In the event of auto theft, you need to have comprehensive coverage as part of your auto insurance policy if you expect your stolen car to be replaced.

Filing a claim for a stolen car can be a lengthy process. Completing a police report and the claim itself with your auto insurance provider requires a lot of documentation and some back and forth.

Here’s what you need to know about auto insurance and car theft:

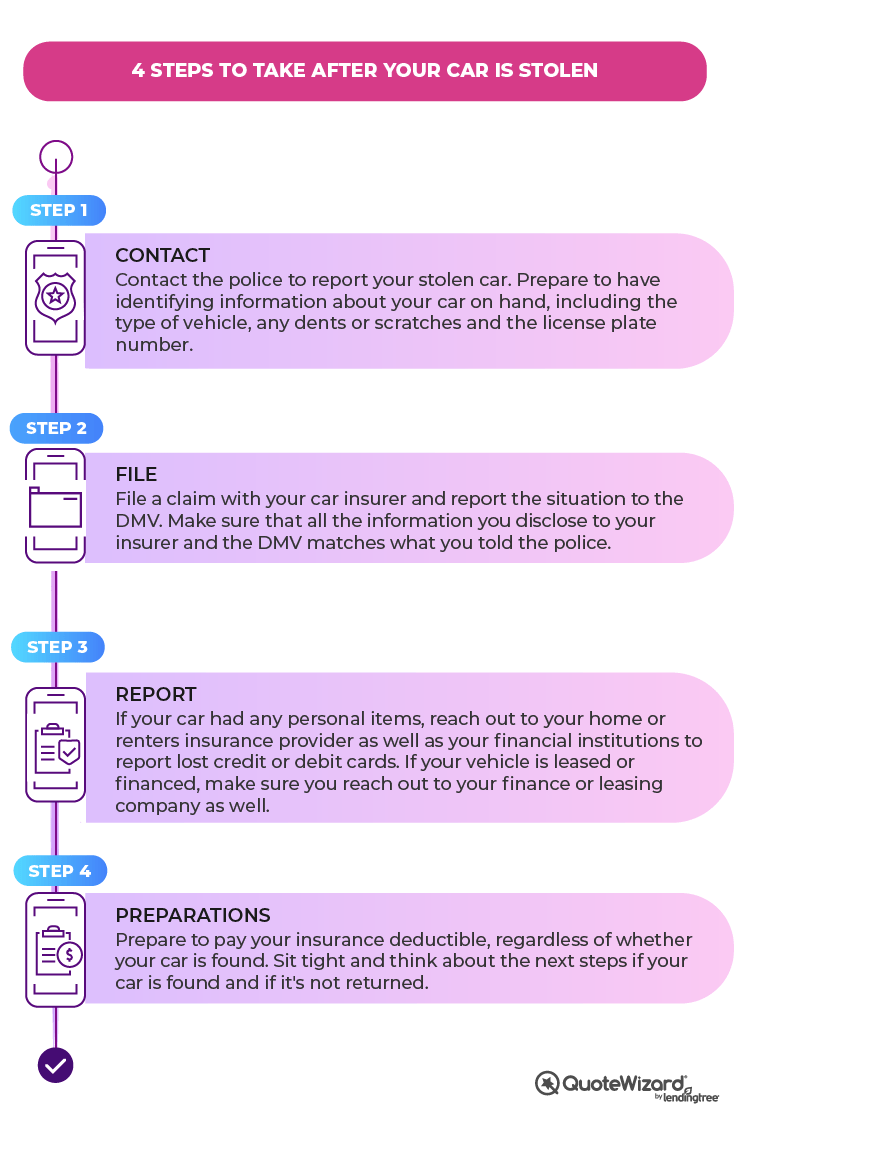

What you need to do after your car gets stolen

If your car is stolen, think of getting a payout for a new car as a two-step process. First comes the police report, then comes the car insurance claim. Additionally, if you are leasing or financing the car, contact your lessor or lender as soon as possible.

Call the police and report your car stolen

After confirming that your car is stolen, call 911 and file a police report immediately. The sooner the authorities start looking for the car, the more likely they are to find it.

Reporting a stolen car

When filing a police report for a stolen car, have the following information on hand:

- Your vehicle identification number (VIN), which can be found on your insurance card.

- The license plate number of the car.

- The car’s year, make and model.

- The location and estimated time of the theft, as well as any other relevant information.

- Identifying details of your car — large dents, custom add-ons or scratches, for example — or distinguishing features.

We recommend that you always have up-to-date photos of your car on your phone in case of an emergency situation like a theft. This can make the process of identifying your vehicle much quicker.

Locating your stolen car

If the stolen car has a GPS system, notify the police and your insurer. Make sure you get the police report number and a contact phone number for your auto insurance company to reference before you hang up. The police may contact someone at the company for you and get the ball rolling in that regard. If they don't, get on the phone yourself.

File a claim with your insurance company

Once you complete the police report, contact your auto insurer.

This step is especially important if you have comprehensive coverage. That's because it is the only form of car insurance that covers damaged or stolen vehicles.

Auto insurers usually have online systems to file claims quickly, but it is highly recommended that you call and talk to your own dedicated agent. This way you can answer any questions they may have immediately and reduce the amount of back-and-forth in an already time-sensitive situation.

When you file a claim, your car insurance company typically needs:

- Your auto insurance policy number.

- The police report number

- Your certificate of title.

