Allstate Auto Insurance Review

Allstate is the fourth-largest car insurance company in the U.S., with a market share of over 10%. Its tagline, “You're in good hands,” is one of the most recognizable in the industry. But despite its size and reputation, Allstate is not always the most affordable option for car insurance.

According to our data, Allstate rates are more expensive than the national average for most individuals. This is true even for drivers with good credit and no accidents on their record. Allstate's car insurance rates are more expensive than some of its competitors for a few reasons. First, Allstate has a higher cost of doing business than some insurers. This is because it has a larger network of agents and spends more on advertising. Second, Allstate's underwriting standards are more stringent than some other companies. This means that it may not be as willing to insure high-risk drivers.

If you're looking for a company with a strong reputation and a good claims process, Allstate is a good choice. If price is an important factor in your decision, it is likely you will want to compare car insurance quotes from other providers to find the best cheap option for you.

Pros

- Providing many different coverage options

- Drivers who would like to work with an agent

- Offering many different discounts

- Provides customer service 24 hours a day, 365 days a year.

Cons

- If you are looking for cheap auto insurance rates

- Quick claims processing

Allstate insurance ratings

In our study, we found that Allstate has a strong financial foundation and a commitment to customer service.The company has received an “A” rating from AM Best. This rating indicates that Allstate is a financially strong company that is well positioned to meet its financial obligations.

Allstate has a J.D. Power rating of 4.1 out of 5 stars, which indicates that the company is above average in terms of customer satisfaction. Allstate also has an A rating from the Better Business Bureau (BBB), which indicates that the company has a good reputation for handling customer complaints.

Overall, Allstate is a financially strong and customer-centric company that is a good choice for car insurance.

