10 | Florida | $59,227 | $7,925 | 13.4% |

| 11 | Maine | $58,924 | $7,879 | 13.4% |

| 12 | Alabama | $51,734 | $6,823 | 13.2% |

| 13 | West Virginia | $48,850 | $6,326 | 12.9% |

| 14 | Nevada | $63,276 | $8,133 | 12.9% |

| 15 | Montana | $57,153 | $7,343 | 12.8% |

| 16 | Ohio | $58,642 | $7,509 | 12.8% |

| 17 | Georgia | $61,980 | $7,933 | 12.8% |

| 18 | Missouri | $57,409 | $7,296 | 12.7% |

| 19 | South Carolina | $56,227 | $7,111 | 12.6% |

| 20 | Texas | $64,034 | $8,057 | 12.6% |

| 21 | Iowa | $61,691 | $7,632 | 12.4% |

| 22 | New Mexico | $51,945 | $6,342 | 12.2% |

| 23 | Vermont | $63,001 | $7,603 | 12.1% |

| 24 | Idaho | $60,999 | $7,307 | 12.0% |

| 25 | Nebraska | $63,229 | $7,563 | 12.0% |

| 26 | Wyoming | $65,003 | $7,732 | 11.9% |

| 27 | Kansas | $62,087 | $7,369 | 11.9% |

| 28 | Indiana | $57,603 | $6,729 | 11.7% |

| 29 | Minnesota | $74,593 | $8,666 | 11.6% |

| 30 | Wisconsin | $64,168 | $7,254 | 11.3% |

| 31 | North Dakota | $64,577 | $7,195 | 11.1% |

| 32 | Oregon | $67,058 | $7,449 | 11.1% |

| 33 | New Hampshire | $77,933 | $8,531 | 10.9% |

| 34 | Rhode Island | $71,169 | $7,787 | 10.9% |

| 35 | Pennsylvania | $63,463 | $6,906 | 10.9% |

| 36 | Illinois | $69,187 | $7,396 | 10.7% |

| 37 | Virginia | $76,456 | $8,144 | 10.7% |

| 38 | Michigan | $59,584 | $6,318 | 10.6% |

| 39 | Delaware | $70,176 | $7,435 | 10.6% |

| 40 | Connecticut | $78,833 | $7,816 | 9.9% |

| 41 | Colorado | $77,127 | $7,496 | 9.7% |

| 42 | New Jersey | $85,751 | $8,281 | 9.7% |

| 43 | New York | $72,108 | $6,470 | 9.0% |

| 44 | Utah | $75,780 | $6,777 | 8.9% |

| 45 | Alaska | $75,463 | $6,576 | 8.7% |

| 46 | Maryland | $86,738 | $7,506 | 8.7% |

| 47 | California | $80,440 | $6,894 | 8.6% |

| 48 | Massachusetts | $85,843 | $6,852 | 8.0% |

| 49 | Washington | $78,687 | $5,951 | 7.6% |

| 50 | Hawaii | $83,102 | $6,236 | 7.5% |

| -- | United States | $65,712 | $7,388.00 | 11.2% |

Methodology:

To find out which states have the largest disparities between middle-class income and out-of-pocket health insurance costs (premiums and deductibles), QuoteWizard analyzed The Commonwealth Fund’s state-by-state report, Health Insurance Costs Taking Larger Share of Middle-Class Incomes as Premium Contributions and Deductibles Grow Faster Than Wages. We compiled 2019 employee contributions to yearly health insurance premiums and average deductible costs and compared them to each state’s median income. Median middle-class income data was sourced from the U.S. Census. States with the highest average percentages of income that go to out-of-pocket health insurance costs are ranked closer to 1 (worst) and states that had relatively lower health insurance costs compared to income ranked closer to 50 (best).

To determine each state’s percentage of people with medical debt in collections, percentage of people without insurance and median debt in collections, we used data from the Urban Institute.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.