- Details such as mileage, service records and any upgrades installed in the car.

- A description of what happened, including the estimated date and time of the theft and any photos you have of the location of theft.

Your car insurance provider may require additional information, such as the location of all the vehicle’s keys and contact information of anyone who had access to your car. It is the insurer’s job to be thorough in the task of recovering your car in order to avoid a claim payout and going through the hassle of buying a replacement car, so be as helpful as you can.

Along those lines, expect some deep questioning when you file your claim. Fraudulent auto theft claims happen, and this makes insurers jittery about auto theft claims. Be as direct as possible with your insurer, and answer their questions as fully as possible.

Ensure that the information you provide the police and your insurer are the same, as any inconsistencies can cause issues in the claims process.

Contact your homeowners or renters insurance provider

If personal property was stolen along with your car, you’ll need to contact your homeowners or renters insurer. It may sound odd, but the stuff in your car at the time of the theft isn’t covered by your auto insurance. The personal property section of your homeowners or renters insurance policy should cover the replacement of your stolen belongings.

Auto insurance won't help you deal with this part of the crime. So if you lack a renters or homeowners policy, you'll have to replace your possessions on your own dime.

Alert your credit card issuer, financial institution and other entities, if necessary

You only need to follow this piece of advice if you left any personal items — or items containing personal information — in your car.

For instance, a lot of people keep their insurance card or registration document in the glove compartment. Even more people leave receipts or paycheck stubs sitting on the dashboard.

Those habits can cause problems if someone steals your vehicle. Specifically, they can lead to identity theft.

To avoid this scenario, take these precautionary measures if you suspect your personal information is stolen:

- Call your bank, credit union and credit card issuer.

- Alert other entities, like the DMV, if your wallet or purse were in your car when it went missing.

- Make sure you contact your leasing agent or finance company if your vehicle is leased or financed

Let them know what happened so they can keep an eye out for suspicious activity.

Sit tight and prepare to pay your deductible

Imagine the police never finding your vehicle. Your insurance company won't declare it a lost cause for at least 30 days. If you pass that deadline and your car's still MIA, your insurer will pay you its current market value — assuming you have comprehensive car insurance, of course.

And what if your car finds its way back to you? Again, if you have the right kind of coverage, your insurance company will reimburse you for any damage done.

Something else to keep in mind: you'll likely have to pay your deductible no matter how things are resolved.

What happens if your car is stolen and recovered?

If your car is found, what happens next is a case-by-case scenario. If the car is retrieved, your auto insurance company will see if any damages are repairable and will cover the cost of repairs up to your comprehensive coverage limits. If the car is unrepairable when found, they will pay you out at actual cash value minus your deductible.

If your claim has been paid out before the car is recovered, it depends on your auto insurer. They may take ownership of the car to recoup their costs, or they may require you to return the claim payout.

As soon as you get your car back, you should inspect it for any damage or items inside that don't belong to you.

Does car insurance cover auto theft?

Legal minimum auto insurance policies do not cover you if your car is stolen. Basic car insurance only covers liability, which pays out in the event of you being at fault for injuries or property damage due to a car accident. Car theft falls outside these criteria. In order to have coverage in the event of your car being stolen, you need to buy comprehensive coverage.

How comprehensive coverage covers a stolen car

Comprehensive coverage is a type of car insurance that you can purchase as an add-on to your policy. Comprehensive coverage provides protection against theft or damage to your car due to events other than collision. These perils include:

- Falling objects, like tree branches.

- Vandalism.

- Riot or civil disturbance.

The cost of comprehensive coverage varies among insurers. If you are leasing a car or if you purchased one through a lender, your lender will probably require you to purchase comprehensive coverage in order to protect their investment.

How does auto insurance replace a stolen car?

Most car insurance providers have a waiting period, usually 30 days, before they consider the car a total loss. It’s a good idea to add rental car reimbursement to your auto insurance policy for situations like this. A basic car insurance policy does not include the cost of a rental car during the waiting period.

If your car is deemed irrecoverable, your auto insurance provider will pay out on your claim at the actual cash value (ACV) of your car. This means the payout will be based on the current market value of the vehicle, including any depreciation due to age. Your auto insurer will cut you a check for the ACV amount, minus whatever your auto insurance deductible is. If you’re leasing or financing the automobile, the payout will go to your lessor or lender.

If you are leasing or went through a lender to buy your car, seriously consider investing in gap insurance. Gap insurance covers the difference between the limit of your comprehensive coverage and how much is owed on the stolen car. Ask your car insurance company about the cost of gap insurance when you’re buying comprehensive coverage.

Will my car insurance rates go up if I file a claim for a stolen vehicle?

It depends on where you bought your policy. It also depends on your claims history. If you make a claim for an incident that's largely your fault, there's a high chance your insurer will increase your premium.

In the event of auto theft, you need to have comprehensive coverage as part of your auto insurance policy if you expect your stolen car to be replaced. A basic auto insurance policy primarily provides liability insurance, which doesn’t cover car theft. Comprehensive coverage is available as an add-on to your auto insurance policy, should misfortune strike. Comprehensive coverage is typically required for a financed car.

Filing a claim for a stolen car can be a lengthy process. Completing a police report and then the claim itself with your auto insurance provider requires a lot of documentation and some back and forth. Also, be aware that your car insurance provider will pay out for a new vehicle based on what the stolen car was worth at the time of the theft, not what you paid for it.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.