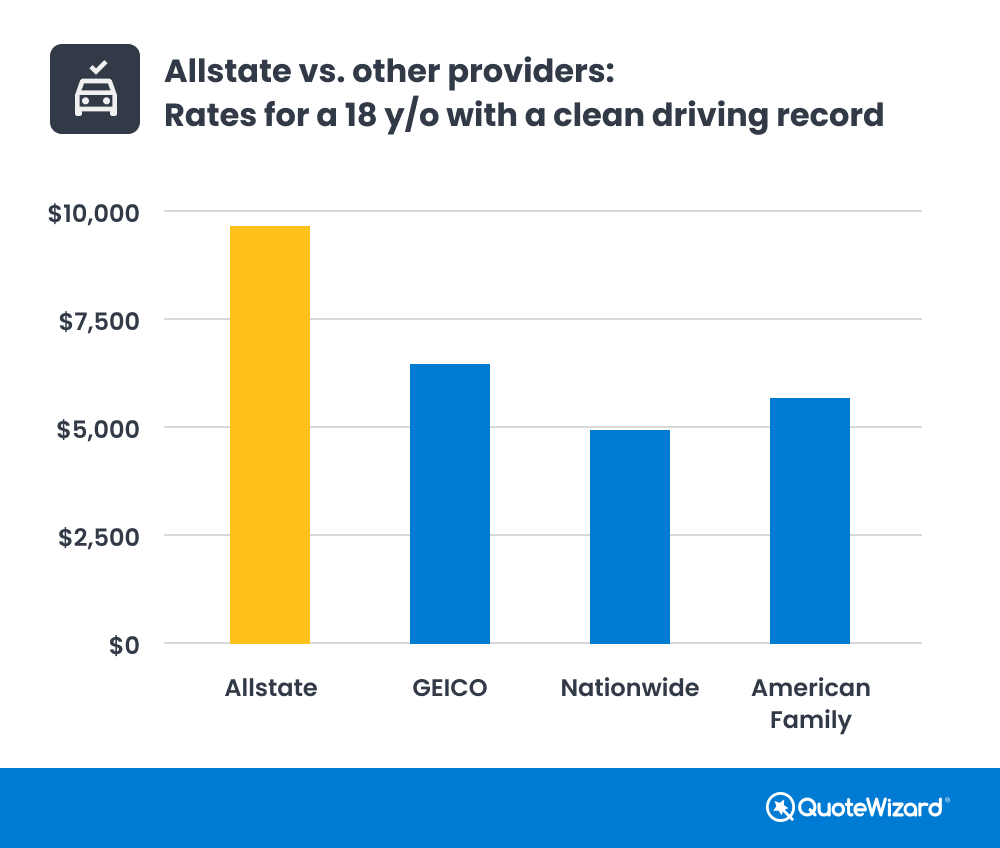

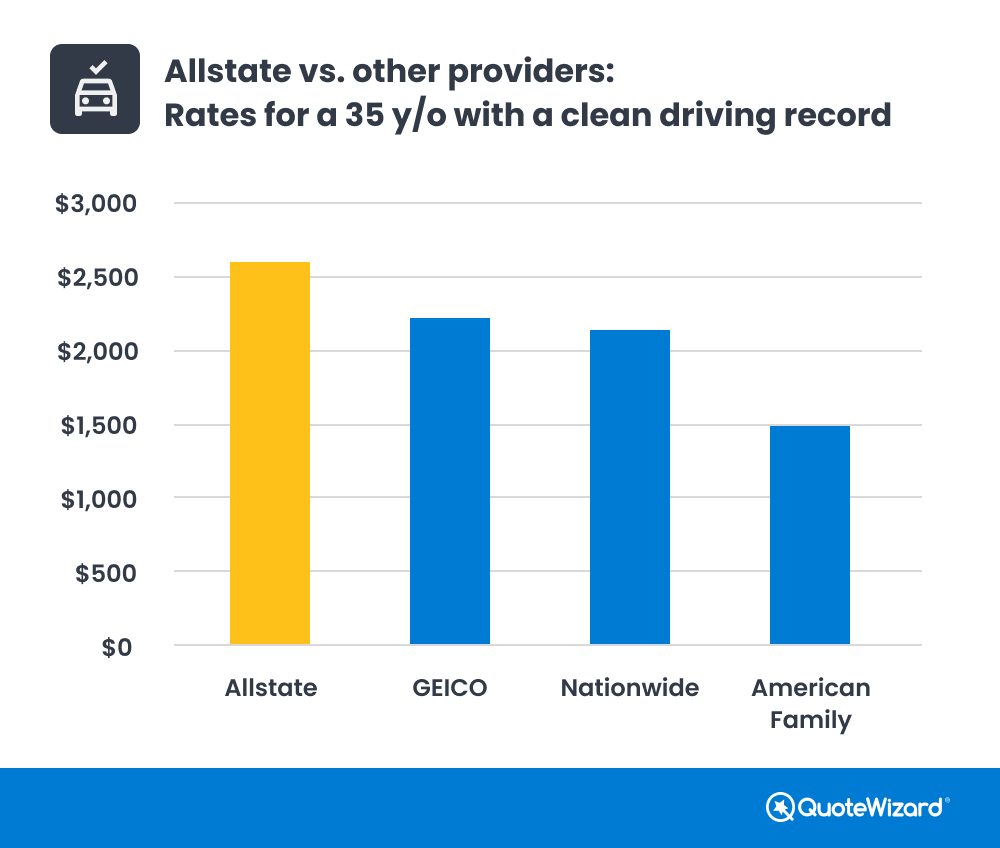

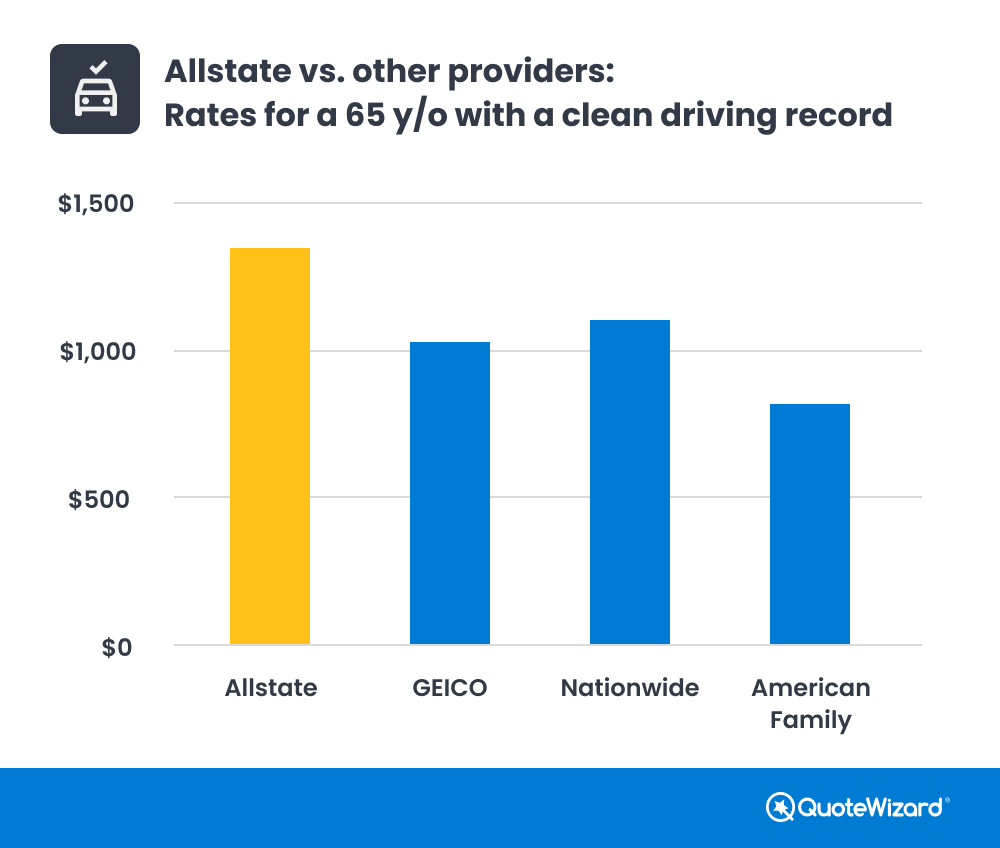

How Allstate compares to competitors for drivers with a clean record

When we analyzed the average price of car insurance for teen drivers, middle-aged drivers and senior drivers, we found that Allstate had higher prices than most of its competitors. Specifically the cost of teen car insurance was significantly higher than its cohorts according to our data.

How Allstate compares to competitors for drivers with a speeding ticket

According to our data, Allstate drivers that receive a speeding ticket can expect to see their rates increase by an average of 18%.

The national average for car insurance for drivers with a speeding ticket is $1,185 per year. This means that Allstate's rates are higher than the national average.

If you have a speeding ticket, you should shop around for car insurance quotes from other companies. You may be able to find a cheaper policy with another company.

| Company | Minimum coverage (yearly) |

|---|---|

| USAA | $623 |

| State Farm | $962 |

| American Family | $1,013 |

| Progressive | $1,185 |

| GEICO | $1,317 |

| Nationwide | $1,470 |

| Allstate | $1,505 |

| Travelers | $1,676 |

| Farmers | $1,912 |

| Rates are for minimum-coverage car insurance for a 35-year-old male with a speeding ticket. | |

How Allstate compares to competitors for drivers with a DUI

The national average for drivers with a DUI is $1,712 per year, but Allstate's policyholders might find themselves paying a slightly higher premium. On average, Allstate drivers with a DUI on their record are looking at $1,853 per year. This is a noteworthy increase over the national average but can vary based on individual circumstances.

There's more to buying car insurance than the price of a policy, though. Allstate offers a range of coverage options, benefits and customer service features that may make the added cost worth it for some drivers. The quality of coverage, accessibility of agents and overall satisfaction with the provider are key factors to consider alongside the price.

That said, if the price is the most crucial aspect for you in choosing a car insurance policy, compare quotes from other providers. In our research, companies like Progressive, American Family and State Farm typically offer more affordable average costs for drivers with a DUI.

| Company | Minimum coverage (yearly) |

|---|---|

| USAA | $954 |

| Progressive | $1,177 |

| American Family | $1,296 |

| State Farm | $1,341 |

| Allstate | $1,853 |

| Travelers | $2,031 |

| Farmers | $2,184 |

| Nationwide | $2,206 |

| GEICO | $2,452 |

| Rates are for minimum-coverage car insurance for a 35-year-old male with a DUI. | |

How Allstate compares to competitors for drivers with an at-fault accident

On average, Allstate policyholders will see their costs spike by an eye-catching 58% after an at-fault accident. This statistic places Allstate among the providers with the highest post-accident insurance costs, according to our comprehensive data.

Furthermore, it's important to put these numbers into context. When comparing Allstate's premiums to the national average for drivers who have had an at-fault accident, Allstate's customers fare noticeably higher. They pay, on average, 41% more than the national baseline, which stands at $1,430 per year.

| Company | Minimum coverage (yearly) |

|---|---|

| USAA | $732 |

| State Farm | $1,042 |

| Progressive | $1,409 |

| American Family | $1,515 |

| Nationwide | $1,536 |

| GEICO | $1,733 |

| Travelers | $1,888 |

| Allstate | $2,020 |

| Farmers | $2,099 |

| Rates are for minimum-coverage car insurance for a 35-year-old male with an at-fault accident. | |

Allstate average price by state

When analyzing the cost of car insurance by state, Allstate's average prices come in higher than the national average. Allstate's average for minimum coverage is $1,275 a year and for full coverage car insurance is $2,584. The National average is $969 for minimum coverage and $1,949 for full coverage.

| State | Average minimum coverage | Average full coverage |

|---|---|---|

| Alabama | $1,024 | $1,762 |

| Alaska | $587 | $1,543 |

| Arizona | $1,158 | $2,281 |

| Arkansas | $929 | $2,138 |

| California | $1,061 | $1,793 |

| Colorado | $1,303 | $2,499 |

| Connecticut | $1,412 | $2,934 |

| Delaware | $1,880 | $3,469 |

| Florida | $2,426 | $7,137 |

| Georgia | $1,244 | $2,190 |

| Hawaii | $786 | $1,714 |

| Idaho | $824 | $1,797 |

| Illinois | $1,128 | $2,462 |

| Indiana | $1,121 | $2,016 |

| Iowa | $743 | $1,674 |

| Kansas | $1,246 | $2,675 |

| Kentucky | $1,718 | $3,258 |

| Louisiana | $2,127 | $5,348 |

| Maine | $771 | $1,497 |

| Maryland | $1,937 | $3,401 |

| Massachusetts | No Data | No Data |

| Michigan | No Data | No Data |

| Minnesota | $1,406 | $2,801 |

| Mississippi | $903 | $2,010 |

| Missouri | $1,393 | $2,766 |

| Montana | $1,025 | $2,402 |

| Nebraska | $1,165 | $3,505 |

| Nevada | $2,422 | $3,923 |

| New Hampshire | $1,087 | $2,033 |

| New Jersey | $1,610 | $2,622 |

| New Mexico | $1,224 | $2,544 |

| New York | $2,371 | $4,253 |

| North Carolina | No Data | No Data |

| North Dakota | No Data | No Data |

| Ohio | $944 | $1,975 |

| Oklahoma | $1,095 | $2,286 |

| Oregon | $1,567 | $3,433 |

| Pennsylvania | $1,263 | $2,799 |

| Rhode Island | $2,139 | $3,846 |

| South Carolina | $961 | $1,758 |

| South Dakota | No Data | No Data |

| Tennessee | $1,018 | $2,151 |

| Texas | $1,104 | $2,321 |

| Utah | $1,293 | $2,316 |

| Vermont | $366 | $1,349 |

| Virginia | $1,393 | $2,781 |

| Washington | $1,323 | $2,120 |

| West Virginia | $969 | $2,208 |

| Wisconsin | $1,075 | $2,114 |

| Wyoming | $724 | $2,090 |

| Rates are for full and minimum-coverage car insurance for a 35-year-old male with a clean driving record. | ||

Allstate available auto insurance discounts

Allstate offers a variety of car insurance discounts to help its customers save money. Here is a list of some of the discounts they advertise on their website:

- Allstate eSmart® discount: You can receive a discount by going paperless and signing up for ePolicy to view insurance documents online.

- Anti-lock brake discount: You can get a discount if your car is equipped with anti-lock brakes.

- Anti-theft device discount: If there's an anti-theft device in your car, you can receive a discount.

- Early Signing Discount®: If you sign your policy seven or more days before it becomes effective, you can receive a discount.

- EZ pay plan discount: Setting up automatic withdrawal for paying your premium can get you a discount.

- FullPay® discount: Paying your policy in full can get you a discount.

- Multiple policy discount: Having multiple policies with Allstate can help you save on your auto insurance.

- New car discount: If your car is a current model year or one year prior and you're the first owner, you can avail a discount.

- Responsible payer discount: If you did not receive a cancellation notice for non-payment in the past year, you can receive a discount.

- Safe driving club: You can save significantly if you meet the safe driving requirements to make it into the club.

- Smart student discount: If you're unmarried and under 25, you can receive a discount by fulfilling any of the following criteria: averaging a B- or above in grades, having a GPA of 2.7 or above, successfully completing the teenSMART driver education program or attending school at least 100 miles away from where your car is garaged.

Allstate homeowners insurance

Allstate is a well-known insurance company that offers affordable rates for home insurance. It also offers great savings to help lower your rates.

Best for:

- You qualify for several discounts

- You're looking for cheap rates

Bad for:

- You're looking for an insurer with exceptional customer service

How much does Allstate home insurance cost?

Allstate has an average annual home insurance premium of $1,734. These rates, however, vary considerably across states. Comparing home insurance quotes can get you the cheapest rates from insurers.

| Insurance company | Average annual premium |

|---|---|

| Allstate | $1,734 |

| American Family | $2,466 |

| Country Financial | $1,876 |

| Chubb | $1,615 |

| Erie Insurance | $1,471 |

| Farm Bureau | $2,406 |

| Farmers | $2,168 |

| Nationwide | $2,164 |

| State Farm | $1,888 |

| Travelers | $2,273 |

| USAA | $1,776 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

According to our study, Allstate is the cheapest home insurer in the states below.

| State | Allstate's average annual premium |

|---|---|

| Alabama | $1,631 |

| California | $663 |

| Connecticut | $1,062 |

| District of Columbia | $993 |

| Michigan | $1,032 |

| Missouri | $1,491 |

| New Jersey | $729 |

| New Mexico | $1,825 |

| South Carolina | $1,008 |

| Vermont | $560 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

Your average premium will vary depending on how much coverage you need, especially for dwelling coverage. The dwelling coverage you choose should equal the cost of rebuilding your home. Below are average annual premiums from Allstate for dwelling coverage amounts ranging from $200,000 to $500,000:

| Dwelling coverage amount | Allstate's average annual premium |

|---|---|

| $200,000 | $1,403 |

| $275,000 | $1,734 |

| $350,000 | $1,931 |

| $425,000 | $2,211 |

| $500,000 | $2,531 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

Your premium will also vary according to the deductible amount you choose. Below are average annual premiums from Allstate for deductibles ranging from $500 to $2,000:

| Deductible amount | Allstate's average annual premium |

|---|---|

| $500 | $1,779 |

| $1,000 | $1,734 |

| $1,500 | $1,550 |

| $2,000 | $1,473 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

Home insurance coverages

Allstate offers all the standard coverages you would expect to have in your home insurance policy. This includes:

| Coverage type | What it covers |

|---|---|

| Dwelling | Structure of your home |

| Personal property | Personal belongings in your home |

| Liability | Yourself if someone is injured in your home |

| Guest medical | Medical expenses if a guest is injured on your property |

A standard homeowners policy might not cover all the things you need to protect your home. That's why you have the option to add additional coverages. Allstate's optional coverages include:

- Personal umbrella policy: Protects you against large liability claims when you reach the liability limit on your property policy.

- HostAdvantage: Protects your belongings if you're home sharing.

- Manufactured/mobile home insurance: Protects your manufactured or mobile home.

Homeowners insurance discounts

Allstate offers many discounts that homeowners in different circumstances can take advantage of. For instance, you can save if you purchase a newly constructed home or if you're a recent homebuyer. You can also get a discount if your home has theft or fire protection devices. Other discounts include:

- You can save up to 25% when you bundle your home and auto insurance policies.

- If you have a good history of paying on time and in full, you may be eligible for a discount, too.

- You can save up to 20% if you switch to Allstate and don't have a recent home insurance claim.

- You can save up to 10% by switching to Allstate. The savings continues for each year that you remain an Allstate policyholder.

- You can save up to 5% if you have automatic payments.

- You can save up to 10% on your premium if you sign up for a new policy at least seven days before your current one expires.

Allstate's home insurance rating

3.9 out of 5

Allstate has thousands of agents across the country and offers affordable home insurance rates that are cheaper than the national average rate of $1,903. On top of cheap rates, Allstate offers many discounts with high savings.

On the flip side, it has a below-average customer satisfaction score of 815 (out of 1,000) on J.D. Power's 2022 U.S. Home Insurance Study.

Allstate renters insurance

Allstate offers all the standard coverages you would expect for renters insurance, as well as optional add-ons. Allstate has an average annual premium that is higher than some of its competitors. If you have an auto insurance policy with Allstate, a renters insurance policy with Allstate would be a good fit.

Best for:

- If you're retired and looking to take advantage of discounts.

- You want to choose from many coverage options.

Bad for:

- If you're looking for an insurer with the cheapest rates.

How much does Allstate renters insurance cost?

We gathered online quotes from Allstate from thousands of addresses across the country. Allstate has an average annual renters insurance premium of $233, which is $19 more than the national average of $214. The table below shows how Allstate's rates compare with competitors.

| Company | Average annual premium |

|---|---|

| Allstate | $233 |

| Amica | $206 |

| Farmers | $277 |

| State Farm | $155 |

| Travelers | $212 |

| Note: Average rates are based on online quotes from provider websites. Your rates may vary. | |

Like homeowners insurance, renters rates can vary greatly across the country. Even though Allstate has an average premium that is higher than the national average, some states may offer cheap rates from Allstate. According to our study, Allstate is the cheapest company in the states below.

| State | Allstate's average annual premium |

|---|---|

| Alabama | $1,631 |

| California | $663 |

| Connecticut | $1,062 |

| District of Columbia | $993 |

| Michigan | $1,032 |

| Missouri | $1,491 |

| New Jersey | $729 |

| New Mexico | $1,825 |

| South Carolina | $1,008 |

| Vermont | $560 |

| Note: Average rates are based on online quotes from provider websites. Your rates may vary. | |

Renters insurance coverages

Allstate's standard renters insurance policy includes personal property, liability, reimbursed living expenses and guest medical coverage.

| Coverage type | What it covers |

|---|---|

| Personal property | Personal belongings in your home |

| Liability | Covers legal fees and other damages if someone sues you for an injury in your rental |

| Guest medical | Covers medical expenses if a guest is injured on your property |

| Reimbursed living expenses | Covers your living costs if you can't live in your rental after a covered loss |

You can also add optional insurance coverages or policies, including:

- Personal umbrella policy: Protects you against large liability claims when you reach the liability limits of your renters insurance policy.

- Scheduled personal property coverage: Helps protect specific, appraised valuables, such as pieces of jewelry.

- Identity theft: Helps pay for the cost of legal fees, lost wages and other costs if your identity is stolen.

Renters insurance discounts

You can lower your premium if you take advantage of Allstate's discounts. These include:

- You can save by having renters insurance in addition to your Allstate auto policy.

- Retired renters or part-time workers who are 55 years or older can get up to 25% off their premium.

- You can save if you enroll in Allstate's Easy Pay Plan, which allows you to pay in advance from your account.

Allstate's renters insurance rating

3.7 out of 5

Allstate's average annual premium is higher than most companies in our study. However, Allstate offers some great discounts that could make your premium much lower if you qualify, such as their retiree discount. Allstate also offers some great optional coverages. This includes identity theft restoration, which helps cover legal fees and lost wages if someone steals your identity.

Allstate also has a low overall customer satisfaction rating of 837 out of 1,000 points according to J.D. Power's study. J.D. Power surveys renters to evaluate interactions, coverages, rates, billing process and policy information, and claims of insurance companies.

Methodology

For auto insurance, rates shown in this analysis are based on non-binding quotes for minimum-coverage and full-coverage car insurance obtained from Quadrant Information Services.

Unless otherwise noted, the typical driver is a 35-year-old male who drives a 2014 Honda LX for an average of 13,500 miles a year.

Full-coverage car insurance includes the following coverages, limits and deductibles:

- Bodily injury liability: $100,000 per person/$300,000 per year

- Property damage liability: $100,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

- In states where uninsured/underinsured motorist coverage and personal injury protection are required, the minimum limits required by law are included in the quoted policy.

For home insurance, we collected quotes for a standard HO-3 homeowners insurance policy. We used the following coverages and limits:

- $275,000 dwelling

- $27,500 other structures

- $137,500 personal property

- $55,000 loss of use

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

For renters insurance, we collected online quotes from thousands of addresses in the U.S. We used the following coverages:

- $30,000 of personal property

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

- Loss of use: 30%

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.